Market Outlook: Expert Insights on Vietnam’s Economic Landscape for 2024-2025

Source: FiinGroup

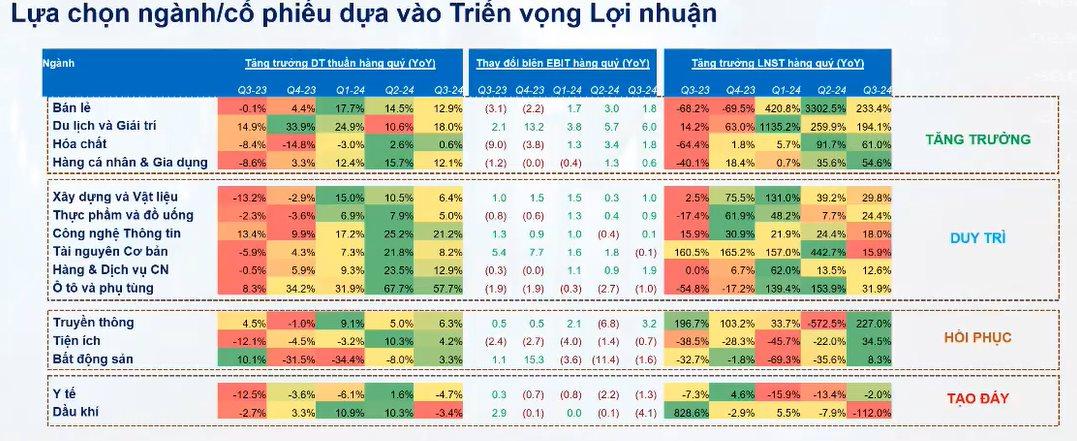

At a recent seminar on “Pulse of Money Flow” co-organized by FIDT and FiinTrade, Ms. Do Hong Van, Head of FiinGroup’s Analysis Team, shared her insights on the market trends for the upcoming years. She predicted that in 2024, businesses’ profit growth would remain steady at 20% year-on-year, driven primarily by exports and recovering demand in sectors such as retail, tourism, entertainment, and food industries.

Regarding interest rates, with the Fed’s current high-interest rate environment and the high exchange rate, domestic interest rates are unlikely to decrease further in 2025. As a result, lending rates are expected to slightly increase next year, moving away from the current low-interest rate environment.

According to the FiinGroup expert, the growth story of 2025 will rely more on Vietnam’s internal strengths rather than external factors. The key drivers will be the acceleration of public investment, the gradual improvement in private investment, and the ongoing recovery of the real estate market. Businesses that can capitalize on these factors will likely maintain profit growth throughout 2025.

Source: FiinGroup

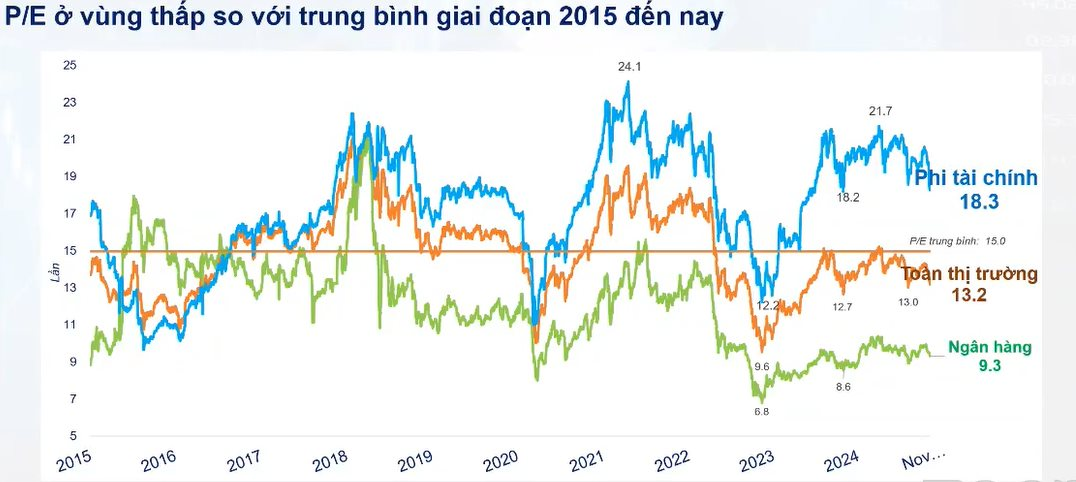

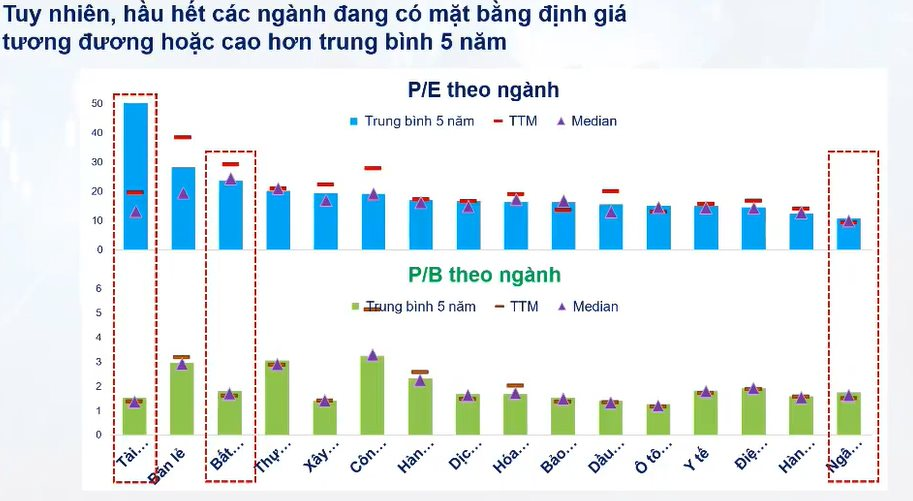

Besides profit prospects, reasonable valuation is another crucial factor for investment decisions. FiinGroup’s expert pointed out that from 2020 onwards, valuations have been in a phase of strong profit growth. Therefore, when assessing current valuations, historical comparisons are essential. Currently, valuations are at a level equivalent to the five-year average. While profit growth is on an upward trajectory, the valuations reflect the market’s expectations for a high-growth phase.

Based on profit prospects and valuations, Ms. Van identified two potential sectors for investors to consider.

1. Banking Sector

Ms. Van noted that the banking sector’s profit growth has not yet matched the favorable conditions it enjoys. The industry is poised to benefit from the recovery of private investment and the rebound in credit growth. Additionally, banks currently have attractive valuations, equivalent to the five-year average and median.

“While many are concerned about the non-extension of Circular 02, the high level of non-performing loans, and the proactive provisioning by banks, I believe that with the expected rebound in credit growth and the low-profit base, the banking sector will have the opportunity to achieve profit growth and re-rating in 2025,” said the FiinGroup expert.

2. Real Estate Sector

The real estate sector is also highly regarded due to policy adjustments and the market’s recovery. However, the expert does not anticipate a significant surge in profits for these companies. Attractive valuations are another driving force for this stock group.

Other Sectors

Regarding the construction and materials industry, Ms. Van believes that businesses in this sector will benefit from the more positive disbursement of public investment capital next year. However, this is expected to be reflected in the companies’ performance towards the end of 2025.

For the steel industry, besides the recovery from the bottom, there is also the potential for growth driven by exports and the rebound in the real estate sector. While the group’s current valuations are lower than the five-year average, they are still higher than the median. To reach reasonable valuation levels, profits would need to increase by 30-40%, which is challenging to achieve, given the high base in 2024.

Source: FiinGroup

The retail sector is also expected to benefit from stronger consumer demand as household incomes improve and the product replacement cycle sustains positive profit growth for businesses.

However, the expert noted that the retail group’s valuations are currently higher than the five-year average and the median, indicating high future expectations. For valuations to reach reasonable levels, profits in the retail sector would need to increase by 40-50% in 2025, which is unlikely to happen. As a result, this group is considered relatively expensive in terms of valuation.

The Hottest Apartments of 2024 and Trends to Watch Out For in 2025

The Vietnamese condominium market has witnessed a significant shift in the demands and preferences of homebuyers, especially the younger generation. While larger apartments with multiple bedrooms were once the primary criterion, the trend now leans towards optimally designed, moderately sized homes.

Gold Prices Rise Slightly After US Jobs Report and Political Turmoil in South Korea, France

The spot gold price in New York edged higher on Tuesday (December 3) after stronger-than-expected employment data reinforced expectations of a more cautious Fed in its monetary policy easing process. In the Asian market, gold prices also ticked up following political turmoil in South Korea and France.