Vietstock LIVE is an in-depth online dialogue series, bringing together leading experts in economics and finance to discuss and analyze topical issues affecting the market. The program not only focuses on explaining macro and microeconomic events and trends but also delves into how these dynamics impact the investment strategies of individuals and organizations.

Through this program, experts will offer multifaceted perspectives, share practical experiences, and introduce effective asset allocation methods. Notably, the program provides practical advice on how investors can adjust their strategies to optimize profits and minimize risks in a volatile market environment. This is a valuable opportunity for the investment community to learn, enhance their knowledge, and equip themselves with the necessary analytical tools to make informed decisions in all situations.

Commenting on the current situation, MB Securities Company (MBS) stated that the Vietnamese economy continues to demonstrate remarkable growth, with a 6.82% year-on-year increase in GDP for the first nine months, driven primarily by strong exports and FDI inflows. Inflation has also been well-controlled, remaining below the government’s 4.5% target. Based on these positive signals, MBS forecasts GDP growth to reach 6.9% in 2024 and 6.7% in 2025, supported by a recovery in consumption, industrial production, and accelerated public investment disbursement for key national projects. However, the growth outlook still faces challenges, including risks related to exchange rates, global trade tensions, and widening geopolitical conflicts, which could disrupt supply chains and exert inflationary pressures.

Additionally, the Vietnamese stock market is predicted to witness a positive shift due to expectations of a market upgrade. With new policies and laws coming into force and the influx of foreign capital, will the stock market in 2025 bring “joy” to investors? All this information will be shared and answered at the Vietstock LIVE #14 program with the theme “Vietnamese Economy in 2025 – Opportunities and Challenges.”

|

Moderating the program is Mr. Nguyen Quang Minh, CMT Charterholder, Member of the American Association of MTA, and Director of Vietstock Research Block. Mr. Minh is an expert with nearly 20 years of experience in analysis and investment in the Vietnamese stock market.

Joining the Vietstock LIVE #14 program is Mr. Nguyen Tien Dung, Master of Finance and Banking – Head of Industry and Stock Analysis Department of MB Securities Company (MBS), with 12 years of experience in securities analysis. Prior to joining MBS, he was the Head of Analysis at VNDirect Securities Corporation (VND).

The Vietstock LIVE #14 livestream on the theme “Vietnamese Economy in 2025 – Opportunities and Challenges” will be broadcast live at 15:00 on Friday, December 6, 2024, on the Vietstock Fanpage & YouTube Channel and MBS Fanpage & YouTube Channel. Investors are invited to tune in.

A Pause in the Uptrend

The VN-Index’s upward momentum stalled with a slight dip in the latest trading session as volume remained below the 20-day average. This indicates a continued cautious approach from investors. However, the MACD indicator still holds a buy signal and is poised to cross above the zero threshold. Should this crossover occur, it would provide a more optimistic outlook for the market, suggesting that the dip may be short-lived.

Market Beat: VN-Index Retreats to 1,240-Point Mark

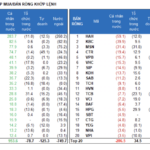

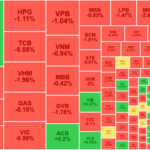

The market closed with the VN-Index down 9.42 points (-0.75%) to 1,240.41, and the HNX-Index falling 0.67 points (-0.3%) to 224.62. The market breadth tilted towards decliners with 438 losers and 260 gainers. Meanwhile, the large-cap basket VN30-Index showed a dominance of red ticks as 25 stocks dropped, and only five added points.

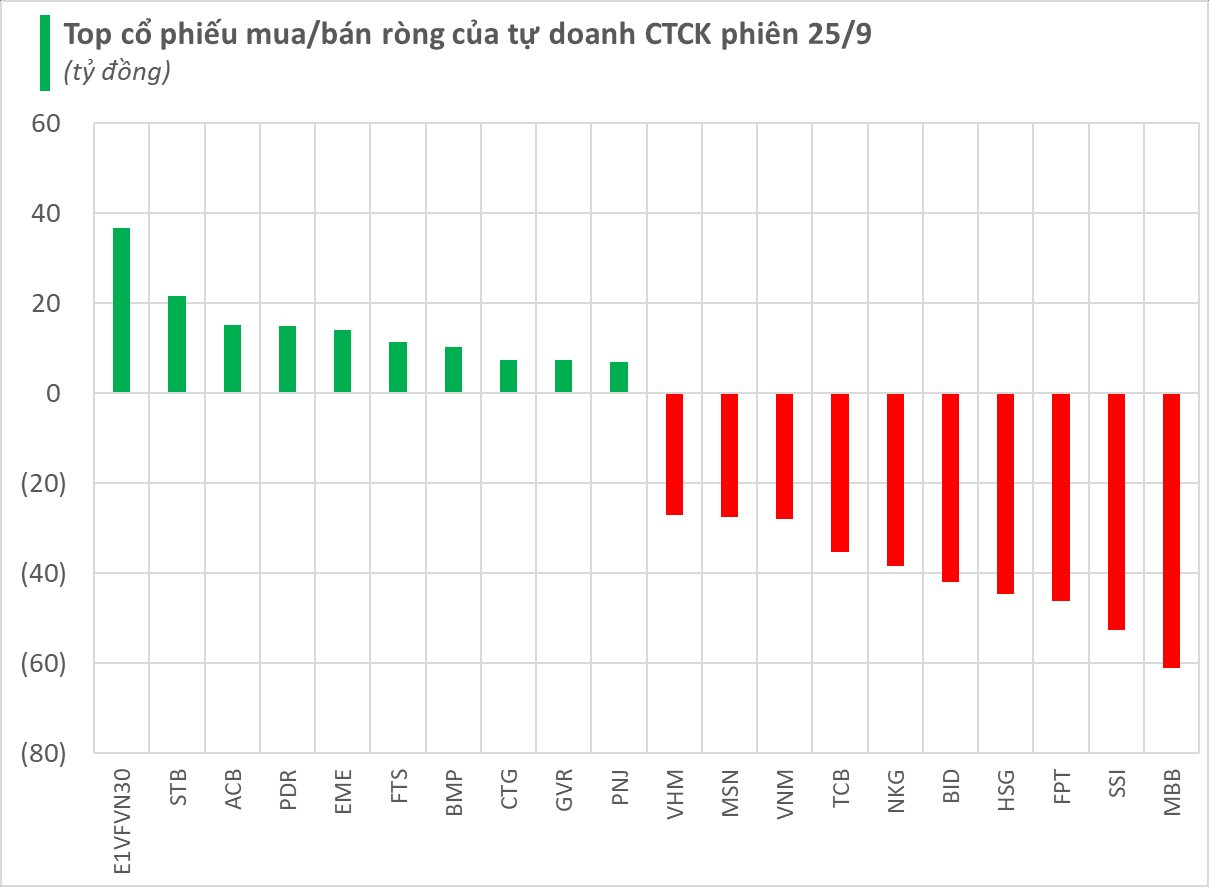

The Battle for Points: VCB and SAB Struggle, Broad Market Adjustments, and Foreigners Withdraw 690 Billion

Finally, a true correction session has arrived for investors who were sitting on the sidelines with cash in hand. The selling pressure intensified during the afternoon session, leading to a broad-based adjustment in stock prices. The VN-Index shed 9.42 points, with the number of declining stocks doubling those that advanced.