In late November to early December, banks increased their deposit interest rates by 0.2-0.5 percentage points compared to the previous period.

In the most recent period, MSB raised all term interest rates by 0.4 percentage points. The bank increased interest rates for 1-3 month term deposits to 3.6%/year, 6-9 month term deposits to 4.7%/year, and 12-month or longer-term deposits to 5.5%/year.

From November 25th, MB slightly increased interest rates for all terms of up to 12 months by 0.05-0.1 percentage points. For deposits below VND 500 million, MB raised the interest rate for 1-month term deposits to 3.2%/year, 3-month term deposits to 3.6%/year, 6-9 month term deposits to 4.2%/year, and 12-month term deposits to 4.95%/year.

Meanwhile, from December 3rd, VPBank increased interest rates for 1-3 month term deposits by 0.2 percentage points while decreasing interest rates for over 12-month term deposits by 0.2 percentage points. Specifically, for deposits below VND 1 billion, VPBank raised the interest rate for 1-month term deposits to 3.7%/year and 3-month term deposits to 3.9%/year, while reducing the interest rate for over 12-month term deposits to 5.5%/year.

In the state-owned group, Agribank was the first bank to raise deposit interest rates. The bank increased interest rates for terms below 12 months by 0.5 percentage points. Agribank’s 1-month term deposit rate was increased to 2.2%/year, 3-month term deposits to 2.5%/year, 6-9 month term deposits to 3.5%/year, while the 12-month term deposit rate remained unchanged at 4.7%/year.

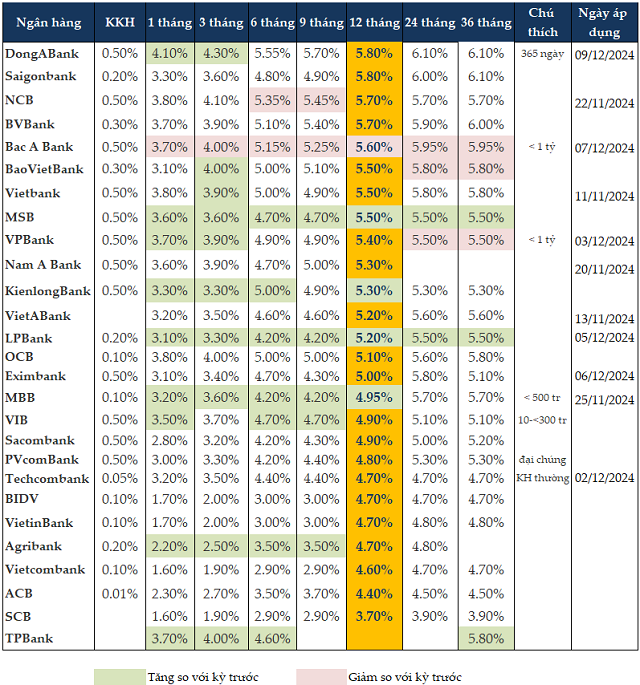

As of December 9, 2024, personal savings deposit rates for 1-3 month terms ranged from 1.6 – 4.3%/year, 6-9 month terms ranged from 2.9 – 5.7%/year, and 12-month terms ranged from 3.7 – 5.8%/year.

For the 12-month term, DongABank and Saigonbank offered the highest deposit rate at 5.8%/year, followed by NCB and BVBank at 5.7%/year.

For the 6-month term, DongABank maintained the highest interest rate at 5.55%/year, followed by NCB at 5.35%/year.

Meanwhile, for the 3-month term, DongABank offered the highest interest rate at 4.3%/year.

|

Personal savings deposit rates at banks as of December 9, 2024

Source: Author’s compilation

|

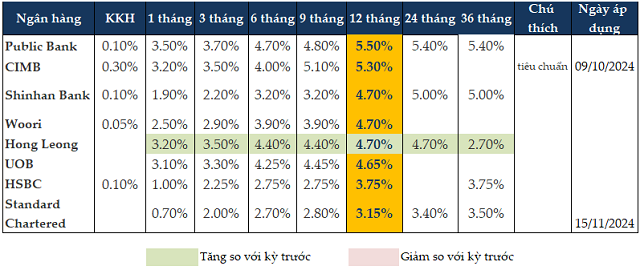

Among foreign banks, Hong Leong Bank was the only one to increase deposit interest rates. As of December 9, 2024, Public Bank offered the highest interest rate of 5.5%/year for 12-month term deposits, and 4.7%/year for 6-month term deposits.

|

Personal savings deposit rates at foreign banks as of December 9, 2024

Source: Author’s compilation

|

Recently, at the regular Government press conference on December 7, Deputy Governor of the State Bank of Vietnam (SBV) Dao Minh Tu stated that the total outstanding loans of the economy were approximately VND 15.3 quadrillion, and capital mobilization had reached nearly VND 14.8 quadrillion. The loan growth rate is higher than that of capital mobilization, indicating that in addition to commercial banks’ capital mobilization, the SBV has also taken measures to support commercial banks through policy implementation.

Mr. Pham Nhu Anh – CEO of MBB shared that in the last months of 2024, there is a high demand for consumption among the people and businesses. Therefore, there is an increase in the demand for capital mobilization, and a slight increase in deposit interest rates to prepare for the capital needs of the credit market at the end of the year.

The slight increase in deposit interest rates does not significantly affect the bank’s lending rates. Banks have also optimized their operating costs to maintain the current low-interest rate level, ensuring that people’s access to credit remains acceptable.

Meanwhile, Assoc. Prof. Dr. Dinh Trong Thinh – Economic Expert forecasted that lending rates would remain stable, while deposit rates might increase slightly in the coming time.

Assoc. Prof. Dr. Nguyen Huu Huan – University of Economics Ho Chi Minh City assessed that towards the end of the year, banks tend to push up deposit interest rates to meet the rising demand for loans. However, this trend is only seasonal.

For the future, Mr. Huan predicted that interest rates would likely remain stable. As the US Federal Reserve (Fed) has shown no intention of further reducing interest rates, Vietnam’s interest rates are not expected to decrease significantly.

“Unleashing Economic Growth: A 12.5% Surge in Credit Across the Nation as of December 13th.”

The information was released by the State Bank of Vietnam (SBV) at a conference on December 14, 2024, reviewing the monetary policy control and banking activities in 2024 and outlining tasks for 2025.

Securities KIS: Forex Pressure to Ease in Coming Months

According to KIS Securities, in December and the first quarter of 2025, the exchange rate will cool down and no longer put too much pressure on the economy and the stock market. This is due to the loose monetary policies of major central banks around the world, such as the FED and ECB, low foreign exchange demand, and trade surplus.

“Proposing a Dedicated Government Bond for Multi-Billion Dollar ‘Mega Projects’”

Experts are calling for the issuance of specific government bonds to attract additional investors for mega-projects currently valued at billions of dollars. An example of such a project is the high-speed North-South railway, with an estimated total capital of 67 billion USD, slated for completion in 2035.