Exchange Rate Pressure Mounts from 2023

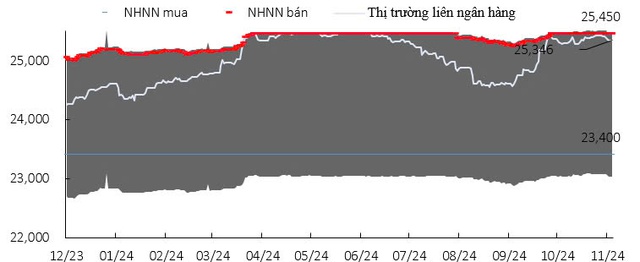

According to KIS Securities, the upward trend of the exchange rate in the past two years can be divided into two phases: the second half of 2023 to September 2024, and from September 2024 onwards.

In the initial phase, pressure on the exchange rate continually intensified, peaking between April 2024 and July 2024, as the rate consistently remained at a high level. This pressure primarily stemmed from the Fed’s tight monetary policy. To curb inflation, the Fed repeatedly raised interest rates and maintained them at a high level from August 2023.

The Fed has been raising interest rates and keeping them high since August 2023 to curb inflation.

These high-interest rates created a gap between US and foreign interest rates, causing capital to flow out of developing countries and into the US, which offered higher returns. This capital outflow weakened other currencies while strengthening the US dollar, putting significant pressure on currencies like the VND and pushing the VND/USD exchange rate higher.

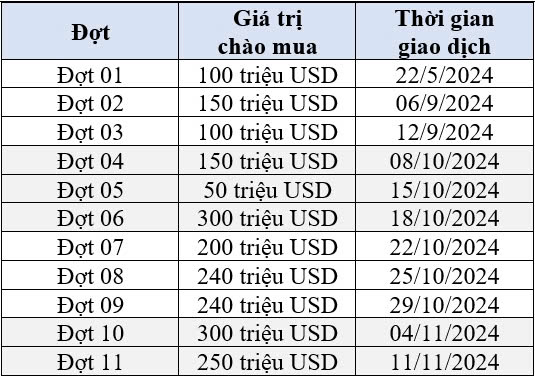

USD trading dynamics as observed by the State Bank of Vietnam – Source: SBV, Bloomberg, Fiinpro, KIS

In the second phase, KIS Securities noted a decrease in pressure on the exchange rate; however, internal factors, mainly related to demand, pushed the rate higher in the last two months. Specifically, in September 2024, the Fed signaled a shift in its monetary policy by cutting interest rates by 0.5%. Since then, there has been an additional cut, totaling 0.75%. This move sent a positive signal, helping to ease pressure on the exchange rate in August and September. Nonetheless, the VND/USD rate climbed back up, nearly reaching its previous peak. In October and November, foreign exchange demand surged, particularly from businesses and the State Treasury. While businesses required USD to import raw materials for year-end and Tet 2025 production, the State Treasury was actively purchasing USD to repay foreign currency debts.

Foreign currency purchase auctions by the State Treasury – Source: State Treasury

Exchange Rate Pressure to Subside

According to KIS Securities, despite the current high exchange rate, this pressure is expected to ease in the near future due to three main groups of reasons:

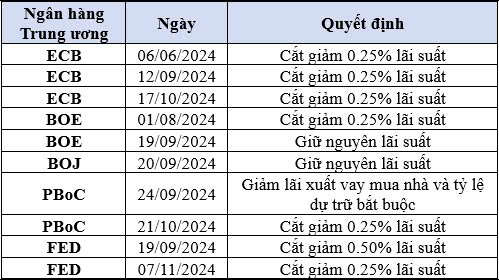

Firstly, KIS Securities believes that the accommodative monetary policies of major central banks will have a positive impact. Specifically, September 2024 marked a crucial turning point in global monetary policy when several central banks, including the Fed, ECB, BoE, and PBoC, simultaneously eased their policies. The Fed’s surprise rate cut of 0.50%, the first in over four years, aimed to support the US economy as employment growth showed signs of weakening. The ECB and BoE also lowered interest rates, while the PBoC reduced the reserve requirement ratio and mortgage rates to stimulate the economy. These moves significantly narrowed the interest rate gap between Vietnam and other countries, contributing to a more stable exchange rate.

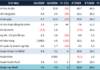

Monetary Policy Decisions by Select Central Banks – Source: KIS Compilation

Secondly, foreign exchange demand is anticipated to decrease in the upcoming period. Businesses have already imported sufficient raw materials for year-end and Tet 2025 production, reducing the need for foreign currency to settle orders. Additionally, the State Treasury has also purchased enough foreign currency to repay bond debts, and the pressure to repay foreign currency debts in 2025 is not expected to be significant.

Lastly, KIS Securities forecasts an increase in foreign currency supply in the coming months. Specifically, the trade surplus improved in the final months of 2024 due to a resurgence in export growth. Demand from major markets like the US and EU recovered, resulting in a trade surplus of $24.31 billion for Vietnam as of November 2024. Moreover, foreign capital has returned to the stock market, with net foreign buying reaching approximately VND 1,000 billion in week 48. This not only improved market liquidity but also injected foreign currency into the system, alleviating the demand for USD. Additionally, remittances in the upcoming period are expected to further boost USD supply.

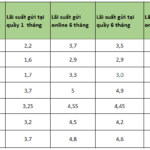

Online Savings Accounts: Earn Higher Interest with Agribank, BIDV, VPBank, TPBank, and More

Many banks offer higher interest rates for online savings accounts, ranging from 0.1% to 0.4% per annum, compared to the rates advertised at their physical branches.

Gold Prices Rise Slightly After US Jobs Report and Political Turmoil in South Korea, France

The spot gold price in New York edged higher on Tuesday (December 3) after stronger-than-expected employment data reinforced expectations of a more cautious Fed in its monetary policy easing process. In the Asian market, gold prices also ticked up following political turmoil in South Korea and France.

The Week in Forex: Central Bank Interest Rates and Interbank Rates Cool Off, SBV Cuts Liquidity Support

Last week, the interbank exchange rate fell to 25,372 VND/USD, while VND interest rates continued their downward spiral across all tenors. The State Bank of Vietnam (SBV) withdrew a net amount of VND 16,000 billion from the market through open market operations.