Foreign selling pressure made a surprise comeback today, along with negative sentiment from the South Korean stock market, causing the VN-Index to plunge. The index struggled throughout the session but eventually closed sharply lower, shedding 9.42 points to fall back to the 1,240-point level. The market breadth turned decidedly negative, with 281 declining stocks outweighing 109 gainers.

No sector managed to stay in positive territory. Large-cap banks, securities, and real estate stocks bore the brunt of the selling. Vin stocks lost ground across the board, with VRE down 2.26%, VHM falling 1.96%, and VIC declining by 0.99%. Other real estate names like NVL, NLG, IDC, and PDR also suffered significant losses. Among banks, VCB stood out as a lone gainer, propping up the index, while BID, CTG, VPB, LPB, and TCB closed in the red. Securities stocks followed suit, with VND plunging 3.64% and HCM, MBS, VCI, SSI, VIX, and SHS all losing more than 1%.

The technology and telecommunications sector, usually a magnet for speculative money, also witnessed a broad sell-off. FPT fell by 1.03%, and VGI declined by 0.97%. Eight stocks, including BID, VHM, CTG, and MWG, were the biggest drags on the market, wiping out 5.34 points from the index.

On the downside, bottom-fishing funds remained on the sidelines, with total matched transactions on all exchanges reaching VND 15,800 billion. Foreign investors offloaded a net VND 711.5 billion, with a net sell of VND 649.9 billion in matched orders.

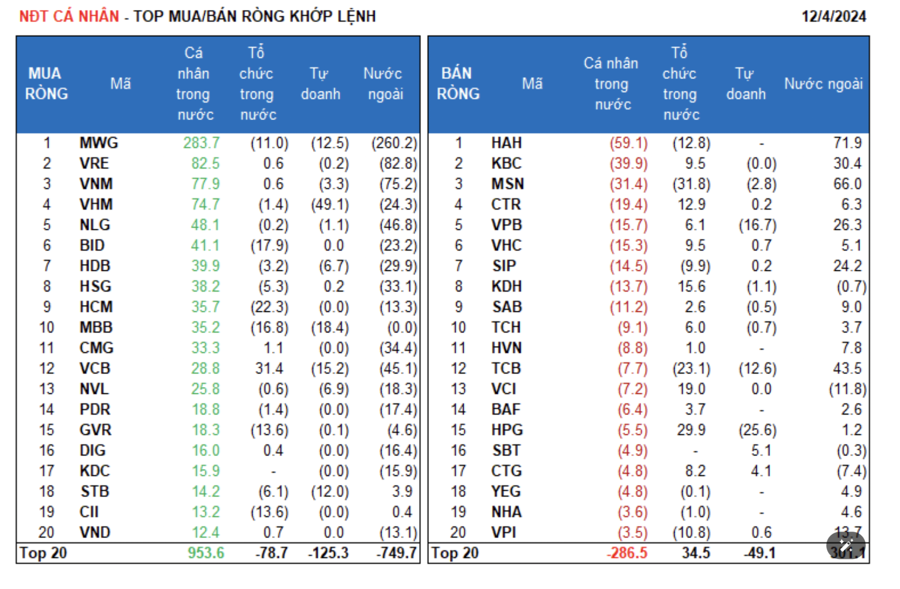

Foreign investors’ net buying on the matched orders side was focused on the Industrial & Consumer Services, Construction & Materials, and Food & Beverage sectors. Their top net buys by value were HAH, MSN, TCB, KBC, VPB, SIP, DPM, VPI, SAB, and FUEVFVND.

On the sell side, foreign investors offloaded Retail stocks, with MWG, FPT, VRE, VNM, NLG, CMG, HSG, HDB, and VHM being their top net sells.

Individual investors net bought VND 917.1 billion, with a net buy of VND 831.2 billion in matched orders.

In the matched orders segment, they net bought 13 out of 18 sectors, mainly in Retail. Their top net purchases by value were MWG, VRE, VNM, VHM, NLG, BID, HDB, HSG, HCM, and MBB.

On the sell side, they net sold 5 out of 18 sectors, mainly in the Industrial & Consumer Services, Construction & Materials, and Utilities sectors. Their top net sells by value were HAH, KBC, MSN, CTR, VPB, VHC, KDH, SAB, and TCH.

Proprietary traders net sold VND 394.4 billion, with a net sell of VND 347.6 billion in matched orders.

In the matched orders segment, they net bought only 1 out of 18 sectors – Automobiles & Parts and Media. Their top net buys by value were SBT, CTG, FRT, DCM, NT2, VHC, HT1, DRC, VPI, and FTS. On the sell side, they focused on banks, with their top net sells being FPT, VHM, HPG, MBB, VPB, VTP, VCB, BMP, TCB, and MWG.

Domestic institutions net bought VND 129.6 billion, with a net buy of VND 166.3 billion in matched orders.

In the matched orders segment, they net sold 10 out of 18 sectors, mainly in Financial Services. Their top net sells by value were MSN, TCB, HCM, BID, MBB, GVR, CII, HAH, SSI, and MWG. On the buy side, they focused on Information Technology stocks, with their top net buys being FPT, VCB, HPG, VCI, KDH, CTR, ACB, VIB, KBC, and VHC.

Negotiated trading value reached VND 2,312.9 billion, down 46.9% from the previous session and accounting for 14.7% of the total trading value.

Notable negotiated trades occurred in VHM, with individual investors transacting more than 10.6 million shares worth VND 434.4 billion.

Individual investors also participated in negotiated trades of bank stocks (LPB, EIB, HDB, STB), large-cap stocks (FPT, VIC), and EVF.

Cash flow allocation increased in Real Estate, Securities, Chemicals, Food & Beverage, Retail, Software & Services, and Warehousing & Logistics but decreased in Banks, Construction, Oil & Gas Equipment & Services, Water Transport, and Air Transport.

In the matched orders segment, cash flow allocation increased in mid-cap stocks (VNMID) but decreased in large-cap (VN30) and small-cap (VNSML) stocks.