Illustrative image

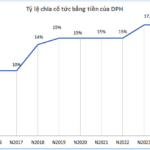

LPBank, the Vietnam Joint Stock Commercial Bank for Lucky Development (LPBank – Code: LPB), recently announced that December 30th will be the record date for shareholders to receive dividends in shares.

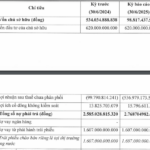

Accordingly, LPBank will issue approximately 429.7 million shares to pay dividends, equivalent to a ratio of 16.8%. The total issuance value at par value is VND 4,297 billion. The source of capital for the issuance comes from undistributed post-tax profits as of December 31, 2023, in LPBank’s 2023 audited financial statements.

Following the issuance, LPBank’s charter capital is expected to increase from VND 25,576 billion to VND 29,873 billion.

This plan to increase charter capital was approved by the Extraordinary General Meeting of Shareholders on November 16, and on December 12, LPBank received the State Bank of Vietnam’s approval for the capital increase.

According to LPBank, the issuance of shares to pay dividends not only maximizes benefits for shareholders but also helps LPBank realize its growth targets. It lays the foundation to enhance competitiveness, diversify financial products and services, and expand customer reach. This is an important part of LPBank’s sustainable development and expansion strategy for the coming period.

With the shareholder record date set as December 30, 2024, LPBank is the last bank to pay dividends for the year 2024.

The Great FDI Flow into Vietnam: Unlocking the Secrets to the Country’s Economic Success

In the first 11 months of this year, the country attracted nearly US$31.4 billion in foreign direct investment (FDI), largely focused on provinces and cities with well-developed infrastructure, a stable workforce, and a proven track record of administrative reform and proactive investment promotion efforts.

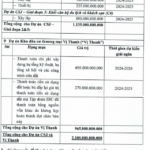

“DIG Receives Approval from the SSC to Issue 200 Million Shares to Existing Shareholders”

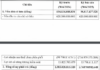

On December 12, 2024, the State Securities Commission (SSC) approved the proposal of Digital Investment and Development Corporation (HOSE: DIG) to offer 200 million shares to existing shareholders at a price of VND 15,000 per share.