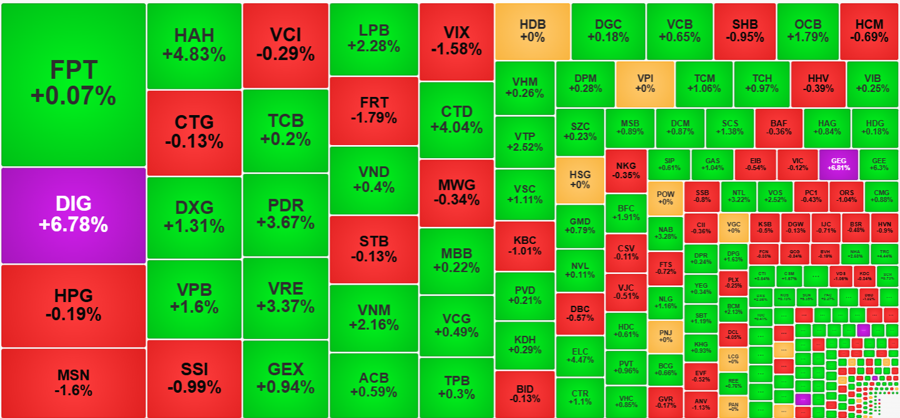

Although the VN-Index closed today with a modest gain of 0.39%, nearly a hundred stocks saw gains of over 1% compared to the reference price. The VN30 basket contributed only 6 of these, with the rest being mid-cap and small-cap stocks. Notably, many of these stocks with high liquidity were among the market leaders.

The blue-chip stocks also showed some improvement in the afternoon, helping the index regain its upward momentum, but they couldn’t quite reach the peak of the morning session. Of the VN30 basket, 17 stocks improved their prices, while 10 declined. Unfortunately, some of the largest stocks, such as VCB, BID, VHM, and VIC, were among those that weakened in the afternoon session. Had there been better synergy from these stocks, the VN-Index could have performed even better, triggering a more pronounced euphoric response.

Nonetheless, the mid-cap and small-cap groups were impressive today. Mid-caps ended the day up 0.53% with a 2% increase in liquidity compared to yesterday. Small-caps rose 0.85%, while their liquidity decreased slightly by 2.3%. In contrast, the VN30-Index performed the least impressively, rising only 0.31% with a significant drop in liquidity of over 19%.

The ability of mid-cap and small-cap stocks to maintain good liquidity and price fluctuations indicates that money is flowing into this segment. In fact, since the December 2022 lows, mid-cap and small-cap stocks have been the top performers in terms of price movements. Of the 12 stocks on the HoSE that gained over 1% with liquidity exceeding 100 billion VND, VPB, VRE, VNM, and LPB are from the VN30 basket. Other outstanding performers include DIG, which rose 6.78% with 449.8 billion VND; HAH, up 4.83% with 265.7 billion VND; DXG, up 1.31% with 252.3 billion VND; PDR, up 3.67% with 231.5 billion VND; CTD, up 4.04% with 186.4 billion VND; VTP, up 2.52% with 102.3 billion VND; and VSC, up 1.11% with 100.6 billion VND.

It’s rare for mid-cap and small-cap stocks to surpass the 100 billion VND transaction threshold. However, volumes of a few dozen billion are more manageable for most retail investors. Today, dozens of stocks in these groups saw gains of 3-6%, creating a highly euphoric sentiment, including APG, JVC, GEG, SGN, GEE, SHI, ELC, and TRC.

Not all mid-cap and small-cap stocks that have risen sharply in recent days have impressive business results. However, the signal of a strong rise in the context of a stable market, supported by blue-chips, is very positive and indicates an increase in short-term money flow. This also aligns with the consistently high liquidity observed in these two groups.

Trading in blue-chip stocks has slowed and become more differentiated. Today’s strongest stocks have a mid-range capitalization within the VN30 basket. VRE rose 3.37%, and LPB gained 2.28%, making them the two strongest stocks, but their capitalization is not yet in the top 15 of the VN-Index. VRE contributed only about 0.3 points to this index, far less than VCB (0.8 points) despite VCB’s more modest increase of 0.65%. The breadth of the VN30 basket at the close was also not significantly different, with 15 stocks rising and 14 falling. The lack of pull from the leading stocks can be seen as an obstacle as the VN-Index returns to the double-peak region of December last year.

Foreign investors this afternoon stepped up their buying, investing an additional 1,051.6 billion VND on the HoSE, a 47% increase from the morning session. Selling also increased, but the difference was not significant, at -62.8 billion VND net. In the morning session, this group sold a net of 302.4 billion VND. This is the third session since the Tet holiday that foreign investors have net sold, totaling over 2,500 billion VND. However, domestic investors have had a great couple of buying sessions, with net buys of over 3,400 billion VND in just the first two days of the week.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)