The southern land and agricultural land market has yet to recover its “stamina” after the crisis. Both transactions and prices remain subdued compared to the beginning of 2022. Especially, investors holding agricultural land on the outskirts of Ho Chi Minh City, such as District 9 and Hoc Mon, Can Gio, Cu Chi, and Binh Chanh, are struggling with liquidity. It’s not easy to sell at a loss compared to the initial capital cost.

According to data from the Vietnam Real Estate Brokers Association (VARS), agricultural land prices in many areas have decreased by about 10-20% due to cooling demand. Transactions are slow, and liquidity is subdued.

The new provisions of the 2024 Land Law facilitate farmers and are suitable for businesses investing in agriculture. However, investing in and buying agricultural land to change its purpose and subdivide it for sale is very challenging.

The 2024 Land Law also stipulates cases of land revocation due to violations of land laws. Agricultural land, depending on the type, will be subject to administrative fines and possible revocation if left fallow or unused for 12-24 months.

According to experts, investors holding agricultural land to anticipate projects and planning will face difficulties if they do not convert to cultivation or residential use, given the tighter regulations in the new Law.

Decision 83, which prohibits investors from subdividing land in 1:500 projects in Ho Chi Minh City, has impacted investor psychology. The market has shifted its focus to land owned by individuals. Pre-subdivided land in projects has become a rare commodity, with potential for significant price increases due to the lack of new supply. Meanwhile, agricultural land seems to be “lagging.”

With the birth of Decision 83, residential land in Hoc Mon, Cu Chi, and Can Gio gained attention. In contrast, agricultural and garden land experienced price declines, and investors sought to offload their holdings to recoup their capital. However, liquidity is challenging due to the slow investment activities.

In parallel, Decision 100 untied the knot of Decision 60/2017, which existed for many years, by removing the condition of 1/2,000 planning for land plots designated for agriculture and existing residential areas, and 1/500 planning for land plots designated for new residential or mixed-use areas (including residential function).

As a result, the land owned by individuals will become more vibrant, attracting more attention. Some large-scale investors may take advantage of this loophole to buy large plots of agricultural or garden land and then subdivide them for sale.

However, commenting on whether Decision 100 facilitates the subdivision of agricultural land, Le Quoc Kien, a real estate investment advisor, said that this only applies to small-scale residential land, typically a few hundred square meters or less. Not many people have large plots of residential land of several thousand square meters to subdivide and sell.

If it’s a few thousand square meters, it’s mostly agricultural land, with only a few hundred square meters of residential land. Converting the entire plot to residential land and then subdividing it for sale, as was done previously, will be challenging because the new land price table is already 50%-70% of the market price. Not to mention, not all cases will be approved for land-use conversion, as it depends on the district-level land-use planning or the approved urban planning regulations.

“Therefore, this may benefit those with existing residential land, but for those holding several thousand square meters of agricultural land, subdividing is impractical,” said Kien. “Decision 100 gives a feeling of relaxation, but it won’t be exploited to intensify the subdivision of land for sale. Notably, as people feel that the subdivision procedure is more accessible, the land tax regulations have also been adjusted upward. If one is not careful about the tax costs, subdividing can become a significant burden. These changes can make the real estate market more vibrant, but careful consideration of the costs is necessary before taking action.”

The Reign of Land Investment Has Ended: Exploring Alternative Investment Avenues in the Current Climate

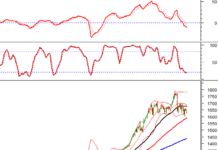

As of Q3 2024, apartment prices in Hanoi had surged, witnessing a remarkable 64% increase compared to Q2 2019. This surge outpaces Ho Chi Minh City’s growth, doubling its rate of increase. The average primary selling price is now approaching 60 million VND per square meter. Economic experts attribute this shift to the apartment segment, dethroning land as the once-undisputed investment king.

“Alleyway Homes: The 30-50sqm Gem That’s Now a Rarity in the Market and Priceless”

“There has been a recent change in the minimum land lot size requirements in Vietnam, according to Le Viet Long, Director of the Resource Center at RECO Home Real Estate Company. Previously, a plot of land as small as 30 square meters could be registered as a separate lot, but the new regulations now require a minimum size of 50 square meters. As a result, houses in alleys with an area of around 30-50 square meters have become a rarity and are no longer available on the market, driving up prices significantly in this segment.”

“Legislature Seeks to Temper the Real Estate Market, Avoiding a ‘Hot’ or ‘Frozen’ Scenario”

The resolution 161/2024/QH15 passed by the National Assembly requests that the Government directs ministries, sectors, and localities to take measures to regulate and promote a healthy real estate market. The aim is to prevent the market from either “overheating” or “freezing,” which could negatively impact the overall economic development of the country.

The End of FLC’s Billion-Dollar Project in Kon Tum

The Kon Tum Provincial Department of Planning and Investment has announced the termination of the FLC Group Joint Stock Company’s commercial, entertainment, and service trade complex and townhouse project.