The Vietnamese stock market witnessed a surprising influx of capital in the afternoon of December 5th, reversing the slow trading momentum from the morning session. This sudden influx of money caused a wave of stocks to turn from red to green, with financial stocks, particularly securities stocks, standing out as some even hit the daily limit-up.

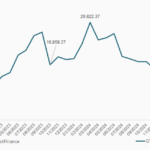

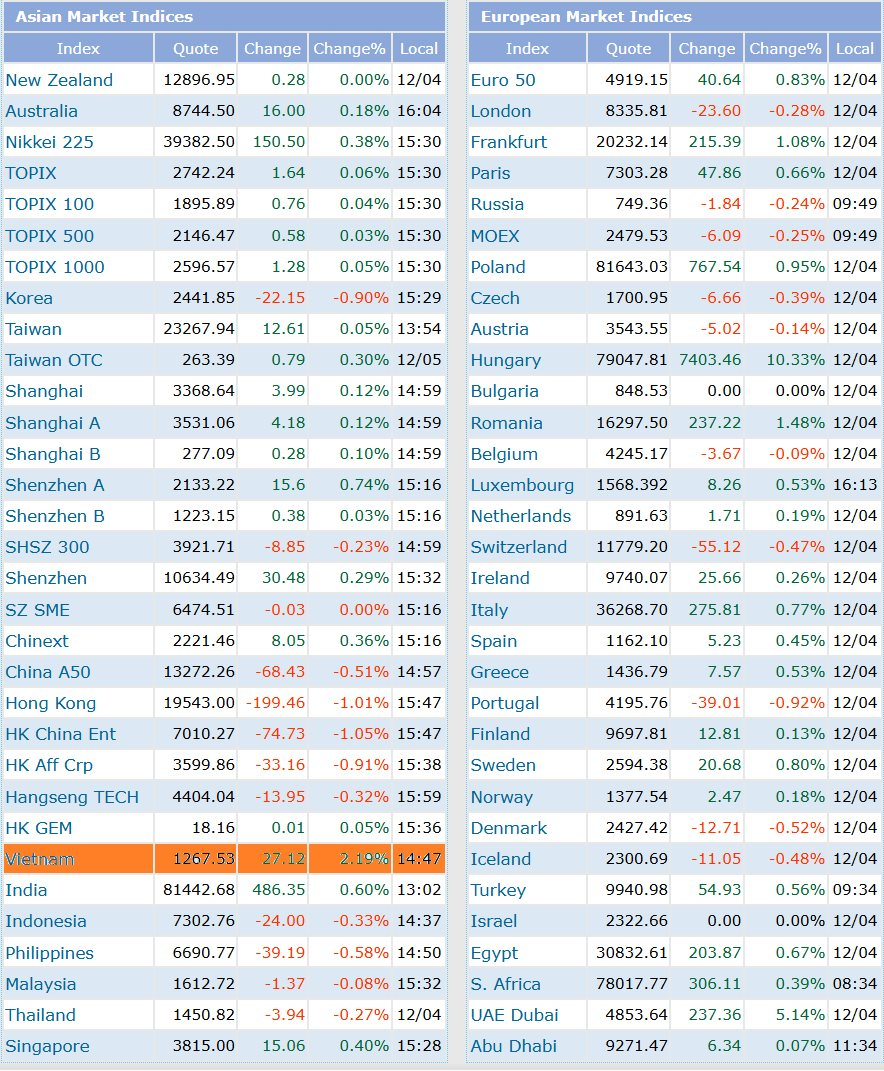

The VN-Index closed the session with a significant gain of 27.12 points (+2.19%) to 1,267.53 points, the highest level in over a month. This was the strongest increase in the index in over three months since August 16th. The 2.19% gain also made Vietnam the best-performing stock market in Asia on December 5th.

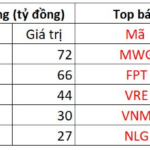

The vibrant trading atmosphere in the afternoon pushed the matched order liquidity on HoSE above 19 trillion VND, the highest in many months. Moreover, the impressive breakthrough of the market on December 5th was also marked by the return of foreign investors, who net bought over 700 billion VND on HoSE. While this move cannot confirm a trend reversal, it is still a positive signal for the market.

In a recently updated report released in mid-November, Dragon Capital stated that the US dollar strengthened in October due to expectations of policy changes in Trump’s new term, which could lead to higher-than-expected inflation and put pressure on currencies in emerging markets, causing the VND to depreciate by 2.9%. Dragon Capital assessed that the strong US dollar could prolong the outflow of foreign investment from emerging markets back to the US.

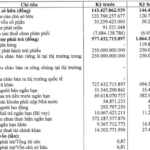

However, Vietnam’s third-quarter profits remained positive, with 80 companies in the research scope recording a 19% growth in net profit year-on-year. This result demonstrates the resilience of the Vietnamese stock market and reinforces the expected growth of 16-18% by 2025. These 80 companies are trading at a projected P/E ratio of 11.6 times compared to the five-year average of 13.9 times, providing solid support for the market.

Similarly, the Finnish fund Pyn Elite Fund also holds a positive outlook for the Vietnamese stock market. Mr. Petri Deryng, the fund’s head, forecasts that the profits of listed companies on the Vietnamese stock market could grow by about 20% this year and maintain a similar pace in 2025. The market is still reasonably valued, with the projected P/E ratio for 2025 at around 10 times.

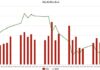

Regarding market trends, Mr. Tran Hoang Son, Market Strategy Director of VPBankS, shared on the December 2nd episode of “Khớp Lệnh” that the bottoms of the VN-Index have been firmly established around 1,200 points. Mr. Son also maintained his view that there would be a “gift” for investors this Tet holiday. Accordingly, investors who buy stocks around the 1,200-point level and hold them from November to April of the following year are likely to profit, he assured.

“The stock market has many positive stories, such as the trading system upgrade, market upgrade expectations, and improved GDP growth. Therefore, market corrections present buying opportunities. For now, as the VN-Index reaches a resistance level, short-term investors should consider taking profits, while medium and long-term investors who have already purchased stocks at the lowest prices recently should continue to hold and wait for a more positive market trend in the latter part of this year and early next year,” Mr. Son recommended.

The Global Ambition of RYG: A Promising Newcomer on the HOSE Floor

With a robust foundation, experienced leadership, and strategic vision, RYG is poised to soar and cement its position in the tile industry, both in Vietnam and on the global stage.