Vietnam’s stock market just experienced a thrilling trading session. Bottom-fishing demand that emerged in the afternoon pushed the VN-Index significantly higher. At the close of the December 5 session, the VN-Index surged 27.12 points (+2.19%) to 1,267.53, while the HNX-Index gained 4.98 points to 229.6, marking the strongest performance for the former in over three months since August 16.

In terms of foreign trading activities, after a period of aggressive selling, foreign investors unexpectedly returned to net buying, with a net purchase value of nearly VND675 billion across the entire market.

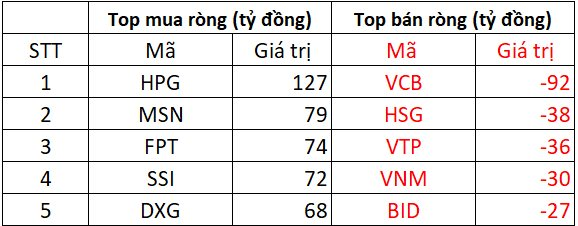

On the Ho Chi Minh Stock Exchange (HoSE), foreign investors net bought VND669 billion

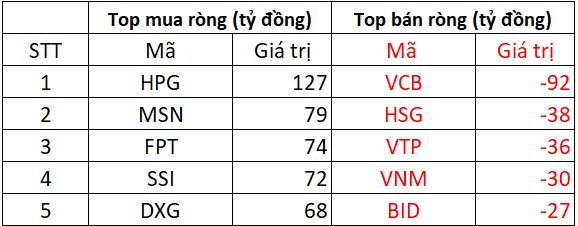

HPG was the most purchased stock by foreign investors on HoSE, with a net buy value of VND127 billion. Following HPG, MSN, FPT, and SSI were net bought for over VND70 billion each. In addition, DXG was also bought for VND68 billion.

On the other hand, VCB faced net selling of VND92 billion. HSG, VTP, and VNM also experienced net selling pressure from foreign investors, with more than VND30 billion sold for each stock. BID came next, with VND27 billion worth of shares sold by foreign investors.

On the Hanoi Stock Exchange (HNX), foreign investors net bought over VND22 billion

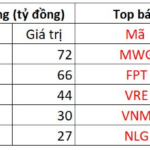

MBS was the most purchased stock on HNX, with a net buy value of VND7 billion. Additionally, DTD was the second most bought stock by foreign investors on HNX, with a net buy value of VND5 billion. Foreign investors also spent a few billion dong to net buy IDC, SHS, and TIG.

Conversely, CEO faced net selling pressure from foreign investors, with a net sell value of only VND2 billion. PVS, PMC, TNG, and PGN also experienced net selling of a few hundred million to VND1 billion.

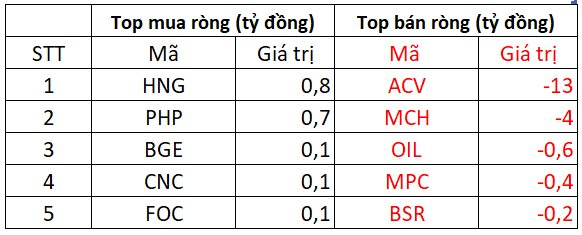

On the Unlisted Public Company Market (UPCoM), foreign investors net sold VND16 billion

In terms of net bought stocks on UPCoM, HNG, PHP, BGE, and CNC were among the few that were net bought, with values of a few hundred million dong each.

In contrast, ACV faced net selling pressure from foreign investors, with a net sell value of VND13 billion. Foreign investors also net sold MCH, OIL, MPC, BSR, and a few other stocks.

The Art of Margin Lending in a Dry Liquidity Climate

Market liquidity is on a downward trend, with average transaction values consistently declining month-on-month since June.

The Foreign Sell-Off: Aggressive Selling by Foreign Investors Totals Nearly VND 700 Billion, with Two Leading Stocks Taking a Significant Hit

Foreign trading activities were less than positive, with continued net selling and a strong focus on the HOSE floor.