Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 385 million shares, equivalent to a value of more than 9.2 trillion VND; HNX-Index reached over 35.6 million shares, equivalent to a value of more than 570 billion VND.

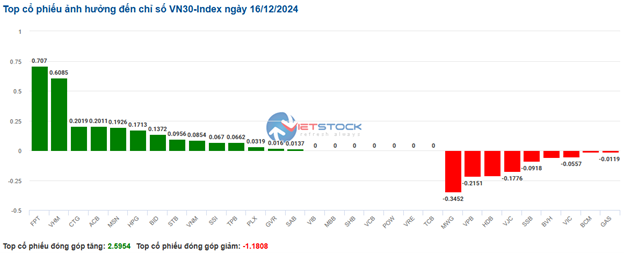

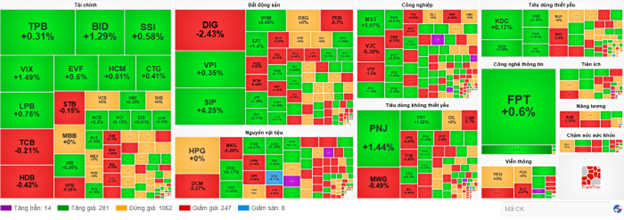

At the beginning of the session, with selling pressure continuing to dominate, the VN-Index continued to weaken, but a sudden return of buying pressure helped the index recover and turn green by the end of the session. In terms of impact, BID, HVN, VNM, and VHM were the most positive influences on the VN-Index, contributing over 1.6 points. On the other hand, HPG, GVR, MBB, and GAS were the most negative influences, but their impact was not significant.

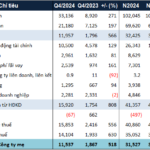

| Top 10 stocks with the strongest impact on the VN-Index on 12/16/2024 |

Similarly, the HNX-Index also had a positive performance, with the index positively impacted by KSV (+9.97%), IDC (+1.42%), MBS (+0.69%), SHS (+0.76%)…

|

Source: VietstockFinance

|

The essential consumer goods sector was the best-performing group in the market, with a 0.99% increase mainly driven by VNM (+1.25%), DBC (+0.19%), KDC (+2.25%), and HAG (+0.81%). Following the recovery were the telecommunications and industrial sectors, with increases of 0.63% and 0.44%, respectively. On the other hand, the energy sector was the only group to decline significantly, falling by -1.4% mainly due to BSR (-2.22%), PVS (-0.59%), TMB (-0.27%), and THT (-1.63%).

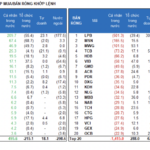

In terms of foreign trading, they continued to sell a net of more than 204 billion VND on the HOSE exchange, focusing on HPG (148.28 billion), PDR (54.78 billion), BID (54.66 billion), and DIG (35.58 billion). On the HNX exchange, foreigners bought a net of more than 3 billion VND, focusing on IDC (23.68 billion), VTZ (2.09 billion), and TVC (1.91 billion).

| Foreigners’ net buy and sell flow |

Morning Session: Turning Red

After the short-lived excitement at the beginning of the session, the VN-Index gradually descended and even turned red by the end of the morning session. At the midday break, the VN-Index fell slightly by 0.07%, settling at 1,261.66 points; the HNX-Index decreased by 0.11%, reaching 226.74 points. The number of declining stocks surpassed that of advancing stocks, with 334 stocks declining and 230 stocks advancing.

The initial upward momentum failed to attract buying pressure as no significant catalysts emerged. Liquidity continued to remain low, with the matched transaction value in the morning session reaching just over 3.9 trillion VND on the HOSE and over 262 billion VND on the HNX.

Stocks in the VN30 basket mostly fluctuated slightly around the reference price, with BID standing out with a 1.2% increase. This stock also had the most positive impact on the VN-Index in the morning session, contributing nearly 0.8 points. In contrast, MWG, VCB, and TCB were the most negative influences on the overall index.

In terms of sectors, the energy group was at the bottom due to the significant adjustment of BSR (-2.67%), as this stock accounts for more than 60% of the sector’s market capitalization. Most other sectors fluctuated within a narrow range. The essential consumer goods sector led on the upside, supported by MCH (+3.11%), VLC (+3.51%), VNM (+0.62%), HAG (+1.21%),…

Foreigners’ net selling continued this morning, with a value of nearly 68 billion VND on the HOSE in the morning session. The selling volume was concentrated in BID (36.51 billion) and DIG (30.68 billion). Meanwhile, SIP (43.43 billion) led on the buying side. On the HNX exchange, foreigners sold a net of nearly 9 billion VND, focusing on PVS (6.51 billion).

10:30 am: The challenge of surpassing the 1,265-point threshold for the VN-Index remains

Investors’ hesitation caused the main indices to continue to fluctuate around the reference price. As of 10:30 am, the VN-Index increased by 2.16 points, trading around 1,264 points. The HNX-Index rose by 0.23 points, trading around 227 points.

Most of the stocks in the VN30 basket maintained a positive sentiment. Notably, FPT, VHM, CTG, and ACB contributed 0.7 points, 0.6 points, 0.2 points, and 0.2 points to the VN30 index, respectively. On the other hand, MWG, VPB, HDB, and VJC were under selling pressure, but their impact was not significant.

Source: VietstockFinance

|

The essential consumer goods group led the current recovery, although its performance was somewhat mixed. Specifically, on the buying side, stocks such as MSN rose by 0.28%, VNM by 0.16%, DBC by 0.75%, and HAG by 1.61%… The rest remained unchanged or faced slight selling pressure, including BAF, QNS, ANV, and SBT, but the declines were not significant.

Following this was the information technology sector, which also contributed to the market’s overall upward movement. Notably, the two giants in the industry, FPT and CMG, rose by 0.47% and 1.29%, respectively. Additionally, other stocks in the sector, such as SMT, CMT, and ITD, also posted gains.

However, the energy sector exhibited mixed performance, with selling pressure regaining dominance after an eight-session winning streak. Selling focused on BSR, which fell by 1.33%, PVC by 0.96%, PVB by 0.36%, THT by 1.63%, and HLC, which hit the daily limit-down… Only a few stocks managed to stay in positive territory, including PVD, which rose by 0.21%, TMB by 0.96%, and NBC by 2.15%.

Compared to the beginning of the session, the market continued to fluctuate, with over 1,000 stocks unchanged and buying pressure slightly dominating. There were more than 280 advancing stocks and more than 240 declining stocks.

Source: VietstockFinance

|

Opening: Mild Gain at the Start of the Session

At the start of the December 16 session, as of 9:30 am, the VN-Index turned green immediately and rose by nearly 3 points to 1,264.71 points. Meanwhile, the HNX-Index also posted a slight gain, maintaining the 227.17-point level.

Green dominated the VN30 basket, with 9 declining stocks, 16 advancing stocks, and 6 unchanged stocks. Notably, HDB, VJC, and BCM were the stocks with the sharpest declines. In contrast, BID, POW, PLX, and MSN were the stocks with the strongest gains.

The telecommunications services sector was one of the most prominent industries at the beginning of the morning session. Stocks in this sector rose positively from the start, including YEG, which increased by 1.7%, VGI by 0.89%, CTR by 0.66%, DST by 7.32%, and MFS by 0.28%…

Along with this, the essential consumer goods sector contributed positively to the market’s performance this morning. Specifically, stocks such as MCH rose by 1.86%, MSN by 0.42%, VNM by 0.16%, HAG by 0.4%, VLC by 4.09%, and KDC by 0.52%…

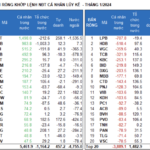

The Year-End Shopping Spree: Foreign and Retail Investors Stock Up for the Lunar New Year “Red Packet”

Foreign investors bought a net amount of 614.6 billion VND, with a net purchase of 589.6 billion VND in matched orders. The proprietary trading arm also bought a net amount of 534.8 billion VND, with a net purchase of 538.4 billion VND in matched orders.