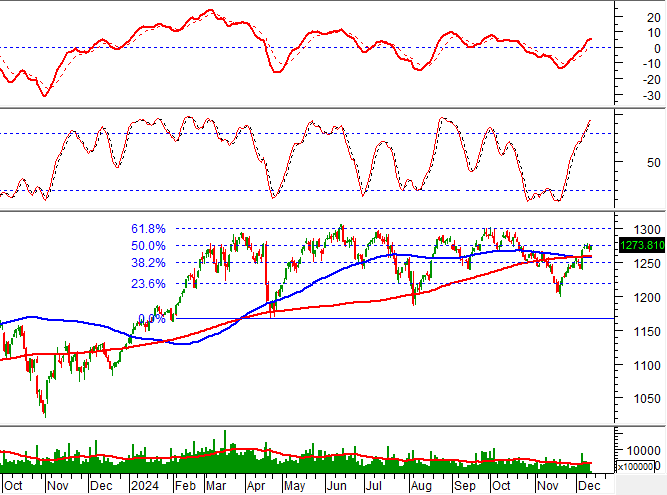

Technical Signals of VN-Index

In the trading session on the morning of December 12, 2024, the VN-Index gained points, and trading volume increased significantly, indicating an improvement in investor sentiment.

However, the Stochastic Oscillator indicator continued to rise and entered deeper into the overbought zone. If sell signals reappear and the indicator falls out of this zone, a short-term correction scenario may occur in the following sessions.

Technical Signals of HNX-Index

In the trading session on December 12, 2024, the HNX-Index gained points, and trading volume improved in the morning session, indicating a return to optimistic investor sentiment.

Currently, the HNX-Index continues to test the short-term downward trendline, while the MACD indicator maintains the previous buy signal. If the index successfully tests this trendline, the recovery prospect may continue in the coming sessions.

BCG – Bamboo Capital Joint Stock Company

In the morning session of December 12, 2024, BCG rose in price, and trading volume exceeded the 20-session average, indicating investors’ optimistic sentiment.

Currently, the stock price has broken out of the medium-term downward trendline, suggesting that the prospect of recovery is gradually materializing.

In addition, the stock price rebounded after successfully testing the Middle line of the Bollinger Bands, while the Stochastic Oscillator indicator has been rising steadily after giving a previous buy signal, further reinforcing the strength of the stock’s current trend.

NAB – Nam Á Commercial Joint Stock Bank

In the morning session of December 12, 2024, NAB stood firm, and a Doji candlestick pattern appeared, with a significant increase in trading volume in the morning session, expected to exceed the 20-day average by the end of the session, indicating investors’ uncertainty.

Currently, the stock price remains above the SMA 50 and SMA 100 lines, while the MACD indicator has been steadily rising after giving a previous buy signal, indicating the presence of a positive medium-term prospect.

Technical Analysis Department, Vietstock Consulting

The Market Beat: Afternoon Dip Turns All Three Boards Red

The unexpected afternoon slump saw all three market indices close in the red on December 12th. The VN-Index led the decline, falling 1.51 points to 1,267.35, followed by the HNX-Index, which dropped 0.19 points to 227.99. The UPCoM index also slipped, shedding 0.06 points to close at 92.68. Foreign investors offloaded Vietnamese shares for the fourth consecutive session.

“Steering Through the Storm: Navigating Investment Strategies for 2025 and Beyond”

In less than a month, the stock market will close out an unpredictable 2024. As we transition into the new year, investors are seeking answers to the question: What’s in store for 2025? To provide insights and guidance, VPBankS Talk 04, themed “Navigating Through the Storm,” will be held on December 16.

The Good News: Foreigners Change Course, Pouring Nearly VND 700 Billion into Vietnam Stocks – What’s the Focus?

In the afternoon trading session, HPG stock witnessed the largest foreign buying on HOSE, with a value of VND 127 billion. Following closely, MSN, FPT, and SSI stocks each experienced net buying of over VND 70 billion.