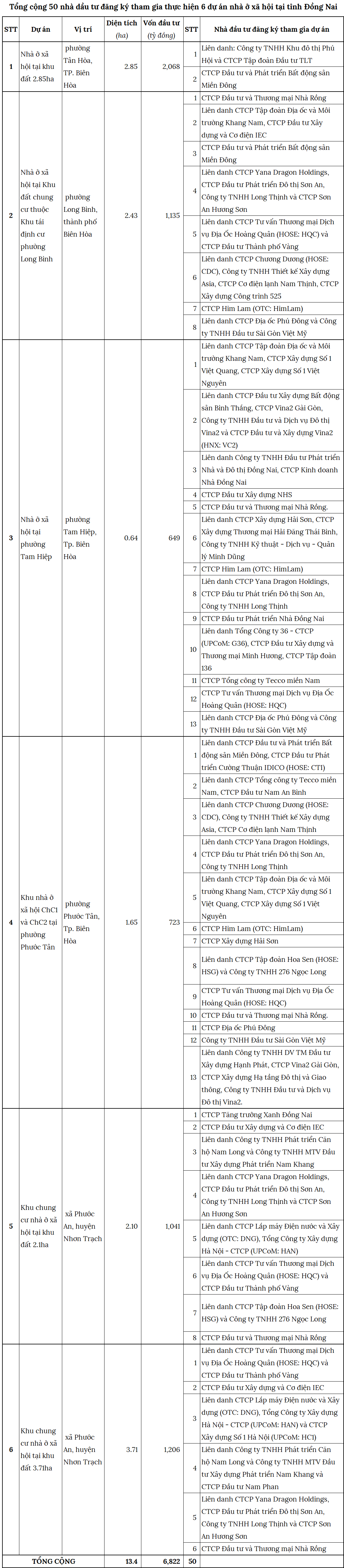

In May and June, the People’s Committee of Dong Nai province announced a list of investors who registered to participate in a series of social housing projects in prime locations in the old Bien Hoa city and Nhon Trach district.

According to preliminary statistics, up to 50 businesses and joint ventures submitted applications, reflecting the high demand for affordable housing in one of the fastest-urbanizing localities in the South.

The first project is located in Tan Hoa ward, old Bien Hoa city (now Ho Nai ward) on a 2.85-hectare site, currently vacant. The total investment is nearly VND 2,068 billion, with a planned population of about 4,000 people. There are two investors registered for the project: Dong Nai Real Estate Investment and Development Joint Stock Company and the joint venture between Phu Hoi Urban Area Company Limited and TLT Investment Group Joint Stock Company. The project is expected to be completed by the end of 2027.

The social housing project in Long Binh ward, Bien Hoa city (now Long Binh ward), has an area of over 2.4 hectares, a total investment of over VND 1,135 billion, with about 1,248 apartments and a population of nearly 2,500 people. The project is expected to be completed by early 2028. Eight investors have expressed interest in the project, including the joint venture between Commercial Services Real Estate Consulting Joint Stock Company (HOSE: HQC) and its subsidiary, City Gold Investment Joint Stock Company; the joint venture between Chuong Duong Joint Stock Company (HOSE: CDC), Asia Design Construction Company Limited, Nam Thinh Refrigeration Electrical Joint Stock Company, and Construction Works 525 Joint Stock Company; Him Lam Joint Stock Company (HimLam); and the joint venture between Phu Dong Real Estate Joint Stock Company and Saigon Viet My Company Limited, among others.

The social housing project in Tam Hiep ward has an area of nearly 6,406 square meters, a total investment of nearly VND 649 billion, and will provide about 520 apartments. It is expected to be completed by early 2028, and there are 13 investors vying for the project. Notable participants include listed companies such as the joint venture between Binh Thang Real Estate Investment and Construction Joint Stock Company, Vina2 Saigon Joint Stock Company, Vina2 Urban Investment and Services Company Limited, and Vina2 Investment and Construction Joint Stock Company (HNX: VC2); Him Lam Joint Stock Company; the joint venture between Corporation 36 – Joint Stock Company (UPCoM: G36), Minh Huong Construction Investment and Trading Joint Stock Company, and Corporation 136 Joint Stock Company; HQC Joint Stock Company; and the joint venture between Phu Dong Real Estate Company and Saigon Viet My Company Limited, among others.

The social housing project ChC1 and ChC2 in Phuoc Tan ward has an area of nearly 1.65 hectares, a total investment of nearly VND 723 billion, and will provide about 478 apartments. It is expected to be completed by April 2026. Notable investors include the joint venture between Dong Nai Real Estate Investment and Development Joint Stock Company and Cuong Thuan IDICO Investment and Development Joint Stock Company (HOSE: CTI); the joint venture between CDC Joint Stock Company, Asia Design Construction Company Limited, and Nam Thinh Refrigeration Electrical Joint Stock Company; Him Lam Joint Stock Company; the joint venture between Hoa Sen Group Joint Stock Company (HOSE: HSG) and 276 Ngoc Long Limited Company; HQC Joint Stock Company; Phu Dong Real Estate Company Limited; Saigon Viet My Company Limited; and others.

Meanwhile, in Phuoc An ward, the social housing project on a 2.1-hectare site has a total investment of nearly VND 1,041 billion and a population of about 2,800 people. The site is currently vacant but has technical infrastructure and has been cleared for construction. The project is expected to be completed within 30 months, and eight investors have registered to participate, including the joint venture between Electrical and Water Installation Joint Stock Company (OTC: DNG) and Hanoi Construction Joint Stock Company (UPCoM: HAN); the joint venture between HQC Joint Stock Company and City Gold Investment Joint Stock Company; the joint venture between HSG Joint Stock Company and 276 Ngoc Long Limited Company; and others.

Also in Phuoc An ward, the social housing project on a 3.71-hectare site has a total investment of over VND 1,206 billion and a population of about 6,000 people. The project will provide about 1,490 apartments and is expected to be completed within 30 months. Six investors have expressed interest, including the joint venture between HQC Joint Stock Company and City Gold Investment Joint Stock Company; the joint venture between DNG Joint Stock Company, HAN Joint Stock Company, and Hanoi No. 1 Construction Joint Stock Company (UPCoM: HC1); the joint venture between Nam Long Apartment Development Company Limited and Nam Khang Development Investment Construction Company Limited, Nam Phan Investment Joint Stock Company; the joint venture between Yana Dragon Holdings Joint Stock Company, Son An Urban Development Investment Joint Stock Company, Long Thinh Company Limited, and Huong Son Son An Joint Stock Company; House Dragon Investment and Trading Joint Stock Company; and IEC Investment Construction and Electromechanics Joint Stock Company.

Source: Author’s compilation

|

Thanh Tu

– 11:05 29/07/2025

The Cautious Sentiment Rises

The VN-Index witnessed a negative decline, with trading volume dipping below the 20-day average, indicating a return to cautious sentiment among investors. However, it’s important to note that the index is currently resting on the Middle Bollinger Band. If, in the upcoming sessions, the index holds firm above this threshold and the MACD indicator continues to signal a buy, the situation may not be as pessimistic as it seems.

The Hesitancy Hurdle: Navigating Market Uncertainty

The VN-Index edged slightly higher, snapping a four-day losing streak with the emergence of a Doji candlestick pattern. Accompanying this pattern, the trading volume remained below the 20-day average, indicating investor indecision in the market. Notably, the Stochastic Oscillator has now crossed into overbought territory and is flashing a sell signal. This development suggests that the risk of a market correction increases if the indicator falls out of this zone.

Minister Tran Hong Minh Urges Expediting Construction of 8 Rest Stops on the North-South Expressway

“Vietnam’s Minister of Transport, Tran Hong Minh, issued an urgent directive to the Vietnam Highway Corporation, the Vietnam Road Administration, project management boards, and investors to expedite the progress of eight business investment projects for rest stops along the North-South Expressway in the East.”