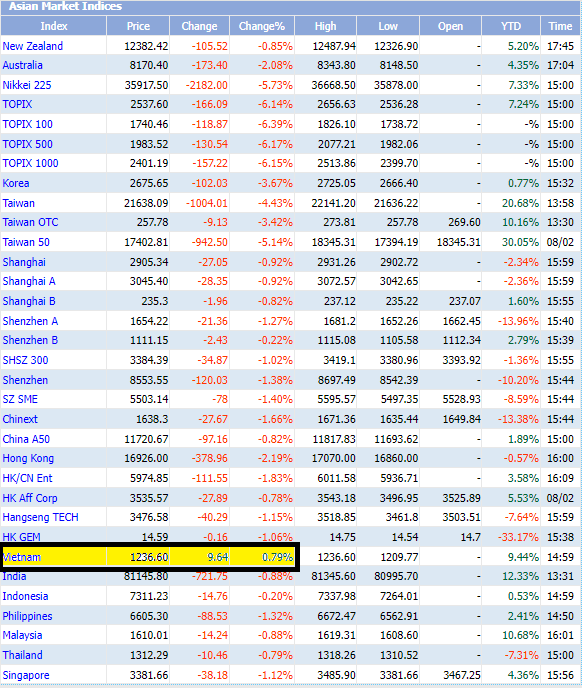

Last week, the VN-Index dropped 35.92 points to 1,495.21. Market liquidity reached VND243.8 trillion. Trading volume on HoSE increased by nearly 32% compared to the previous week, averaging over 1.8 billion shares per session. Meanwhile, the HNX-Index ended the week at 264.93 points, up 10.37 points from the previous week.

On the HoSE, foreign investors net sold more than 86.4 million units, corresponding to a net selling value of over VND4,754 billion. On the HNX, foreign investors net bought more than 5.4 million units, with a net buying value of over VND57 billion.

In the Upcom market, foreign investors net sold in all five sessions with more than 0.33 million units, with a net selling value of nearly VND185 billion. Thus, during the trading week from July 28 to August 1, foreign investors net sold more than 81.39 million units on the entire market, with a total corresponding net selling value of over VND4,882 billion.

Profit-taking

Four senior leaders of Petrosetco – Stock Code: PET) recently announced their full divestment from PET from August 6 to September 4 through matching and agreement.

4 senior leaders of Petrosetco fully divest from PET.

Specifically, Mr. Vu Tien Duong, Member of the Board of Directors and General Director of PET, registered to sell all 399,250 shares. Mr. Ho Minh Viet, Member of the Board of Directors, registered to sell 209,100 shares.

In addition, two deputy general directors of PET, Mr. Huynh Van Ngan and Mr. Ho Hoang Nguyen Vu, intended to sell 297,000 shares and 78,020 shares, respectively. If the transaction is successful, these leaders will no longer hold any shares of PET.

The capital divestment move by the four senior leaders of PET took place immediately after PET became the center of attention in the market, experiencing 14 consecutive gaining sessions from mid-July up to now, including many ceiling sessions even when the market fluctuated strongly. In just the past 14 sessions, PET has increased by nearly 54%, to VND37,650 per share – the highest level in nearly 3 years.

A few days earlier, VietinBank Capital, a major shareholder of PET, also sold 7.8 million PET shares, reducing its ownership from 9.37% to 2.06% of charter capital and was no longer a major shareholder.

VietinBank Capital became a major shareholder of Petrosetco on August 8 after purchasing an additional 5 million shares to raise its total holding to 10 million shares, equivalent to 9.37% of charter capital. The transaction was executed through a matching method with a total value of VND123 billion, corresponding to an average price of VND24,600 per share.

Mr. Ha Duc Hieu, a member of the Board of Directors of DXG, registered to sell 6.355 million DXG shares to reduce his ownership of shares. The transaction is expected to be made from August 4 to September 1, by agreement or order matching. If the transaction is successful, Mr. Hieu will reduce his ownership in DXG to only 414,033 shares. It is estimated that Mr. Hieu will collect about VND124 billion.

Member of the Board of Directors of DXG registers to sell 6.355 million shares.

Previously, Mr. Bui Ngoc Duc, General Director of DXG, registered to sell 744,418 shares out of nearly 1.7 million DXG shares he is holding. The expected transaction time is from July 24 to August 22.

Earlier in June, DXG approved the list of shareholders to issue more than 148 million bonus shares at a ratio of 100:17, meaning that for every 100 shares owned, shareholders will receive 17 new shares issued. The issuance value is over VND1,480 billion.

HIG applies for delisting

Hanoi Stock Exchange (HNX) has just announced the cancellation of registration for trading of nearly 22.6 million shares of HIPT Joint Stock Company (Stock Code: HIG). The last trading date on UPCoM is August 21, and it will officially leave the floor on August 22.

The cancellation of registration for trading was made in accordance with the document dated July 24 of the State Securities Commission, based on the proposal of HIG. This is also one of the contents approved at the 2025 Annual General Meeting of Shareholders of HIG.

HIPT Joint Stock Company was established in 1994, formerly known as Hanoi Computerized Support Development Company under the Hanoi People’s Committee, and transformed into a group model in 2005, specializing in providing IT solution ecosystems. HIG shares started trading on Upcom in June 2009.

During most of the listing period, HIG traded below par value. At the end of March 2025, HIG hit a peak when it traded at VND15,500 per share, up nearly 50% in less than two weeks. Currently, HIG shares are trading around VND13,500 per share.

PV GAS will spend nearly VND4,920 billion on dividend payment.

Vietnam National Gas Corporation (PV GAS – Stock Code: GAS) announced that on August 29, it will finalize the list of shareholders to pay dividends for 2024 and receive shares issued from the implementation of capital increase from owner equity.

Accordingly, PV GAS will pay a cash dividend at a rate of 21%, equivalent to VND2,100 per share owned. With more than 2,342 million shares listed, the company will have to spend a corresponding amount of nearly VND4,920 billion to pay dividends. The expected dividend payment date is November 25.

At the same time, PV GAS will implement a bonus share issuance at a ratio of 100:3, meaning that for every 100 shares owned, shareholders will receive 3 new shares.

“Repayments Begin: The Saga of Quốc Cường Gia Lai and Sunny Island”

In Q2 2025, Quoc Cuong Gia Lai began refunding Sunny Island to reclaim the Phuoc Kien project. Conversely, QCG borrowed an additional VND 240 billion from two major corporations.

What to Expect After the Wild Stock Market Swings?

The stock market is experiencing a lull as the VN-Index once again falters at the 1,500-point mark. Profit-taking pressures are mounting, while supportive news is drying up. Analysts suggest that the market may be entering a phase of accumulation and differentiation, with investors reassessing prospects for the second half of the year.

The VSDC Chair on the Implementation of T+0, Selling Securities Pending Settlement, and Trading Through Lunch

“Regarding intraday trading and the selling of securities on a cash basis, the legal framework is clearly outlined in Circular 120/2020/TT-BTC. Our leadership team assures us that the functional system integration into the KRX platform is also well underway.”