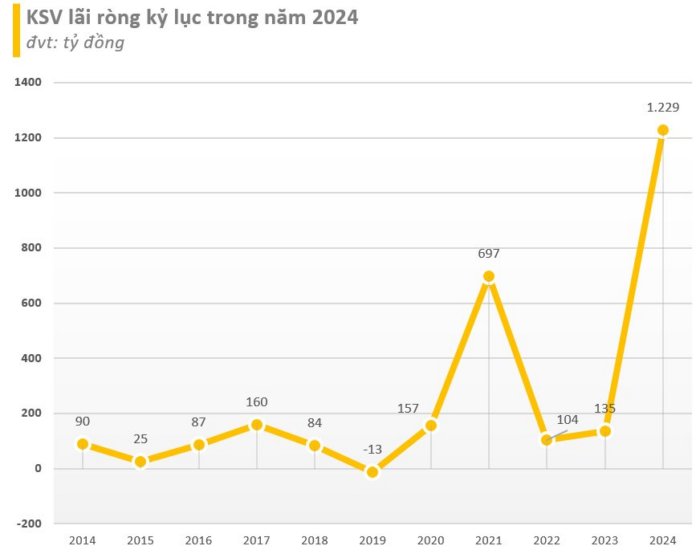

Mineral Corporation TKV (Vimico, code: KSV) has just announced its Q4/2024 financial statement with a remarkable performance. The company’s revenue reached 3,636 billion VND, a 20% increase compared to the same period last year. What’s even more impressive is the surge in profit, with the company’s net profit attributable to parent company shareholders increasing by nearly 9.5 times to 422 billion VND.

For the full year 2024, Vimico’s revenue hit 13,251 billion VND, an 11% increase from 2023. The gross profit margin also witnessed a significant improvement, climbing to 19% compared to 9.7% in the previous year.

This mining company has, for the first time, crossed the impressive milestone of a billion VND in annual net profit, reaching 1,229 billion VND, which is 7.5 times higher than the previous year. The earnings per share (EPS) for the year stood at 6,145 VND.

Vimico attributed this exceptional performance to the significant increase in the average selling prices of its main products compared to the previous year. Specifically, the selling price of copper sheets rose to 230 million VND/ton, an increase of 32 million VND/ton. The selling price of gold also witnessed a substantial jump, climbing to 1.8 billion VND/kg, an increase of 449 million VND/kg. Additionally, the selling price of silver reached 17.9 million VND/kg, a 4 million VND/kg increase, while the selling price of manganese ore stood at 1.6 million VND/ton, a 0.5 million VND/ton increase.

Vimico’s impressive financial performance in Q4/2024

As of the end of 2024, Vimico’s total assets amounted to 9,551 billion VND. The company held approximately 467 billion VND in cash and bank deposits. Aside from fixed assets, the second largest item in the company’s asset structure was inventory, which stood at 2,826 billion VND.

The company’s equity at the end of the period was 3,949 billion VND, including 1,318 billion VND in retained earnings.

Vimico is a subsidiary of the Vietnam National Coal-Mineral Industries Group (Vinacomin). The company specializes in mineral exploitation, including non-ferrous metals, precious minerals, and black metals. Vimico is renowned for its leadership in copper mining and processing in Vietnam, holding the rights to the country’s largest copper mine, the Sin Quyen mine.

The company also owns the Dong Pao rare earth mine, which boasts the largest reserves in the country. Spanning nearly 133 hectares in Ban Hon commune, Tam Duong district, Lai Chau province, Dong Pao is estimated to hold over 11.3 million tons of geological reserves, accounting for more than half of the country’s total rare earth reserves. The remaining sources of rare earth elements are primarily located in Nam Xe (Lai Chau), Muong Hum (Lao Cai), and Yen Bai.

Since 2014, the Dong Pao mine has been operated by the Lai Chau Rare Earth Company – Vimico (Lavreco), a member company in which Vimico holds a controlling stake of 56% of the shares. The mine has a 30-year exploitation license. However, since the granting of the license, Lavreco’s exploitation activities have been relatively insignificant, limited to mine management and protection.

KSV share price surge

“Billion-Dollar Bet: Vincom Retail’s Bold Move to Acquire 1,200 Shophouses”

Vincom Retail is set to launch these shophouses in 2025, with plans to commence revenue recognition from 2026 onwards.

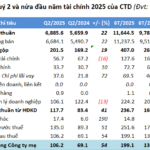

Coteccons Profits Soar to $85 Million in H1 of 2025 Fiscal Year

The first half of the 2025 financial year (July 1st to December 31st, 2024) saw the Construction Joint Stock Company Coteccons (HOSE: CTD) achieve impressive financial results. The company recorded a net profit of nearly VND 200 billion, a remarkable 47% increase compared to the same period last year, and successfully fulfilled 46% of its annual plan. Additionally, new contract wins amounted to VND 16.8 trillion, showcasing the company’s strong performance and promising future prospects.

“TTC AgriS Reaps Results: On Track to Achieve Annual Profit Goals”

TTC AgriS (HoSE: SBT) has unveiled its impressive Q2 financial results for the 2024-2025 fiscal year, showcasing significant growth in both revenue and profit.