Foreign selling pressure made a surprise comeback today, along with negative sentiment from the South Korean stock market, causing the VN-Index to plunge. The index struggled throughout the session but eventually closed deeply in the red, shedding 9.42 points to settle at 1,240. The market breadth was overwhelmingly negative, with 281 declining stocks versus 109 advancing ones.

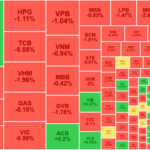

No sector managed to stay in positive territory. Large-cap sectors, including banking, securities, and real estate, witnessed the strongest corrections. Vin stocks lost their appeal, with VRE, VHM, and VIC falling by 2.26%, 1.96%, and 0.99%, respectively. Other real estate stocks like NVL, NLG, IDC, and PDR also suffered significant losses. Among banks, VCB stood out as the only gainer, while BID, CTG, VPB, LPB, and TCB closed in negative territory. Securities firms also faced a sell-off, with VND plunging 3.64% and HCM, MBS, VCI, SSI, VIX, and SHS all losing over 1%.

The technology and telecommunications sector, usually a magnet for speculative money, witnessed a broad sell-off, with FPT and VGI declining by 1.03% and 0.97%, respectively. BID, VHM, CTG, MWG, and FPT were the top five stocks dragging the market down, responsible for a loss of 5.34 points.

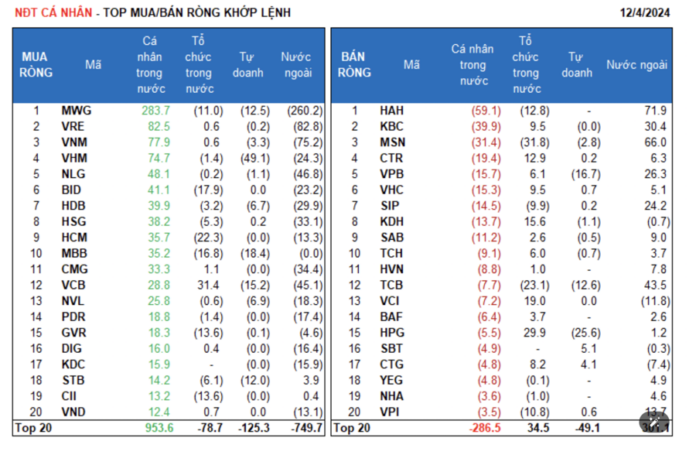

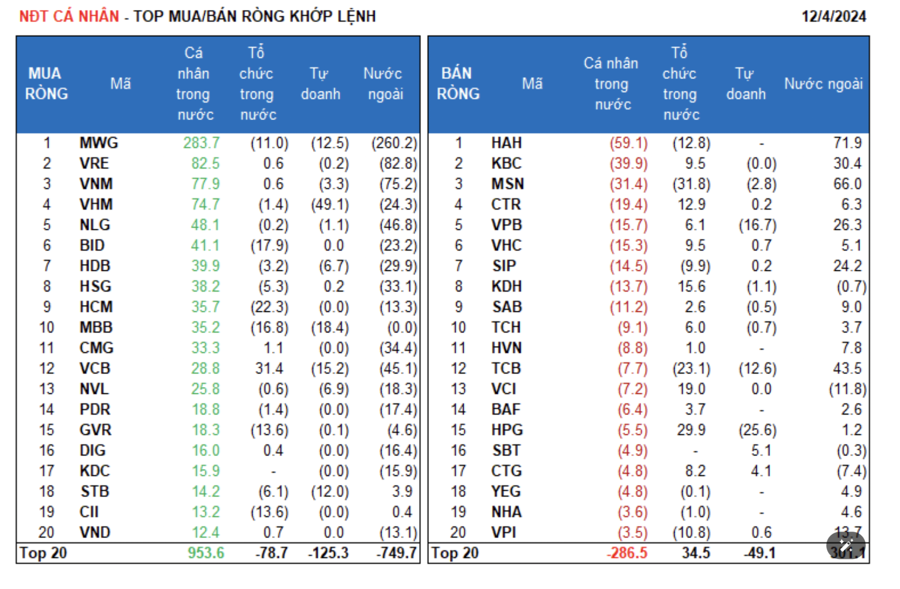

On the institutional side, foreign investors offloaded Vietnamese stocks, with a net sell value of 711.5 billion VND for the entire session and 649.9 billion VND in the matched orders segment. Their net buying focused on the Industrial & Consumer Services, Construction & Materials, and Utilities sectors, with HAH, MSN, TCB, KBC, and VPB being the top bought stocks. On the other hand, they net-sold Retail stocks, with MWG, FPT, VRE, VNM, and NLG being the top sold stocks.

Individual investors were net buyers, with a net buy value of 917.1 billion VND for the entire session and 831.2 billion VND in the matched orders segment. They net bought 13 out of 18 sectors, mainly focusing on the Retail sector. Their top bought stocks included MWG, VRE, VNM, VHM, NLG, BID, HDB, HSG, HCM, and MBB. On the other hand, they net-sold 5 out of 18 sectors, primarily in the Industrial & Consumer Services, Construction & Materials, and Utilities sectors. HAH, KBC, MSN, CTR, and VPB were among their top sold stocks.

Proprietary trading accounted for a net sell value of 394.4 billion VND for the entire session and 347.6 billion VND in the matched orders segment. In terms of sectors, they net bought only one sector, Automobiles & Components, and Media. Their top bought stocks included SBT, CTG, FRT, DCM, NT2, VHC, HT1, DRC, VPI, and FTS. On the other hand, they net-sold banks, with FPT, VHM, HPG, MBB, VPB, VTP, VCB, BMP, TCB, and MWG being the top sold stocks.

Local institutions were net buyers, with a net buy value of 129.6 billion VND for the entire session and 166.3 billion VND in the matched orders segment. They net sold 10 out of 18 sectors, mainly Financial Services. Their top sold stocks included MSN, TCB, HCM, BID, MBB, GVR, CII, HAH, SSI, and MWG. On the buying side, they focused on the Information Technology sector, with FPT, VCB, HPG, VCI, KDH, CTR, ACB, VIB, KBC, and VHC being their top bought stocks.

Today’s negotiated trading value reached 2,312.9 billion VND, a decrease of 46.9% compared to the previous session, contributing 14.7% to the total trading value.

Notably, there was a large negotiated transaction in VHM, with over 10.6 million shares worth 434.4 billion VND changing hands between individual investors.

Individual investors also participated in negotiated transactions in the Banking sector (LPB, EIB, HDB, STB), large-cap stocks (FPT, VIC), and EVF.

In terms of sector allocation, cash flow increased in Real Estate, Securities, Chemicals, Food & Beverage, Retail, Software & IT Services, and Warehousing & Logistics but decreased in Banking, Construction, Oil & Gas Equipment & Services, Water Transport, and Airlines.

Specifically, for matched orders, cash flow allocation increased in the mid-cap sector (VNMID) but decreased in the large-cap (VN30) and small-cap (VNSML) sectors.

The Foreign and Proprietary Blocks: Strong Bottom-Fishing by Individual Cash Flow

Foreign investors net sold VND 711.5 billion today, with a net sell of VND 649.9 billion in matched orders. Meanwhile, individual investors net bought VND 917.1 billion…

Market Beat: VN-Index Retreats to 1,240-point Mark

The market closed with the VN-Index down 9.42 points (-0.75%) to 1,240.41 and the HNX-Index down 0.67 points (-0.3%) to 224.62. The market breadth tilted towards decliners with 438 losers and 260 gainers. Meanwhile, the large-cap basket VN30-Index showed a dominance of red ticks as 25 stocks fell and only 5 advanced.

The Battle for Points: VCB and SAB Struggle, Broad Market Adjustments, and Foreigners Withdraw 690 Billion

Finally, a true correction session has arrived for investors who were sitting on the sidelines with cash in hand. The selling pressure intensified during the afternoon session, leading to a broad-based adjustment in stock prices. The VN-Index shed 9.42 points, with the number of declining stocks doubling those that advanced.

The Ultimate Headline: “Selling Pressure Intensifies”

The VN-Index witnessed a significant decline, with trading volume surpassing the 20-day average, indicating a rather negative investor sentiment. The key takeaway here is that if the index manages to hold above the Middle Bollinger Band in upcoming sessions, there’s reason for cautious optimism. It’s worth noting that the MACD indicator continues to flash a buy signal and is poised to cross above the zero threshold. Should this crossover occur, it would bode well for mitigating risks.