According to the consolidated financial report for Q2 2025, QCG recorded a net revenue of VND 131 billion, a significant increase of 394.8% compared to the same period last year. Notably, real estate revenue surged by 47 times, from over VND 2 billion in Q2 2024 to VND 97 billion in Q2 2025. Electricity sales revenue also witnessed a substantial rise of 75%, reaching VND 25.7 billion.

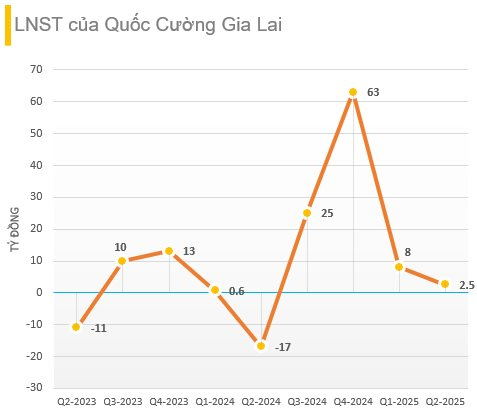

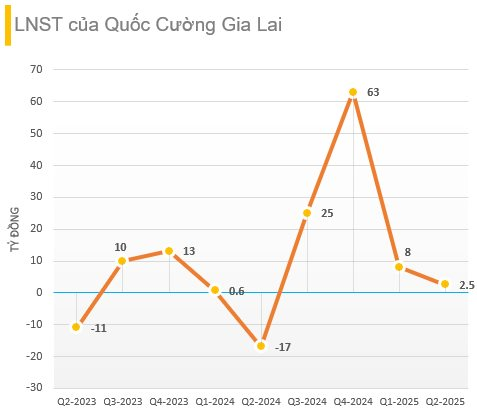

The company achieved a gross profit of VND 49.5 billion, corresponding to a gross profit margin of 37.8%. By effectively managing costs and expenses, the enterprise, led by CEO Nguyen Quoc Cuong, reported a net profit of VND 2.5 billion, a remarkable turnaround from a loss of VND 17.2 billion in the previous year’s same quarter.

For the first half of 2025, QCG’s net revenue surpassed VND 242.5 billion, reflecting a nearly 3.7-fold increase compared to the same period last year. The company’s net profit reached over VND 10.7 billion, in contrast to a loss of more than VND 16.6 billion in the previous year’s first half.

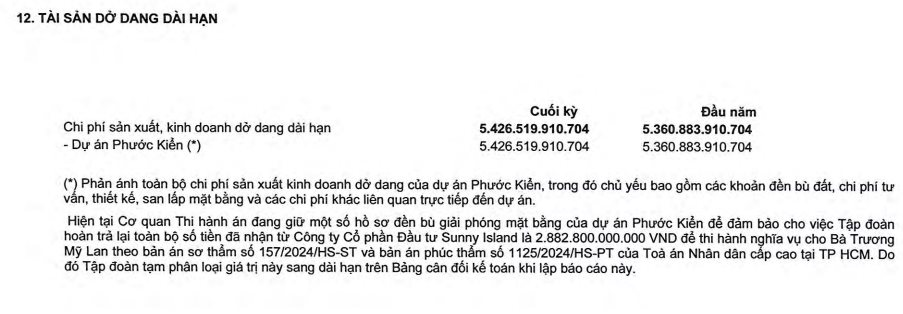

Notably, in Q2 2025, QCG made payments totaling over VND 100 billion toward settling a debt of VND 2,882 billion owed to Sunny Island Investment Joint Stock Company, an entity associated with the Van Thinh Phat Group and Ms. Truong My Lan. This debt is expected to be fully repaid within two years, concluding in Q1 or Q2 of 2027. QCG also mentioned the possibility of early repayment if their financial conditions allow.

As of June 30, 2025, QCG’s total assets amounted to VND 9,485 billion, representing a 6.7% increase compared to the beginning of the year. The company held VND 55 billion in cash, with inventory valued at over VND 1,200 billion. Notably, the production and business costs associated with the Bac Phuoc Kien project accounted for VND 5,420 billion, remaining largely unchanged from the start of the year.

The debt of VND 2,882 billion originated in 2017 when Sunny Island Company transferred funds to QCG as part of an agreement to purchase the Phuoc Kien project for a total value of VND 14,800 billion. However, the transaction was not finalized. QCG utilized a portion of the funds to repay loans at BIDV, and the remaining amount was spent on site clearance for the project. Subsequently, a dispute arose, leading to arbitration at the Vietnam International Arbitration Centre (VIAC). While QCG initially won the case and was not required to refund the received amount, the decision was later overturned by the Ho Chi Minh City People’s Court, which ordered QCG to repay the VND 2,882 billion to regain ownership of the Phuoc Kien project.

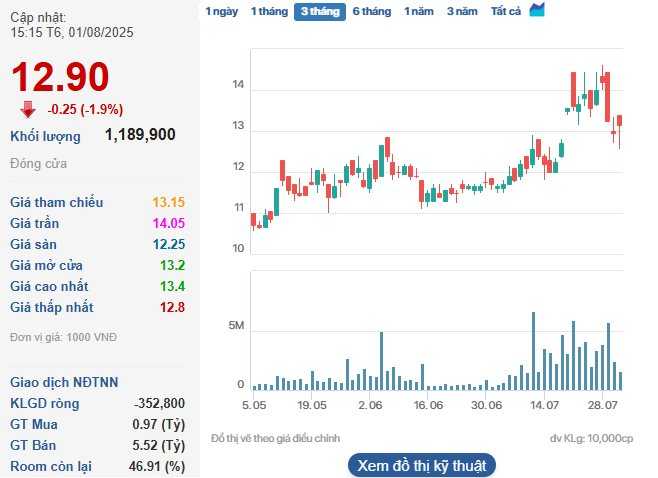

On August 1, 2025, QCG’s stock closed at VND 12,900 per share.

The Unexpected Windfall: A Look at Quoc Cuong Gia Lai’s Surprising Profits

Under the leadership of entrepreneur Nguyen Quoc Cuong, Quoc Cuong Gia Lai experienced a significant surge in revenue, with plans to rebrand with a new name.