Illustrative image

Global Petroleum Commercial Joint Stock Bank (GPBank) has just applied a new electronic savings interest rate for individual customers. Accordingly, the bank has increased the mobilization interest rate for terms from 1 to 36 months by 0.3%/year.

Specifically, the interest rates for 1- and 2-month terms have increased to 3.7%/year and 4.2%/year, respectively. Interest rates for terms of 3 to 5 months currently range from 4.22% to 4.25%/year.

The interest rate for a 6-month term has been increased to 5.55%/year, while the 7-month term is now listed at 5.65%/year, the 8-month term at 5.8%/year, and the 9-month term at 5.9%/year.

Notably, the online savings interest rate for a 12-month term at GPBank has increased to 6.25%/year. Meanwhile, terms of 13 to 36 months are offered an interest rate of up to 6.35%/year.

Source: GPBank

With this adjustment, GPBank is currently the bank with the highest-listed savings interest rate in the system for regular deposits (excluding large deposits that enjoy special interest rates)

GPBank is one of the four banks under special control, along with the Construction Bank (CBBank), Ocean Bank (OceanBank), and DongA Bank (DongABank). According to the State Bank of Vietnam, Global Petroleum Commercial Joint Stock Bank (GPBank) will be transferred to another bank in the future.

After a two-month stagnation, a series of banks, including large banks such as Agribank, Techcombank, and MB, have increased savings interest rates in recent weeks.

In November alone, about 15 banks raised deposit rates, with some banks making two to three adjustments.

These new developments have emerged during the peak credit growth period at the end of the year, and the banking system’s liquidity has shown signs of tightening. According to data from the State Bank of Vietnam, credit growth as of October 31 had increased by 10.08% compared to the end of 2023. In the same period last year, credit growth was only 7.4%.

On the other hand, the USD exchange rate at banks has continuously been listed at the ceiling for more than a month, causing the State Bank of Vietnam to simultaneously apply tools such as bills and foreign currency sales to stabilize the market. The central bank’s operations are expected to curb the rising foreign exchange rate but will somewhat affect the VND liquidity of the banking system.

In a recent report, MBS Securities (MBS) stated that the increase in interbank interest rates signaled a liquidity shortage. According to MBS, the issuance of bills by the State Bank and the withdrawal of more than $4.5 billion by the State Treasury from three large banks in the third quarter of 2024 were factors that increased liquidity pressure.

“Although the State Bank has taken strong measures such as injecting money through the OMO channel, the overnight interest rate still remains above 5%, indicating significant pressure in the system,” MBS said.

MBS believes that this development is a contributing factor in prompting banks to continue adjusting deposit interest rates to attract new capital, thereby ensuring liquidity. MB analysts predict that the interest rate on deposits will increase slightly by 0.2 percentage points by the end of this year.

The Surprising Savings Rates at the ‘Zero-Dollar’ Bank Group

GPBank, a leading 0 VND bank, has surprised the market with a significant hike in savings interest rates. This move sets them apart from another 0 VND bank that was recently handed over and has chosen to reduce interest rates.

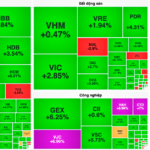

The Foreign Sell-Off: A Tale of Stock Market Turbulence

The market opened the last month of 2024 with a lackluster trading session, despite the VN-Index posting impressive gains at the open. However, foreign investors turning back to net selling is an unsettling signal for the market.