2024 is deemed a “year of change” with significant global events, including elections in over 50 countries, FED rate cuts, and Donald Trump’s second term as US President.

In Vietnam, August 1st marked a memorable milestone with three real estate-related laws taking effect, five months earlier than planned. Despite the market’s incomplete recovery, economic and geopolitical fluctuations are predicted to significantly impact real estate in the coming years.

The following five key trends shape the real estate landscape in 2024:

Residential Segment Rebounds Amid Persistent Supply Imbalance

According to David Jackson, the housing market in 2024 showed more positive progress than the previous year. Most new condo supply, introduced in the second half, fell into the high-end category.

In Ho Chi Minh City, prices for new projects ranged from 72 to 142 million VND per square meter. Reactivated projects also announced higher prices. Hanoi witnessed a sudden price hike at the beginning of the year, which persisted until the end. Condos priced above 70 million VND per square meter became more common in the third quarter, and primary market prices across the city continued to increase by 2-4% in the fourth quarter compared to the previous one.

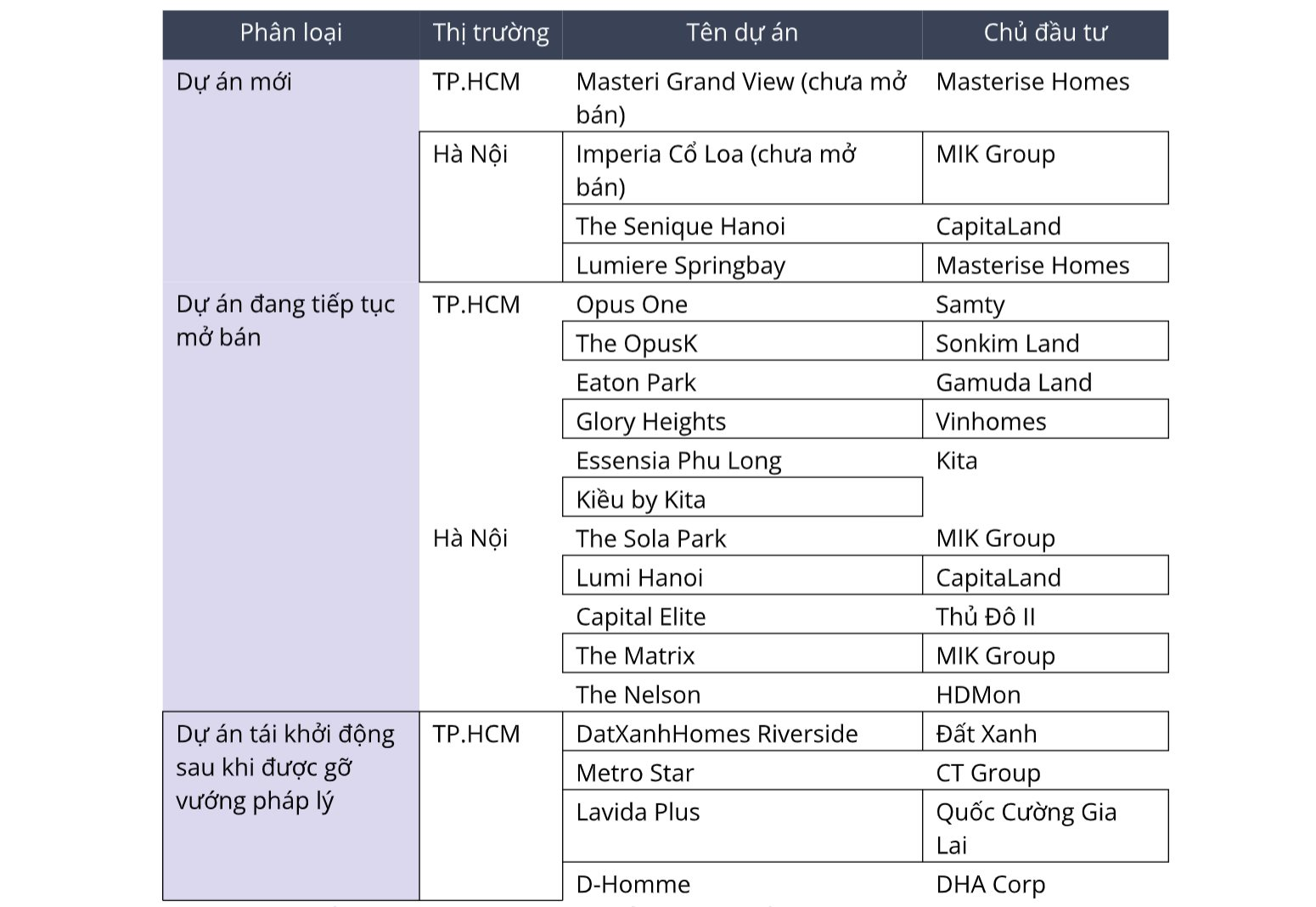

Several projects introduced and sold during the year-end in Ho Chi Minh City and Hanoi

Meanwhile, the mid-range segment remained scarce in both cities. Common price ranges, i.e., below 38 million VND per square meter, were almost non-existent. Continuous price hikes pushed residential properties further from fundamental values, increasing liquidity risks and the gap between market products and buyers’ desires, needs, and abilities.

Developing affordable housing faced challenges. Policies and preferential credit packages for social housing were not attractive enough, while investment and rental/purchase procedures for social housing were complicated.

However, according to Avison, there are still opportunities to improve supply towards balance. Developing common commercial housing and social housing in suburban or new urban areas with abundant land reserves and less expensive construction costs can contribute to a sustainable development trajectory.

Ho Chi Minh City plans to announce 11 TOD urban areas and auction 22 land plots around metro stations, soon adding to the land fund for residential development. With capital costs continuing to rise, the next “game” for investors is to seize opportunities from these land funds, balancing costs, prices, and products to ensure liquidity and project efficiency.

Industrial Real Estate Embraces New Opportunities

The industrial real estate segment remained a market bright spot, with rising rents, supply, and high occupancy rates. FDI in manufacturing sectors, driven by supply chain diversification and China+1 trends, was the primary force behind this development.

Avison Young’s data shows that in key and Tier 1 markets, industrial land rents increased by an average of 2-5% every quarter. Meanwhile, new supply looks promising with many industrial park projects licensed or inaugurated nationwide. Industrial and logistics real estate remained the top choice for foreign investors, leading real estate transactions throughout 2024.

In the short term, economic, commercial, and geopolitical fluctuations due to Donald Trump’s policies may exert immediate pressure on foreign investment attraction and exports. However, in the long run, Vietnam, with its geographical advantages, relatively stable political environment, competitive costs, and improving investment climate, could become the next global manufacturing hub if it seizes the opportunity timely.

Real Estate Legal Framework Enhances Market Confidence

2024 marked a legal milestone for the real estate sector with the Land Law 2024, Housing Law, and Real Estate Business Law 2023 taking effect. The changes and adjustments in these laws were highly regarded for their transparency, clarity, and fairness, contributing to more professional brokerage and transaction activities and laying the foundation for a healthy and sustainable market.