|

The Privia apartment project, developed by Khang Dien and located in Binh Tan District, Ho Chi Minh City. Image: Khang Dien

|

If the entire registered volume is successfully sold, Vietnam Ventures Limited’s ownership in Khang Dien will decrease from 0.89% to 0.73%.

The recent continuous divestment from the developer of The Privia and The Classia projects by VinaCapital’s investment fund comes amidst a stagnant KDH stock price since the second quarter of this year, mirroring the broader market trend.

From July 2024 up until this latest transaction, Vietnam Ventures Limited has sold nearly 11.1 million KDH shares.

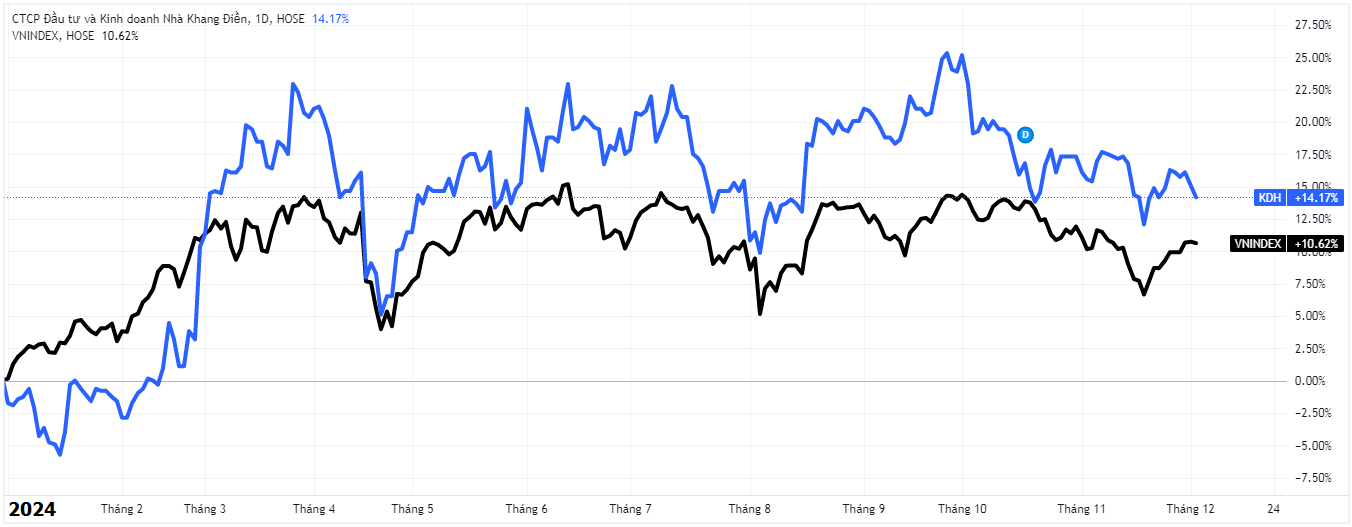

Real estate is among the sectors with lackluster stock market performance in the past year, as the industry is just starting to recover. Although KDH hasn’t shown remarkable improvement, its stock price increase of over 14% (outperforming the VN-Index as of 9:35 am on December 3, 2024) is a bright spot in the industry.

Currently, a representative of VinaCapital, Ms. Nguyen Thi Dieu Phuong, Executive Vice President of the Fund Management Company, still holds a position as a Member of the Board of Directors of Nha Khang Dien.

|

KDH stock price fluctuates with the market in 2024

|

Data as of 9:35 am, trading session on December 3, 2024. Source: VietstockFinance

|

Technical Analysis for the Session Closing November 27th: Deciphering the Diverging Forces Governing the Market

The VN-Index and HNX-Index both witnessed declines, alongside a significant dip in trading liquidity during the morning session. This indicates that investors are exercising caution in their transactions.

Is There a Shuffle of ILB Shares Between America LLC and VinaCapital Member?

In November 2024, VESAF Fund (under VinaCapital) and America LLC displayed contrasting behaviors regarding their investment in Joint Stock Company ICD Tan Cang – Long Binh (HOSE: ILB). While one entity consistently sold off their entire stake in the company, the other actively purchased shares to increase their ownership.

What Will Fuel the VN-Index’s Growth in the Coming Period?

“A robust economy is the fundamental driver of a thriving stock market, and that’s precisely what we’re seeing. With impressive economic growth rates, Vietnam is poised for success. The government forecasts a remarkable 7% growth rate for this year, while VinaCapital predicts a still-healthy 6.5%. This bodes well for the stock market and investors alike.”