Bird’s-eye view of the Nhi Thanh Water Plant owned by Biwase – Long An Water

|

On November 27, Biwase – Long An Water Joint Stock Company successfully issued the BWLCH2434001 bond lot, comprising 7,000 bonds with a par value of VND 100 million each, totaling VND 700 billion. The bonds have a tenor of 10 years and a fixed interest rate of 5.5% per annum.

The above-mentioned interest rate is lower than the bond interest rates of many other enterprises, thanks to the payment guarantee provided by CGIF (Credit Guarantee and Investment Facility), a trust fund of the Asian Development Bank (ADB), with Maybank Securities Company Limited as the advisor.

With the raised capital of VND 700 billion, Biwase – Long An Water will invest in phase 3 of the Nhi Thanh Water Plant project, aiming to double its capacity from 60,000 m3/day to 120,000 m3/day.

Biwase – Long An Water plays a pivotal role in expanding the water supply market in Long An province by operating the Nhi Thanh Water Plant. The parent company, Biwase, estimates that it will invest approximately VND 1,000 billion to double the capacity of the Nhi Thanh Water Plant in the 2025-2026 period, thereby increasing the total capacity of the parent company to 882,000 m3/day.

Biwase – Long An Water has commenced the expansion of the Nhi Thanh Water Plant and is expected to bring it into operation in Q3 2025.

Construction of Nhi Thanh Water Plant Phase 3

|

Biwase – Long An Water, formerly known as DNP Infrastructure Investment Joint Stock Company – Long An (DNP Long An Water), was established on December 2, 2015, specializing in water exploitation, treatment, and supply. Its head office is located in Ap 7, Nhi Thanh Commune, Thu Thua District, Long An Province.

On October 20, 2022, the company’s charter capital increased from VND 250 billion to VND 322 billion, with 100% private capital. DNP Holding Joint Stock Company (HNX: DNP), formerly known as Dong Nai Plastic Joint Stock Company, owns 44% of the capital.

In March 2023, Biwase, the largest water company in Binh Duong province with a complete water value chain, acquired 25.4% of the shares in DNP Long An Water from DNP Holding. Subsequently, on April 25, the company changed its name to Biwase – Long An Water Joint Stock Company. By May 31, Biwase had increased its ownership to 91.6% (the estimated total value of the acquisition was VND 561 billion).

In late 2023, the charter capital of Biwase – Long An Water was further raised to VND 644 billion. Currently, Biwase holds 94.54% of the capital (as of Q3 2024). The legal representatives of the subsidiary are Mr. Tran Chien Cong, Chairman of the Board of Directors, and Mr. Bui Truong Son, General Director. Mr. Cong is also the General Director and Vice Chairman of the Board of Directors of the parent company, Biwase.

At present, Biwase – Long An Water has a market share of approximately 50-60%, supplying water to urban centers and industrial parks in Ben Luc District, Tan An City, and Thu Thua District. The company operates with extremely high efficiency, boasting a water loss ratio of only 1.5%, and has the potential for water price increases.

The management of Biwase believes that the profit margin of Biwase – Long An Water can be comparable to that of the parent company’s water business in Binh Duong province, with a 5-year average gross profit margin of 52%.

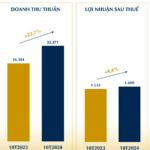

In terms of financial performance, for the first ten months of 2024, Biwase’s revenue is estimated at VND 3,258 billion, up 11% year-on-year, fulfilling 80% of the annual plan. However, profit after tax decreased by 6% to VND 508 billion, achieving 73% of the annual profit target.

As of October, Biwase has not recorded nearly VND 244 billion in revenue from waste and wastewater treatment. If this revenue is included, the total revenue is estimated at VND 3,502 billion, representing 85% of the annual plan (VND 4,100 billion).

By The Manh

“VCBS Successfully Advises on IDI’s 1,000 Billion VND Green Bond Issuance”

On October 31, 2024, VCBS, a leading securities company in Vietnam, successfully advised and acted as an issuer for the offering of VND 1,000 billion worth of bonds by I.D.I, a prominent multinational investment and development corporation.