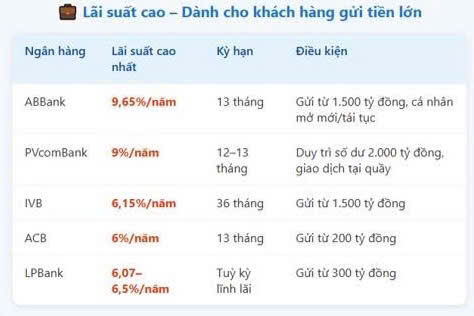

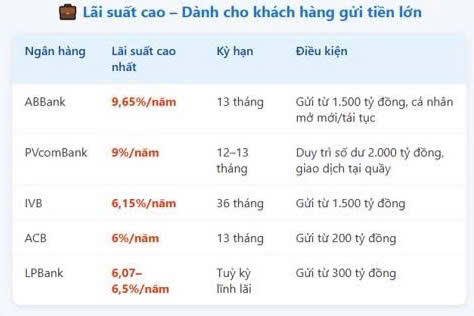

ABBank has announced an interest rate of 9.65%/year for individual customers depositing from VND 1,500 billion with a term of 13 months. PVcomBank offers an interest rate of 9%/year for a term of 12-13 months, with a minimum balance of VND 2,000 billion and over-the-counter transactions.

Other banks are also joining the race with exclusive policies for large depositors. LPBank offers an interest rate of 6.07% to 6.5%/year, depending on the interest payment method (at the beginning, monthly, or end of the term) for deposits from VND 300 billion. ACB applies a rate of 6%/year for a 13-month term with a deposit of VND 200 billion and above.

For regular customers, many banks continue to offer interest rates of 6%/year for long-term deposits with flexible conditions.

Specifically, VietABank offers 6%/year for a 36-month term, while Bac A Bank maintains a similar rate for terms ranging from 18 to 36 months. BVBank lists an interest rate of 6.1%/year for a 60-month term and 6%/year for a 48-month term. Cake by VPBank offers 6%/year for deposits ranging from 12 to 36 months.

A market survey reveals that most banks are offering savings interest rates of 5-6%/year for regular deposits without any special conditions.

After a long period of maintaining low-interest rates, it is predicted that deposit rates at banks will soon enter a cycle of increase. This forecast comes as the economy is expected to recover in late 2025 – early 2026, leading to an increase in capital demand, and factors such as exchange rates and inflation begin to exert significant pressure.

According to KB Securities Vietnam (KBSV), deposit rates could rise by about 1-2 percentage points from Q4 2025. KBSV believes that the possibility of further rate cuts is very low, as the real interest rate after inflation is no longer attractive, especially for 6-12 month terms. At the same time, if credit recovers as expected along with GDP growth, system liquidity pressure will increase.

VNDirect Securities also made similar predictions, forecasting that 12-month deposit rates could rise to 5.2-5.3%/year by the end of this year. According to VNDirect, the 8% GDP growth target will boost economic activities, leading to a sharp increase in credit demand, forcing banks to raise interest rates to attract capital inflows.

SSI Research assesses that funding costs in 2025 could increase by about 17 basis points compared to the same period last year. In its banking sector strategy report, SSI stated that many banks are willing to narrow their net interest margin to support customers, but in the long term, they will need to adjust deposit rates to ensure financial stability.

The Power of Compounding: Maximizing Your Returns with a 6.2% Interest Rate on a 1-Year Fixed Deposit

The 1-year term deposit interest rates offered by banks vary, with rates ranging from 3.9% to 6.2% annually. These rates are subject to the banks’ individual policies, and some institutions offer higher rates for online deposits compared to over-the-counter transactions.

What are the 5 banks that have received a second credit limit increase?

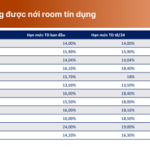

On November 28, 2024, the State Bank of Vietnam (SBV) announced its decision to provide additional credit limits to banks that have utilized 80% of their previously allocated credit limits. This is the second time in 2024 that the SBV has taken such action, the first being in August 2024. With this move, the SBV demonstrates its unwavering commitment to achieving the ambitious 15% credit growth target for the year.