Over-reliance on Banks?

At the seminar “Overview of the Capital Market in 2024 and Prospects for 2025” held this morning (Dec 6), Dr. Nguyen Tu Anh shared that relying too heavily on credit capital can lead to significant risks, such as an increase in non-performing loans.

Additionally, credit per capita is much higher compared to GDP per capita, indicating a disconnect between credit growth and economic growth. This prompts the question: Is the actual amount of credit capital entering the economy significantly lower than what the statistics suggest?

Dr. Nguyen Tu Anh – Director of the Center for Information, Analysis, and Economic Forecasting, Central Economic Committee.

Meanwhile, the corporate bond market, a medium and long-term capital mobilization channel, is mainly participated in by credit institutions and real estate businesses. The lack of diversity in capital mobilization channels makes it challenging for many Vietnamese enterprises to access capital.

This challenge is not limited to small and medium-sized enterprises but also affects medium-sized enterprises, hindering their growth and impacting the overall economic development. Vietnam is in a new phase of development with ambitious plans, such as nuclear power and the North-South high-speed railway.

To achieve these goals, Dr. Tu Anh emphasized the need to promote investment and improve investment quality by diversifying capital mobilization channels.

“A developing economy cannot rely solely on banks. We must develop other critical capital markets, including the bond and stock markets,” said Dr. Tu Anh. “As the capital market evolves and becomes more diverse, the economy will also experience new vibrancy.”

Other Capital Mobilization Channels are Challenging

Dr. Le Minh Nghia, Chairman of the Vietnam Financial Consulting Association, emphasized the importance of the capital market as a crucial component of the financial market, providing medium and long-term capital. It contributes to the efficient mobilization and allocation of resources, laying the essential material foundation for the country’s economic growth.

According to Resolution No. 31/2021 of the National Assembly, the orientation for the capital market by 2025 includes targets such as achieving a minimum of 85% GDP in the stock market capitalization and a minimum of 47% GDP in the bond market outstanding balance, with corporate bonds accounting for about 20% of GDP…

On November 29, the National Assembly passed the amended Securities Law, along with eight accompanying laws related to the financial sector, marking a significant step forward in promoting the development of the capital market. However, Dr. Nghia pointed out that the Vietnamese capital market still faces several challenges.

“The structure of corporate bonds is fragile, with most issuances coming from banks and real estate businesses. The stock market is the most volatile in the region and is still far from meeting the set targets in terms of quality and quantity. The insurance market has experienced record-low growth rates in the past two years. In the banking credit market, there is increasing pressure from non-performing loans, while the buffers of many banks are thinning, indicating underlying risks,” said Dr. Nghia.

“Legislature Seeks to Temper the Real Estate Market, Avoiding a ‘Hot’ or ‘Frozen’ Scenario”

The resolution 161/2024/QH15 passed by the National Assembly requests that the Government directs ministries, sectors, and localities to take measures to regulate and promote a healthy real estate market. The aim is to prevent the market from either “overheating” or “freezing,” which could negatively impact the overall economic development of the country.

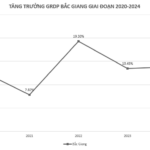

Unveiling the Champion of GRDP Growth in 2024: Three Years of Consecutive Leadership, Surpassing the 200,000 Billion Dong Milestone

Recently, the People’s Committee of Bac Giang province held its 11th periodic conference for 2024. Speaking at the event, Mr. Mai Son, Acting Chairman of the Provincial People’s Committee, emphasized that in 2024, with the unity, consensus, and resilience of the people and businesses, the province’s socio-economic development continued to yield positive results.

The Ultimate Comeback: Quang Nam’s Remarkable Turnaround with a Staggering 26,000 Billion Dong Revenue

Contrary to earlier pessimistic forecasts, the province of Quang Nam has made a remarkable comeback, collecting over VND 26 trillion in revenue, exceeding the estimate by more than 110%.