According to a notification from Thuduc House JSC (stock code: TDH), Mr. Nguyen Quang Nghia, Chairman of the Board, registered to sell nearly 20.7 million shares, equivalent to 18.4% of capital. This accounts for nearly the entire amount of shares that Mr. Nghia currently owns. If the transaction goes through, this major shareholder will only hold 52,200 shares, an insignificant proportion.

The transaction is expected to take place from December 6, 2024, to January 3, 2025. Based on the price of VND 2,160/share, the value of these shares is approximately VND 45 billion. Notably, TDH shares are currently trading around their all-time low.

In terms of personnel, recently, on November 28, Mr. Nguyen Hai Long resigned as CEO for personal reasons. Mr. Long will move to an advisory role for the Board, the CEO, and the Chairman. His replacement as CEO will be Ms. Tran Thi Lien.

Mr. Long was appointed CEO on April 15, 2024, replacing Mr. Dam Manh Cuong, so he has only held the position for about eight months. He is also currently the sole member of the Board of Directors (until his resignation).

Thuduc House’s top management has undergone continuous changes since 2022, following the legal troubles of several executives. The company’s operations began to stabilize under the leadership of Mr. Nguyen Quang Nghia as Chairman. However, both CEOs who served after the formation of the new Board of Directors have chosen to step down within a year of their appointment.

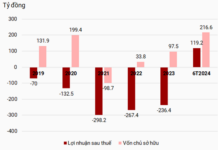

Thuduc House has frequently been subject to tax enforcement actions by the Ho Chi Minh City Tax Department regarding violations related to their export of electronic components during the 2017-2019 period. Their business performance has suffered since then. In 2020 and 2021, the company incurred consecutive losses of nearly VND 310 billion and VND 890 billion, respectively.

In 2022, the company reported a meager profit of VND 8 billion due to significant cost-cutting measures. However, in 2023, Thuduc House returned to a loss-making position.

For the first nine months of this year, the company recorded revenue of nearly VND 37 billion, a more than half decrease compared to the same period last year. They are still making a loss of nearly VND 4 billion and have accumulated losses of approximately VND 755 billion as of Q3 2024.

As of Q3 2024, the company’s total assets stood at VND 963 billion, a significant decrease from the beginning of the year.

The ‘Great Shift’ at the 30-Year-Old Real Estate Firm: Chairman Registers to Sell Over 18% of Company Shares as CEO Resigns Just Six Months into the Role

The Thuduc House leadership has been in a state of flux since 2022, with a string of executives facing legal troubles.

“Ticket Frenzy for ‘Brother Beyond the Thorny Path’ Concert: Producer’s Stock Soars to New Highs, Smashing Liquidity Records”

The YEG (Yeah1 Group Joint Stock Company) stock has been consistently “on fire”, mirroring the scorching popularity of the show.