With a payout ratio of 20% (1 share receives VND 2,000) and 160 million shares in circulation, VCS is estimated to distribute approximately VND 320 billion for this advance dividend payment, expected to be made on December 23, 2024.

The majority of the dividends will go to its parent company, Phenikaa Group – a multi-industry conglomerate with over 30 member units operating in Vietnam. With a direct ownership stake of up to 84.15%, Phenikaa Group is poised to receive nearly VND 270 billion.

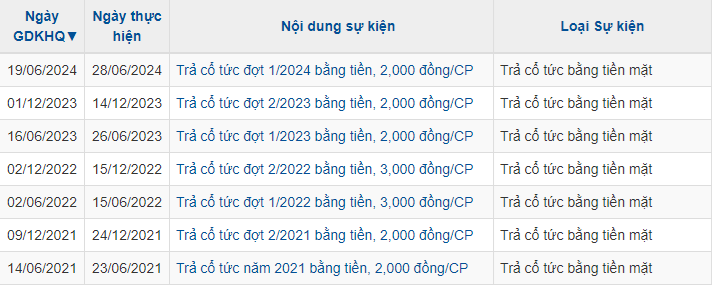

Previously, the company had also paid an advance dividend for the first half of 2024 in cash, at a rate of 20% in June 2024. In previous years, VCS frequently split the annual dividend into two advance payments.

|

VCS’s recent dividend history

Source: VietstockFinance

|

In terms of business operations, in Q3 2024, VCS reported a net profit of nearly VND 162 billion, a 17% decrease compared to the same period last year. The company attributed this decrease to reduced sales of finished goods, which led to lower revenue. Additionally, there was a decline in financial revenue due to reduced interest income from deposits and loans, as well as lower foreign exchange gains. Meanwhile, selling and administrative expenses increased.

| VCS’s recent quarterly financial results |

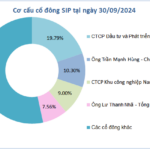

Phenikaa Group, chaired by Mr. Ho Xuan Nang (who also serves as the Chairman of VCS), has its core business in industrial manufacturing of surface materials, with quartz-based artificial stone as its flagship product. This product has been sold in both the domestic and international markets since 2004 and is managed and operated by key subsidiaries, including Vicostone, Style Stone, and Vietnam Stone Processing.

In early November 2024, Phenikaa Group announced the completion of a VND 200 billion bond issuance, with a fixed interest rate of 8.2% per annum and a maturity date of September 30, 2031.

Notably, the bonds are secured by Phenikaa Group’s common shares in VCS and all rights and interests arising from or related to these shares, including but not limited to stock dividends and bonus shares, except for cash dividends.

This is the fourth bond issuance by Phenikaa Group in less than a year. Prior to this VND 200 billion bond issuance, the Group announced the successful raising of VND 320 billion through the PKACH2431001 bond series on September 30, 2024, and VND 900 billion from two bond series issued on December 14, 2023.

In the first half of 2024, Phenikaa Group reported a post-tax profit of VND 514 billion, a 31% increase compared to the same period last year. As of the end of June 2024, the Group’s equity stood at over VND 9,000 billion, while its debt amounted to more than VND 6,300 billion, including VND 900 billion in bond debt.

Huy Khai

The Hydration Industry’s Hottest New Bond Offering: A Dehydrated Perspective.

The company, which is over 94% owned by Biwase, JSC – Binh Duong Water – Environment Corporation (Biwase, HOSE: BWE), has successfully raised a significant amount of bonds with an impressively low-interest rate of just 5.5% per annum, undercutting the bond interest rates offered by many other enterprises.

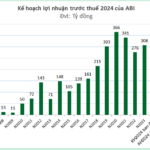

Agribank Insurance Slashes Over 29% Off 2024 Profit Plan Post Q3 Loss

The impact of Super Typhoon Yagi has dealt a significant blow to the operations of the Joint Stock Commercial Bank for Foreign Trade of Vietnam Insurance Corporation (UPCoM: ABI), casting doubts on their ability to meet their revenue and profit targets for 2024.