Capital Influx Expectations

The nearly 18.5% growth in real estate credit in the first half of the year has significantly impacted M&A deals in the market, with capital mainly flowing to the investor group.

David Jackson, CEO of Avison Young Vietnam, points out that data shows that loan growth in the past two years has focused on lending to project development enterprises, signaling potential new supply in the future. This is an important channel for capital, helping enterprises to buy back stalled projects, restructure portfolios, or deploy projects after M&A.

For buyers, good access to capital allows them to proactively seek land with complete legal procedures but lack of capital for development, or to acquire shares to own the project. In contrast, many investors who do not qualify for loans, often due to legal entanglements, have to turn to M&A as an indirect capital mobilization solution.

Strong credit growth is seen as a supportive factor in restructuring the market, as enterprises with financial potential and project implementation capacity will take the lead, thereby promoting consolidation and screening in the real estate market.

In the long run, investors expect advantages such as urban expansion, streamlined apparatus, shortened procedures, and promoted inter-regional infrastructure, which are favorable for M&A deals. However, they remain cautious in monitoring changes related to planning, construction permits, and land valuation during the transition period, he emphasized.

Infrastructure that promotes inter-regional connectivity will boost M&A in real estate. Photo: Le Vu

|

According to Lawrence Lennon, Head of Capital Markets, CBRE Vietnam, the large influx of capital into the real estate sector has led to an increase in M&A activity, especially in the industrial and logistics, residential, and commercial segments in the first half of 2025. The market has witnessed a number of large deals formed by both domestic and international investors.

However, external factors such as tariffs and global instability have somewhat dampened investor sentiment, leading to the postponement of some transactions that were expected to be completed in the first half of 2025. Overall, the credit inflow into the market has created significant momentum, but stakeholders remain cautious when facing these challenges.

Bach Ta, Head of Capital Markets, JLL Vietnam, points out some recent transactions such as Bitexco transferring The Spirit of Saigon project, Keppel divesting from Nam Rach Chiec, while Phat Dat partners with a partner to transfer 80% of the shares of Thuan An 1 project and continues to deploy Thuan An 2. These moves indicate that M&A is becoming a solution for restructuring and unblocking capital effectively.

However, not all deals are priced well, even when the seller is in difficulty. Most investors only transfer projects when they are no longer able to borrow, while the assets are usually mortgaged at the bank. The handling of secured assets in Vietnam is still legally entangled and time-consuming, making the M&A process challenging.

Legal Relaxation Unlocks the Market

The current context is considered favorable for enterprises with financial potential to seek M&A opportunities, after a period when many Vietnamese enterprises faced difficulties due to the pandemic, global instability, and weak purchasing power.

Projects with completed planning and full legal approvals are being valued higher in M&A deals, as investors increasingly prioritize transparency to minimize risks. However, there are still concerns related to land use costs, especially how to determine the fees and their impact on the total project development cost, said Lawrence Lennon from CBRE Vietnam.

Avison Young Vietnam representatives believe that this can be considered a natural market cleansing phase when large enterprises with solid financial foundations and project development capabilities are accelerating their market share.

Looking at the statistics of recent M&A deals, it can be seen that both domestic and foreign “big players” are proactively expanding their land funds. However, decision-making is always accompanied by a thorough study of the project’s feasibility, from actual demand, potential price increases to absorption capacity. Currently, the market share is gradually concentrating in the group of large enterprises, which opens up opportunities for stalled projects to be revived, thereby avoiding land resource waste.

“What needs to be monitored next is how the buyer will develop these land funds after the deal is completed? Are the products meeting the market demand? Is the liquidity good enough to ensure the investment capital turnover? These are the decisive factors for the actual efficiency after M&A,” emphasized David Jackson.

It is known that in the North, Anpha Hanoi spent about VND 2,402 billion to buy 23.06% of the shares in the Cat Ba Amatina project (170 hectares, Hai Phong) from Vinaconex Tourism and Service Investment and Development Joint Stock Company. Sun Group acquired the entire Constrexim Complex project (2.5 hectares, Cau Giay, Hanoi) from CTX Holdings, then renamed it “Sun Feliza Suites”. Meanwhile, CapitaLand Development bought a part of the Hai Dang subdivision at Ocean Park 3 (25 hectares, Hung Yen) from Vinhomes. Sunshine Homes also took over the Alluvia City project (55 hectares, Van Giang, Hung Yen) through share purchase.

Since the three pillar laws, including the Land Law, Housing Law, and Real Estate Business Law, took effect in August last year, the legal environment has improved significantly, promoting smoother transactions. However, more time is needed to thoroughly resolve the remaining entangled projects.

In this context, projects with complete legal procedures, 1/500 planning, land use fee payment, site clearance, and construction permits are rare and likened to “gold in the sand”. High demand and limited supply have caused the value of this type of asset to soar.

In 2025, the significant imbalance between supply and demand, especially in the middle and lower-class housing segments, will continue to push real estate prices in the central areas of Ho Chi Minh City and Hanoi to increase. Photo: TL |

From an appraisal perspective, projects with clear legal procedures often have high asking prices, and many developers choose to value them for loans rather than sell them. In reality, legal value is playing an increasingly crucial role in establishing value and deciding M&A in the real estate market.

Nguyen Le Dung, Head of Investment Consulting Services, Savills Hanoi, forecasts that real estate M&A activities will continue to grow until the end of 2025, thanks to a series of favorable factors such as legal reform, proactive economic diplomacy strategy, and capital flow seeking sustainable value.

Notably, an increasing number of investment funds are making ESG criteria and long-term efficiency prerequisites, promoting transactions in areas such as green projects, industrial parks, and housing for experts. Forms of cooperation in development, phase-by-phase or partial transfers, are expected to continue to be popular to increase flexibility and optimize capital.

Moreover, the merger of provincial-level administrative units is expected to open up new development spaces, attracting investment capital, including M&A activities. Areas located at the old administrative boundaries, with strategic positions and improving infrastructure such as An Duong, Thuy Nguyen (Hai Phong), Chi Linh, Kinh Mon (Hai Duong) are attracting market attention.

Similarly, the outskirts of Hanoi and Ho Chi Minh City are also recording increased demand for surveys, transfers, and investment cooperation. The trend of urban expansion and inter-regional transportation improvement is considered an important driver for M&A activities in the next phase.

Hoang An

The 3-Month-Old BV Group’s Venture: A $170 Million Township Development in Bac Ninh

Northwest Bac Ninh Company, a proud member of the Bach Viet Group (BV Group), has been entrusted by the People’s Committee of Bac Ninh province to undertake a monumental project. Encompassing over 45 hectares, this ambitious urban development venture carries an investment of nearly VND 4.1 trillion.

The Evolving Landscape of Real Estate Law: M&A Project Approvals Gain Momentum

The first half of 2025 saw a cautious pace in the real estate market as Vietnam navigated the recent merger of localities and adapted to new regulations from three related laws that came into force. However, in recent times, project legality has been gradually improving and becoming a core pricing criterion driving mergers and acquisitions.

The New Landscape of Ho Chi Minh City’s Southern Real Estate Market Post-Merger

The new post-merger master plan is unlocking a plethora of opportunities for the southern part of Ho Chi Minh City. With a boost from improved infrastructure and ample land reserves, the real estate in this area is poised for significant growth in the medium to long term.

The Ultimate Escape: Discover the Exclusive Resort Community in Danang by DatVietVAC, Now Offering 18 Luxury Villas for Sale

The luxury real estate project, The Nam Khang Resort Residences, from media and entertainment mogul DatVietVAC Dinh Ba Thanh, has taken a significant step forward with the recent announcement from the Da Nang City Construction Department. Eighteen villas within the resort have been deemed eligible for sale and lease-purchase as future constructions.

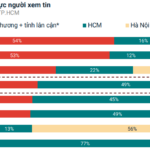

Where Do Binh Duong Province’s Property Buyers Come From?

The real estate market in Binh Duong Province has experienced a robust recovery in 2024 compared to 2023, with significant growth across all areas and most property types. In particular, Di An and Thuan An continue to stand out, attracting considerable investor attention due to their proximity to Ho Chi Minh City and their strong development potential in the future, according to Batdongsan.