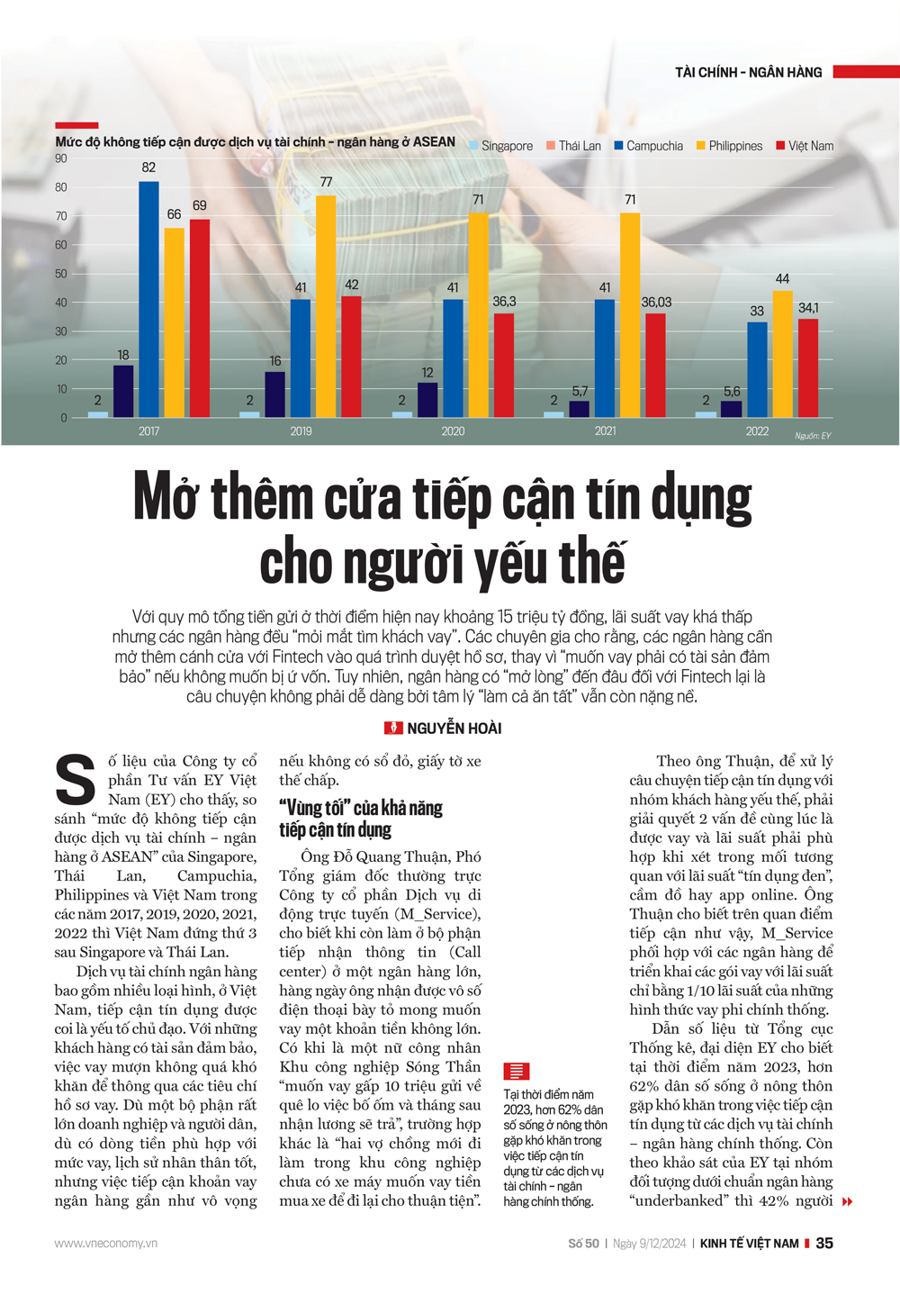

According to statistics from EY Vietnam Consulting JSC (EY), when comparing the “level of financial and banking service exclusion in ASEAN” of Singapore, Thailand, Cambodia, the Philippines, and Vietnam in 2017, 2019, 2020, 2021, and 2022, Vietnam ranked third after Singapore and Thailand.

Financial and banking services encompass a wide range of services, and in Vietnam, access to credit is considered a key factor. For customers with collateral, borrowing is not overly difficult as they can meet the loan application criteria. However, a large proportion of businesses and individuals, despite having cash flow suitable for the loan amount and a good personal history, face almost hopeless situations when trying to access bank loans without real estate or vehicle ownership documents as collateral.

THE “DARK SIDE” OF CREDIT ACCESSIBILITY

Mr. Do Quang Thuan, Deputy General Director of M_Service Joint Stock Company, shared that when he worked in the call center department of a large bank, he received countless calls from people expressing their desire to borrow a small amount of money. For example, a female worker in the Song Than Industrial Park wanted to “borrow 10 million VND urgently to send home to take care of her sick father and promised to repay the loan next month when she received her salary.” Another case was a “couple who had just started working in the industrial park and wanted to borrow money to buy a motorcycle for convenient transportation.”

“I sat there all day receiving information and couldn’t say much else. That’s why these people have to turn to “black credit” because they have no other choice.

To address the issue of credit accessibility for vulnerable groups, we need to simultaneously solve two problems: granting loans and ensuring reasonable interest rates compared to “black credit,” pawnshops, or online apps.”

According to Mr. Thuan, to address the issue of credit accessibility for vulnerable groups, we need to simultaneously solve two problems: granting loans and ensuring reasonable interest rates compared to “black credit,” pawnshops, or online apps. Mr. Thuan shared that based on this approach, M_Service coordinates with banks to implement loan packages with interest rates as low as one-tenth of those charged by informal lending sources.

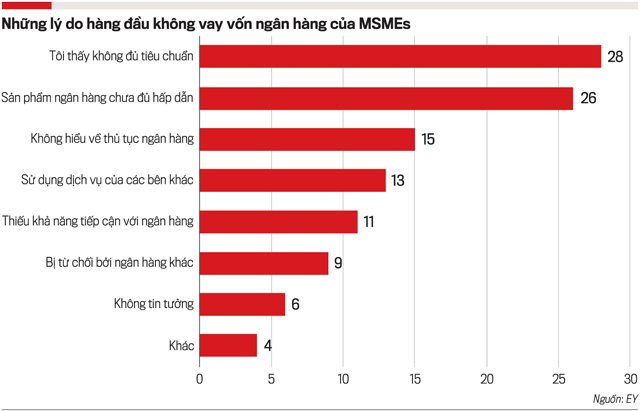

Citing data from the General Statistics Office, EY representatives stated that in 2023, more than 62% of the rural population faced difficulties in accessing credit from formal financial and banking services. Additionally, according to an EY survey of the “underbanked” group, 42% of respondents had used informal services such as borrowing from acquaintances, high-interest loans, or participation in rotating savings and credit associations within the past year.

“These individuals face high costs and significant financial risks. Super small enterprises and business households also encounter challenges in accessing capital from traditional banks due to a lack of collateral or incomplete credit records,” said EY representatives.

VULNERABLE GROUPS FACING BARRIERS IN BANK CREDIT ACCESS

For decades, in the system of policies providing capital and financial solutions for businesses and individuals, the government has always paid special attention to small and medium-sized enterprises, super small enterprises (MSMEs), and “underbanked” individuals.

First, there is the system of people’s credit funds with over 1,100 units, providing loans with a portion of capital from the Vietnam Cooperative Bank (Co-opbank) in addition to market mobilization. As of December 31, 2023, Co-opbank’s total outstanding loans amounted to 30,870 billion VND, mainly for people’s credit funds.

Next is the network of the Vietnam Bank for Social Policies (VBSP). The bank’s lending targets are poor households and national target programs for poverty reduction. As of December 31, 2023, the total outstanding social policy credit reached nearly 332,000 billion VND, with over 6.8 million remaining borrowers.

Notably, a significant institution, Agribank, focuses on lending to agriculture, rural areas, and farmers (“three agriculture” or “tam Nong” in Vietnamese). By the end of 2023, Agribank’s total assets exceeded 2 million billion VND, with capital mobilization reaching 1.88 million billion VND and outstanding loans to the economy amounting to 1.55 million billion VND; of which, loans for “tam Nong” accounted for nearly 65%. Additionally, finance companies within the Vietnamese credit institution system also provide consumer loans to vulnerable groups.

However, the financial systems mentioned above cannot fully satisfy the diverse borrowing needs and purposes of businesses and individuals, such as supplementary working capital loans, debt repayment loans, medical treatment loans, and meeting essential daily needs. This is why the “underbanked” have to turn to other informal lending channels.

According to statistics based on data from the Ministry of Public Security by a company in the data industry, in 2022, there were over 27,000 pawnshops in operation, with about half of them being enterprises. However, there has not been a detailed report on the total number of borrowers in this sector, their profiles, borrowing purposes, and average, maximum, and minimum interest rates…

A question arises: With the deposit scale of the entire credit institution system reaching 15 million billion VND at this point, why are there still organizations and individuals who cannot access bank loans and have to resort to informal credit channels such as pawnshops, “hụi” (a form of rotating savings and credit association), or online apps?

According to Mr. Nguyen Xuan Hoang, Vice Chairman of the Board of Directors of MISA Joint Stock Company, traditional banks often have numerous requirements for their products and services, especially loan products. Customers without bank accounts or with limited use of financial and banking products typically cannot meet the approval criteria regarding credit history and bank-recorded cash flow.

In reality, the loan approval mechanism in banks mostly requires collateral. Data from the State Bank of Vietnam shows that the current credit scale is over 14 million billion VND, and the total value of collateral is equivalent. However, experts note that real estate collateral accounts for 70% of the total collateral value as it is the “preferred choice” of lenders.

“Enterprises have to go through many requirements for financial statements, showing positive cash flow or presenting specific business management documents (such as organizational structure, business strategy, management plan, etc.).

As a result, they often face challenges in directly accessing the products and services of traditional credit institutions.”

For borrowers who have already mortgaged their real estate, expanding their debt is impossible unless they provide additional collateral. Vulnerable individuals rarely have sufficient collateral, so they are consistently categorized as “underbanked.”

Banks often argue that lending without collateral is like “releasing chickens and then chasing after them.” Conversely, the opposing view suggests that it is necessary to enhance the role of “credit scoring” to expand lending to individuals without collateral requirements instead of always asking for real estate or vehicle ownership documents as collateral.

Currently, there are two organizations specializing in credit scoring: the Vietnam National Information Center (under the State Bank of Vietnam) and Vietnam Credit Information Joint Stock Company (PCB). Credit scoring is one of the bases for banks to make lending decisions, but in reality, even with a high credit score, borrowers can only obtain reduced interest rates, and collateral remains a mandatory condition in loan contracts.

BRIDGING THE GAP WITH FINTECH

In an interview with the Vietnam Economic Magazine/VnEconomy, Mr. Nguyen Hai Nam, Director of Credit 360.AI Limited Company, shared: “Nowadays, with the emergence of numerous technology platforms, Fintech companies can update various fields of information about specific individuals in their databases. Therefore, banks can collaborate with Fintech companies for credit scoring to make lending decisions without necessarily requiring collateral.”

Mr. Nam provided an example: if a Fintech company can demonstrate an individual’s monthly expenses, such as shopping receipts, utility bills (electricity, water, phone, TV, internet, etc.), it can confirm that person’s income. When banks access this data from Fintech companies, they can make lending decisions without much hesitation.

Another example is the collaboration between KiotViet, the most popular retail management software provider, and MB to provide a financial support solution specifically designed for small traders. This partnership aims to help small retailers recover from the prolonged pandemic impact, market fluctuations at home and abroad, and seize the high consumption opportunity during the Lunar New Year 2025.

The financial support package is worth up to 1,000 billion VND, offering preferential interest rates, flexible conditions, and a simple and fast application process. KiotViet’s retail business owners who need capital can apply for loans of up to 300 million VND quickly, without collateral, and with online disbursement through the MBBank app. The maximum loan term is 12 months, with attractive interest rates. MB’s leadership shared that if the disbursement of this package is successful, the scale will be expanded to 5,000 billion VND in 2025.

According to KiotViet’s representatives, their software is currently used by over 300,000 merchants. To enable this group of customers to access capital from MB, a credit scoring process is necessary, utilizing algorithms designed by engineers based on various data fields. For instance, merchants who have been using the software for two years or more will have a higher credit score than those who have been using it for six months, or those who have been using it for five years will have a higher score than those who have been using it for two years.

The next data point is that KiotViet has hundreds of features, and users who utilize more features will have a higher credit score than those who use fewer features. For example, if a user takes advantage of features like inventory management, delivery, customer relationship management, or uses features for delivery and transactions on e-commerce platforms, grab services, and payment solutions, their “business” score will be more stable than those who use fewer features. Additionally, merchants who sell on e-commerce platforms and have physical stores will have a higher credibility score.

Furthermore, through this software, managers can analyze merchants’ revenue, profit, suppliers, and customer base. Those who sell 50 units per day will have a higher score than those who sell 30-40 units per day, and merchants with higher cash sales will have a higher credibility score.

In comparison, traditional banks use only a few dozen data points for credit scoring, while KiotViet’s software utilizes thousands of data fields, resulting in highly accurate credit scoring. This forms the basis for the partnership between the bank and the software provider.

However, a reality check reveals that not all Fintech companies that perform well will automatically secure collaborations with banks as mentioned above. Experts believe that the success of bank-Fintech partnerships depends on the will of the bank’s leaders. If bank leaders recognize that Fintech companies excel in certain areas, they should delegate those tasks to them instead of trying to “do it all themselves.” This mindset is the foundation for a successful collaboration between the two sides…

The full content of this article was published in the Vietnam Economic Magazine No. 50-2024, released on December 9, 2024. Please refer to the following link for the full article: https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam

The Dark Cloud of Bad Debt

As per the latest data from the State Bank of Vietnam, the on-balance sheet bad debt ratio stood at 4.55% as of the end of Q3 2024, almost on par with the level at the end of 2023. In its recently updated report on the banking sector outlook, SSI Research noted that the bad debt ratios at state-owned and joint-stock commercial banks rose to 1.49% and 2.59%, respectively, in Q3 2024.

Why Do Lending Institutions Hesitate to Finance Agriculture?

The Mekong Delta region is highly vulnerable to the impacts of climate change, including rising sea levels, saltwater intrusion, and flooding. As per Mr. Tran Viet Truong, Chairman of the Can Tho People’s Committee, these risks make lending institutions hesitant to provide loans as the agricultural sector in this region is heavily dependent on weather and nature.

The Ultimate Guide to Captivating Copy: “3 Businesses with Substantial Assets Have Their Debts Up for Grabs by Banks”

Three businesses’ debts are up for sale by the bank, with an attractive package of collateral. This includes land rights to over 30 plots and 2.6 million shares in a publicly traded company on the HNX. A unique opportunity for investors to acquire these valuable assets and secure a strong financial future.

Sure, I can assist with that.

## SMEs Can Now Mortgage Loans of Up to 20 Billion VND Online

Small and medium-sized enterprises (SMEs) are buzzing about VPBank’s new policy, introduced in July. The bank now offers loans with a limit of up to 100% of the value of the secured asset, and the entire loan application and disbursement process can be completed online. This is a game-changer for businesses, offering a streamlined and efficient way to access much-needed capital. With this innovative approach, VPBank is supporting SMEs in a whole new way, and we can’t wait to see the positive impact it has on their growth and success.