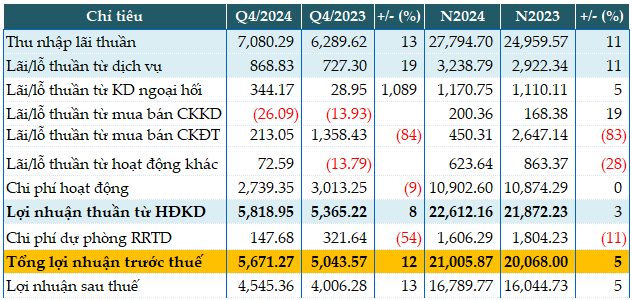

In Q4 2024 alone, the bank recorded over VND 7,080 billion in net interest income, a 13% increase compared to the same period last year.

Non-interest income sources also grew year-over-year. Service activities earned nearly VND 869 billion in interest, a 19% increase. Notably, foreign exchange operations became a bright spot, earning over VND 344 billion in profit, compared to just VND 29 billion in the previous period.

During the quarter, ACB reduced its credit risk provision expenses by 54%, allocating only VND 148 billion. As a result, the bank’s pre-tax profit exceeded VND 5,671 billion, a 12% increase.

For the full year 2024, ACB’s net interest income reached VND 27,795 billion, an 11% increase from the previous year. The bank set aside more than VND 1,606 billion in credit risk provisions (-11%), resulting in a pre-tax profit of nearly VND 21,006 billion, a 5% increase from 2023. Compared to the target of VND 22,000 billion in pre-tax profit set for the year, ACB achieved 95% of its goal.

ACB’s ROE ratio stood at 22%. Looking back at the 2019-2024 period, the bank’s pre-tax profit nearly tripled over five years, while the ROE ratio consistently remained between 22-25%.

|

ACB’s Q4 and full-year 2024 business results. Unit: VND billion

Source: VietstockFinance

|

As of the end of 2024, ACB’s total assets expanded by 20% from the beginning of the year to VND 864,006 billion. Within this, cash decreased by 18% (to VND 5,696 billion), deposits at the State Bank increased by 36% (VND 25,219 billion), and loans to customers grew by 19% to VND 580,686 billion.

Customer deposits increased by 11% from the beginning of the year to VND 537,304 billion. ACB’s total funding for 2024, including customer deposits and securities, reached VND 639,000 billion, a 19% increase. The CASA ratio improved from 22.9% in 2023 to 23.3% in 2024.

Regarding investments in digital transformation during the 2019-2024 period, ACB has developed ACB ONE Digital Bank into a significant business channel alongside its traditional banking operations. As a result, ACB has expanded its funding channels and attracted new customer segments, increasing its market share. The bank achieved compound growth, with a 98% increase in the number of online transactions and a 75% rise in online transaction values during this period.

ACB continues to meet financial safety requirements, with an LDR ratio of 78%, a short-term capital for medium and long-term loans ratio of 18.8%, and a consolidated CAR ratio of over 12%. The average risk coefficient for assets was controlled at around 70%.

|

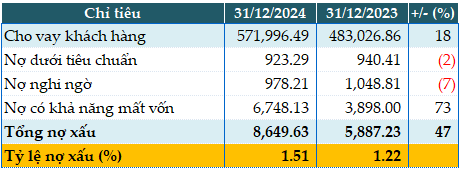

ACB’s loan quality as of December 31, 2024. Unit: VND billion

Source: VietstockFinance

|

Excluding VND 8,690 billion in margin loans from ACBS, as of December 31, 2024, ACB’s total non-performing loans amounted to VND 8,650 billion, a 47% increase from the beginning of the year. The NPL ratio rose slightly from 1.22% at the beginning of the year to 1.51%.

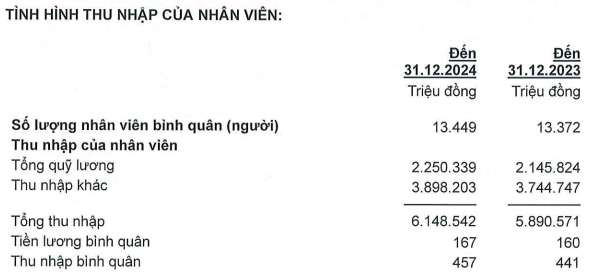

During the year, ACB’s average employee income increased from VND 37 million to VND 38 million per person per month.

Han Dong

– 13:13, January 22, 2025