In the digital age, online savings accounts are becoming a popular choice for many consumers, especially those looking to save time and earn more attractive interest rates compared to traditional over-the-counter savings accounts. Online savings accounts typically offer interest rates that are 0.1-0.4% higher per year than their counter counterparts.

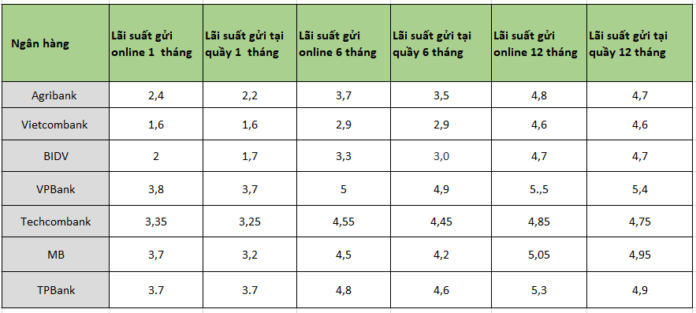

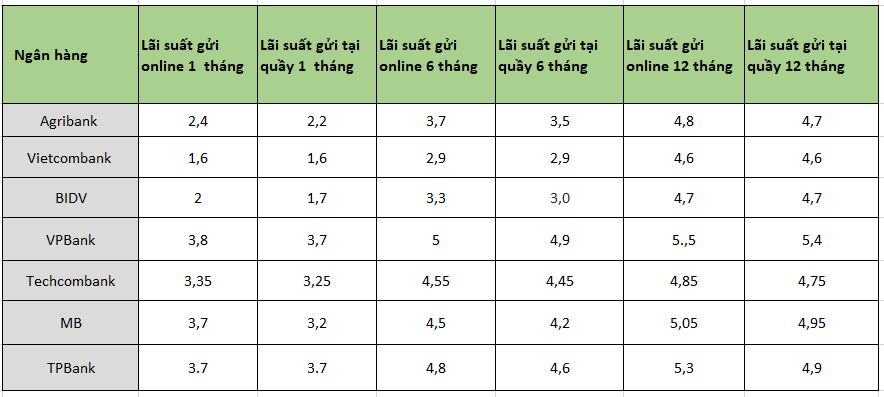

Comparing online and counter savings interest rates at some banks. (Source: Tung Lam)

Why do banks usually offer higher interest rates for online savings accounts compared to counter deposits?

According to Decision No. 986/QD-TTg on the Strategy for the Development of the Vietnam Banking Industry by 2025, with a vision towards 2030, the State Bank encourages banks to promote the development of cashless payments and improve product quality by applying information technology to reduce costs, time, and bring convenience to customers. Therefore, online savings are encouraged during this period of digital transformation.

Online savings not only help customers save time and effort but also bring many benefits to the bank. Firstly, the bank will save infrastructure operating costs.

To mobilize savings in the traditional way, banks need to open many branches in residential areas to make it easier for customers to access banking services. However, with today’s online savings method, banks can mobilize customers to save money more flexibly without having to go directly to the branch.

In addition, encouraging customers to open online savings accounts helps banks optimize the cost of purchasing equipment, improving infrastructure such as furniture, printers, scanners, and computers.

When choosing to save online, the process of opening an account, depositing, and withdrawing money becomes simpler, allowing customers to do it themselves at home without the support of a large number of bank staff. Through the website or hotline, customers can quickly and easily find out all information about the bank’s services.

Therefore, banks can redirect resources from system operations to customer attraction activities, including improving interest rates for online savings products.

Encouraging customers to save online not only helps optimize current costs but also creates a competitive advantage for banks in the race to digitization. Banks with a faster digitization speed will gain an advantage in reaching and serving customers more effectively.

For customers, online savings also bring many benefits. Firstly, customers can save anytime, anywhere, with just a few simple steps on the Internet Banking application or website. This helps customers save time traveling to the transaction offices.

Customers can control information and financial activities on their phones anytime, anywhere through the Internet Banking e-banking service. With advanced technology such as two-factor authentication, data encryption, OTP messages, etc., information about customers’ savings will be securely and fully secured. When depositing money online, customers will receive a higher interest rate than depositing at a transaction counter.

Gold Prices Rise Slightly After US Jobs Report and Political Turmoil in South Korea, France

The spot gold price in New York edged higher on Tuesday (December 3) after stronger-than-expected employment data reinforced expectations of a more cautious Fed in its monetary policy easing process. In the Asian market, gold prices also ticked up following political turmoil in South Korea and France.

Will Interest Rates Drop Further by Year-End?

The continuous rise in deposit interest rates in recent times has sparked a question: Can lending rates drop further by the year-end?