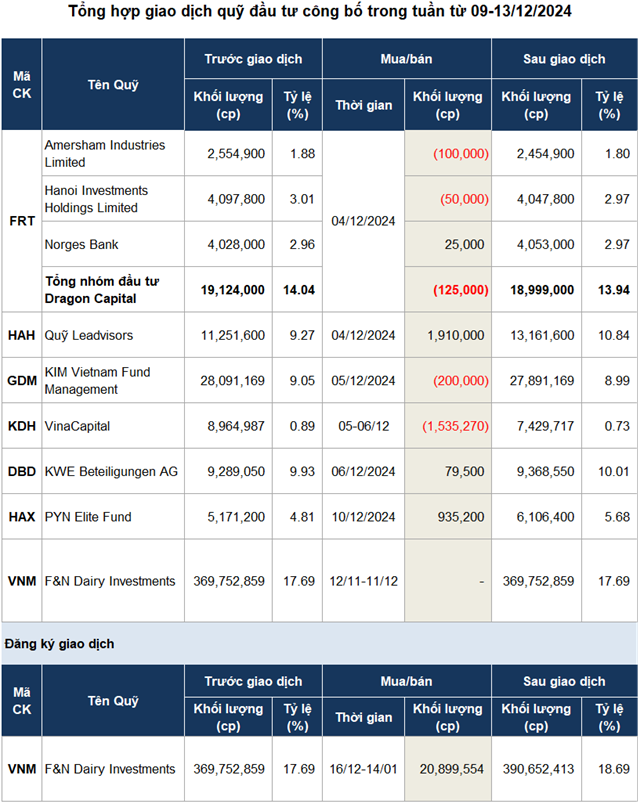

Specifically, foreign fund PYN Elite purchased 935,200 shares of HAX (Hang Xanh Automobile Service Joint Stock Company) during the December 10 session. With this purchase, PYN Elite Fund officially became a major shareholder of HAX, increasing its ownership from 4.81% (5.2 million shares) to 5.68% (6.1 million shares).

| HAX stock price movement from the beginning of 2024 to the session on December 13 |

On December 10, HAX recorded a matching volume of negotiated trades to PYN Elite Fund’s reported purchase. The transaction value reached nearly VND 15 billion, corresponding to VND 15,880 per share, 2% lower than the closing price of that session.

Returning to the fund’s trading activities during the first week of December, the strongest buying momentum was observed in HAH (Hai An Transport and Stevedoring Joint Stock Company) shares by Leadvisors investment fund.

Accordingly, the fund acquired more than 1.9 million HAH shares on December 4, increasing its ownership to 10.85%, equivalent to nearly 13.2 million shares.

| HAH stock price movement from the beginning of 2024 to the session on December 13 |

On December 4, HAH also recorded negotiated trades with a volume matching Leadvisors’ purchase. The transaction value was approximately VND 92 billion, equivalent to VND 48,000 per share, 4% lower than the closing price of the same session.

In early November, the Leadvisors fund purchased 260,000 HAH shares and officially became a major shareholder of HAH, increasing its ownership from 4.94% (6 million shares) to 5.16%. Since then, the fund has continuously increased its stake in Hai An.

| DBD stock price movement from the beginning of 2024 to the session on December 13 |

On December 6, the Swiss-based fund Kwe Beteiligungen AG also purchased 79,500 shares of DBD (Binh Dinh Pharmaceutical and Medical Equipment Joint Stock Company), increasing its ownership above the 10% threshold.

Source: VietstockFinance

|