With a payout ratio of 10% (1 cp receives VND 1,000) and over 7.99 million cp in circulation, it is estimated that NAV will need to pay out nearly VND 8 billion in advance dividends to shareholders. The expected payment date is 10/01/2025.

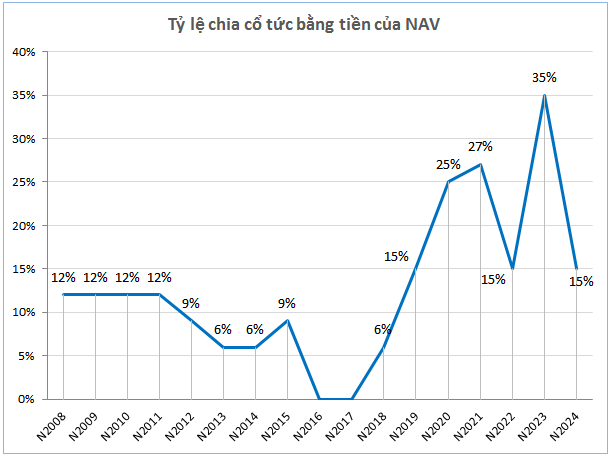

The 2024 Annual General Meeting of NAV approved a plan to distribute 2024 dividends with a ratio of 15% in cash. With the upcoming 15% ratio, the Company will have one more dividend payment of 5% to complete its goal.

Source: VietstockFinance

|

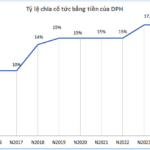

Looking back at NAV‘s history of cash dividend distributions, except for 2016 and 2017 when no cash dividends were paid, the Company maintained a dividend ratio of 6-27% per year. In 2023, shareholders received the highest dividend with a ratio of 35%.

Source: VietstockFinance

|

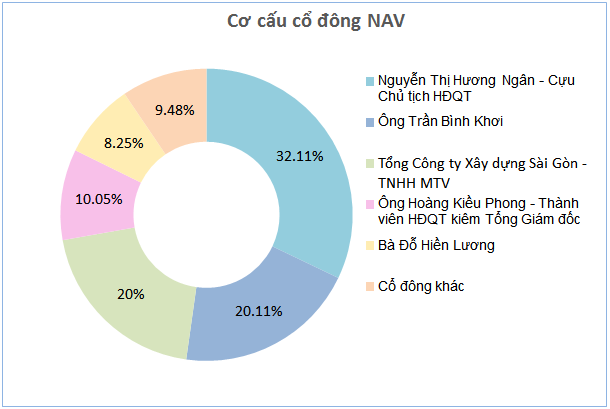

According to NAV‘s shareholder structure as recorded by VietstockFinance, four individual shareholders hold more than 70% of the Company’s capital.

Among them, Nguyen Thi Huong Ngan – former Chairman of the Board of Directors of the Company, owns over 32% of the capital, and Hoang Kieu Phong – Member of the Board of Directors and General Director of NAV, holds 10.05%. With this ownership ratio, it is estimated that Ngan and Phong will respectively receive nearly VND 2.6 billion and over VND 800 million in dividends for the first half of 2024.

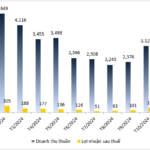

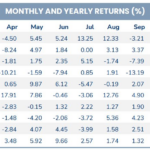

| NAV’s financial results for the first nine months of each year |

In terms of business performance, in the first nine months of 2024, NAV recorded nearly VND 72 billion in net revenue, a 29% decrease compared to the same period last year. However, net profit remained flat year-on-year at approximately VND 14 billion, thanks to a faster reduction in cost of goods sold (down 34%) compared to the decline in revenue.

For the full year 2024, NAV targets net revenue of VND 74 billion and pre-tax profit of VND 17 billion, representing decreases of 43% and 27%, respectively, from the 2023 results. As of the end of the third quarter, the Company has achieved 97% of its revenue target and 90% of its profit target for the year.

The Genesis Fund Alum Becomes SmartMind Securities CEO

The SmartMind Securities Joint Stock Company (SMDS) announces a resolution to relieve the incumbent Chief Executive Officer of their duties and appoint a successor.

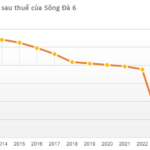

The Reluctant Dividend-Payer: A State-Owned Enterprise’s Eight-Year Itch.

Thus, even after more than 8 years, SD6 has yet to pay dividends from 2016. A lingering issue that raises questions about the company’s financial health and stability.