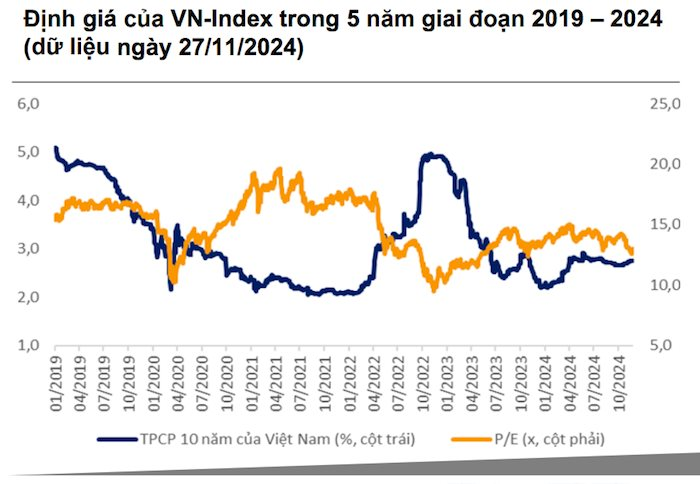

In VNDirect’s updated strategic report, the securities firm noted that the P/E ratio of the VN-Index is currently at an attractive level, trading at a 10.3% discount to its 5-year average. The forward P/E ratio at the end of 2024 is estimated to be in the range of 12.5-13 times. The analysts expect a strong improvement in EPS growth in Q4/24.

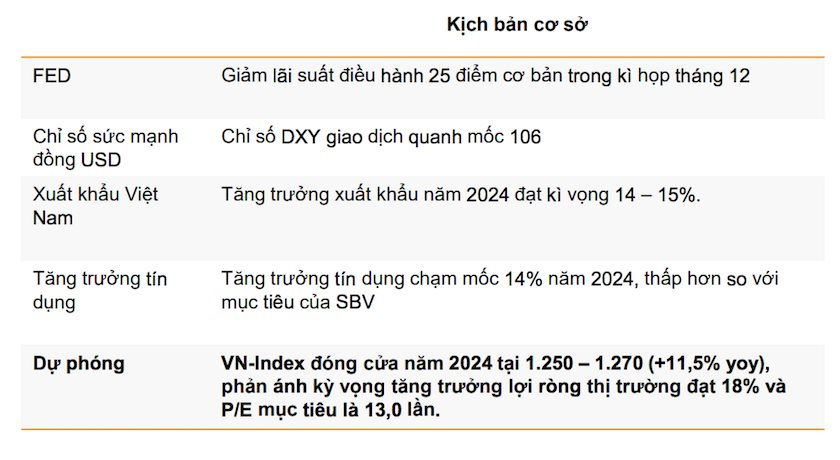

Additionally, the market has already priced in most of the risks associated with President-elect Donald Trump’s proposed policies, which pushed the DXY index to 107. However, VNDirect believes that the Fed will continue to cut interest rates at the upcoming December meeting. This could ease pressure on the DXY index, thereby reducing pressure on the VND exchange rate and allowing the SBV to focus more on supporting system liquidity and credit growth.

“These factors could positively impact stock market liquidity and investor sentiment, thereby pushing the market’s P/E ratio higher by the end of the year,” the report stated.

In terms of P/B valuation, the VN-Index is currently trading at an attractive level of 1.6x book value, a 19.6% discount to its 5-year average.

Expected Exchange Rate Pressure to be Managed in December

On the macroeconomic front, the US CPI showed signs of rebounding in October, leading to more cautious statements from Chairman Powell regarding the Fed’s interest rate cut plans.

However, VNDirect believes that the Fed’s cautious moves are likely to start in 2025, after Trump officially takes office, and that the Fed will still cut interest rates as planned in December this year.

The DXY index is currently one of the most closely watched indicators in the market, as exchange rate pressure can directly impact the monetary policy of the SBV.

Analysts expect exchange rate pressure to be managed in December due to improved USD supply from: 1) a sustained trade surplus and exporters’ tendency to sell foreign currency to banks at the end of the year to meet domestic shopping needs and salary payments; 2) positive growth in realized FDI capital; and 3) December being the peak season for remittances to Vietnam.

Appropriate Time for Capital Allocation and Accumulating Stocks

Regarding the VN-Index, the main index of the stock market, it is currently trading in a range of 1,200–1,300 points, with trading liquidity gradually declining after a period of strong foreign investor net selling.

In the base case scenario, VNDirect expects the VN-Index to fluctuate around 1,250–1,270 points by the end of this year, based on an assumed market net profit growth of 18% and a target P/E ratio of 13.0 times. This target P/E is lower than the 2023 year-end P/E of 13.4 times.

Despite improvements in economic growth and the earnings picture of listed companies, these positives have not been fully reflected in market valuations due to: (1) record foreign net selling, (2) exchange rate pressure, and (3) tighter liquidity conditions in the final months of this year compared to the same period last year.

Given the current valuations and macroeconomic backdrop, analysts believe this is an appropriate time for long-term investors to actively allocate capital and accumulate stocks to build their portfolios for 2025.

However, as the market has not yet established a solid upward trend, excessive financial leverage could be counterproductive and increase risks. Investors are advised to adopt a cautious capital allocation strategy.

The Vietnamese Stock Market Soars: A Surprising Rise to the Top in Asia

The Vietnamese stock market witnessed an unexpected surge in trading activity, with the VN-Index leading gains across Asia. This rally was characterized by a significant jump in trading volume and a return to net buying by foreign investors, setting the stage for a potential shift in market dynamics and investor sentiment.

The Art of Margin Lending in a Dry Liquidity Climate

Market liquidity is on a downward trend, with average transaction values consistently declining month-on-month since June.