The State Securities Commission has issued an administrative sanction decision in the field of securities and the securities market against Central Petroleum Construction Joint Stock Company (PXM).

Specifically, the company was fined VND 85 million for failing to disclose information about shareholder documents and for late disclosure of necessary information. The company was also fined an additional VND 112.5 million for failing to ensure the required number of members on the supervisory board. The total fine for PXM amounted to VND 197.5 million.

PXM is currently listed on the UpCOM exchange, with a share price of just VND 500/share, but there have been hardly any transactions for several months.

KDC: Ms. Vuong Ngoc Xiem, a member of the Board of Directors and Vice President of KIDO Group Joint Stock Company (KDC), has announced the completion of the purchase of 4.2 million KDC shares, increasing her ownership from 1.45% to 1.58%.

Stock market trading

HAG: Hoang Anh Gia Lai Joint Stock Company announced that Mr. Bui Le Quang, a member of the Board of Directors, purchased 40,000 HAG shares, increasing his ownership to 100,000 HAG shares, or 0.01%.

CTF: The Board of Directors of City Auto Joint Stock Company approved the resignation of Mr. Nguyen Dang Hoang as CEO effective December 5 and appointed Mr. Tran Lam to replace him.

MSN: The Board of Directors of Masan Group Joint Stock Company (MSN) has approved a plan for the company to contribute an additional VND 510 billion to the charter capital of The Sherpa LLC. This contribution aims to facilitate the acquisition of shares in Nyobolt Limited.

-

Stock Market Outlook for Tomorrow, Dec 5: Beware of Increased Selling PressureREAD NOW

ILB: Mr. Cao Minh Chuyen, son of Mr. Cao Ngoc Duc, an independent member of the Board of Directors of IDC Tan Cang – Long Binh Port Joint Stock Company (ILB), has registered to sell all 19,680 ILB shares (0.08%) that he holds.

DBT: Mr. Hoang Van An, a member of the Board of Directors and Vice President of Ben Tre Pharmaceutical Joint Stock Company (DBT), registered to buy 70,000 DBT shares directly from the issuing organization during the private placement, increasing the number of shares held after the transaction to 225,193, representing 1.210%.

DGW: Digital World Joint Stock Company (DGW) has reported the completion of its plan to issue 2 million shares (equivalent to 0.92% of the total outstanding shares) to 80 employees under the ESOP program. The issuance is expected to take place from December 2024 to January 2025.

TIP: Industrial Park Development Trust Joint Stock Company (TIP) announced that December 20 is the record date for the 2024 dividend payment with a ratio of 13%.

HNA: Hủa Na Hydropower Joint Stock Company announced its 2023 dividend payment plan for shareholders with a ratio of 10%. The dividend payment date is December 18.

A Pause in the Uptrend

The VN-Index’s upward momentum stalled with a slight dip in the latest trading session as volume remained below the 20-day average. This indicates a continued cautious approach from investors. However, the MACD indicator still holds a buy signal and is poised to cross above the zero threshold. Should this crossover occur, it would provide a more optimistic outlook for the market, suggesting that the dip may be short-lived.

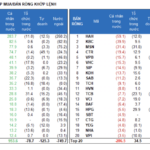

Market Beat: VN-Index Retreats to 1,240-Point Mark

The market closed with the VN-Index down 9.42 points (-0.75%) to 1,240.41, and the HNX-Index falling 0.67 points (-0.3%) to 224.62. The market breadth tilted towards decliners with 438 losers and 260 gainers. Meanwhile, the large-cap basket VN30-Index showed a dominance of red ticks as 25 stocks dropped, and only five added points.