PVN Approves Plan to Increase BSR’s Charter Capital to $2 Billion

PetroVietnam (PVN) has approved a plan to increase the charter capital of Binh Son Refining and Petrochemical Joint Stock Company (BSR) to VND 50,073 billion ($2 billion). The proposal is now with the authorities and is expected to get approved before Q1 2025.

The capital increase aims to fund the expansion of the Dung Quat Refinery and BSR’s long-term development strategy until 2030, with a vision towards 2045. BSR’s current charter capital stands at VND 31,000 billion.

If the proposal is approved, BSR will become the 20th company in Vietnam to reach the $2 billion charter capital milestone.

BSR aims to expand the Dung Quat Refinery with the increased capital.

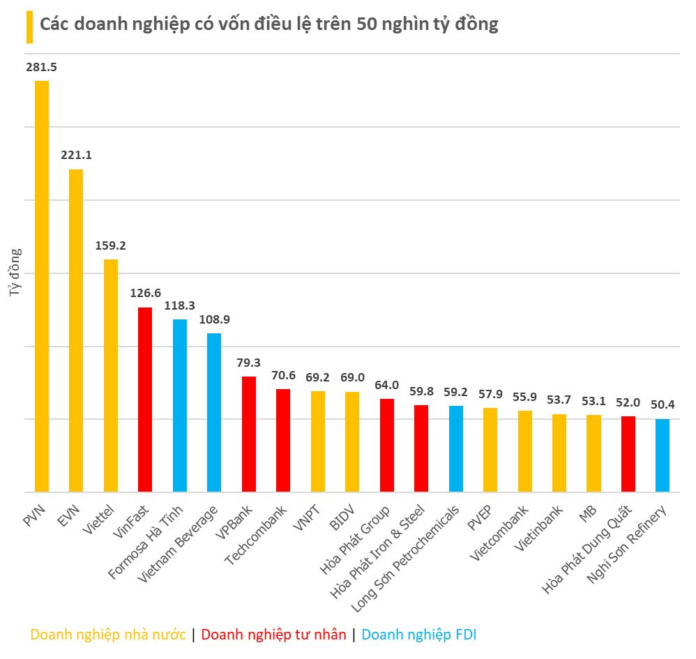

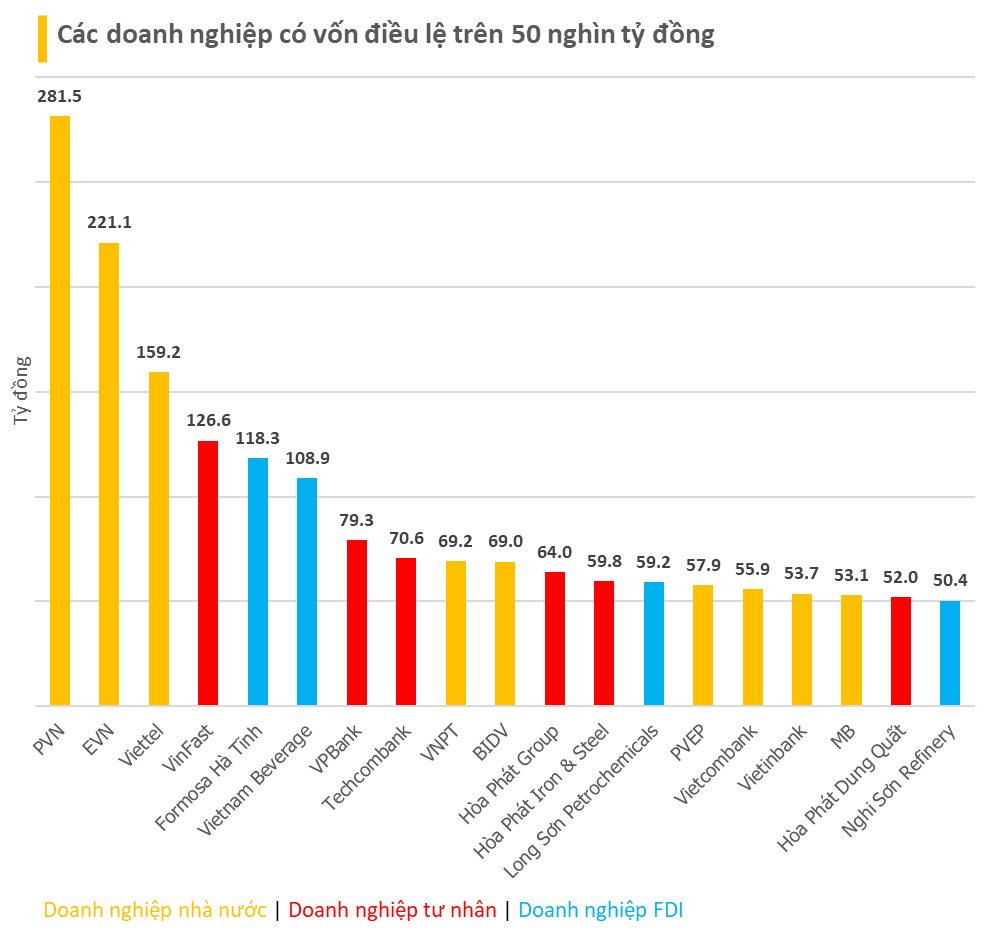

Among the 19 businesses with charter capital above VND 50,000 billion, there are 9 state-owned enterprises, 4 FDI enterprises, and 6 private enterprises.

The three state-owned enterprises, PVN, EVN, and Viettel, have the largest charter capital in Vietnam, all exceeding VND 100,000 billion. The private company with the largest charter capital is VinFast, owned by billionaire Pham Nhat Vuong.

In Vietnam, two companies with similar business lines to BSR, Long Son Petrochemical and Nghi Son Refinery, also have massive charter capital, amounting to VND 59,200 billion and VND 50,400 billion, respectively.

However, these two companies have been incurring losses for several years, while BSR consistently makes profits in the billions each year.

Reasons for Companies Requiring Large Charter Capital

Charter capital is the amount of money investors contribute to establish a company or increase its capital. It reflects the company’s initial financial capacity and the founders’ commitment to its business operations.

According to Vietcap Securities, charter capital plays a crucial role in a company’s ability to borrow money and expand its operations. It also serves as a basis for investors to assess the company’s profitability and future growth potential.

Additionally, charter capital is essential in the management and decision-making of the company, especially regarding critical matters such as issuing shares, bonds, or transferring assets.