The market witnessed a strong start to the week, with the VN-Index surging ahead thanks to some leading stocks. The index’s morning gains were largely driven by a few large-cap stocks like VIC, but the positive sentiment intensified in the afternoon session, with the real estate and banking sectors witnessing broad-based gains. This pushed the VN-Index higher by nearly 33 points, closing in on the 1,528.19 level.

The market breadth was overwhelmingly positive, with 242 stocks advancing and only 89 declining. VIC, which closed at the upper limit, contributed over 6 points to the VN-Index’s gains. VHM also posted solid gains of 2.56%, while other stocks, such as NVL, QCG, and EVG, saw significant upward momentum. In the banking sector, SHB stood out with a surge to its upper limit from early in the session, and TPB followed suit. Most large- and small-cap stocks in the sector recorded average gains of nearly 3%, with only ABB and KLB trading in negative territory, which had little impact on the overall market sentiment.

The securities sector also witnessed strong gains, with SHS and AAS rising to their daily limits, while VIX and VND posted impressive gains of 5.32% and 4.73%, respectively. Other securities stocks, including SSI, MBS, HCM, and CTS, recorded average gains of 2-3%. Overall, the market displayed remarkable strength, with most sectors advancing, including transportation, food & beverage, consumer services, electricity, and construction & investment.

However, liquidity started to wane, with HoSE and HNX recording a combined matched order value of over VND34,100 billion, excluding negotiated trades. This was relatively low compared to the previous week’s average of over VND50,600 billion per session, indicating that money flows were cautious and awaiting clearer opportunities.

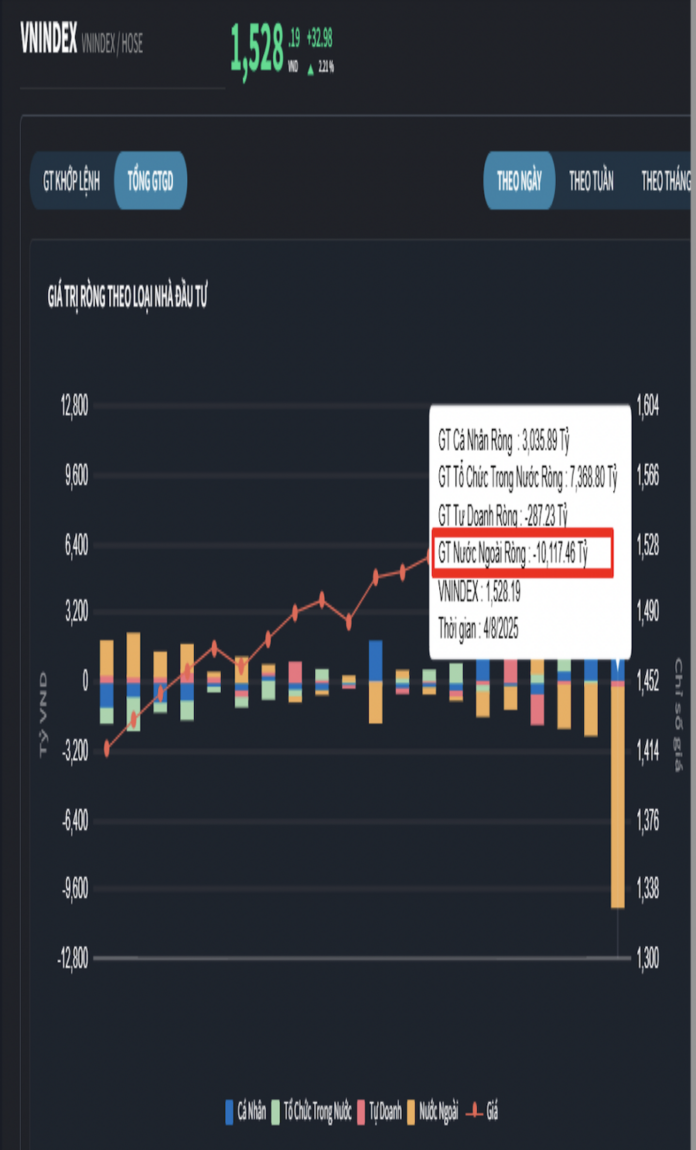

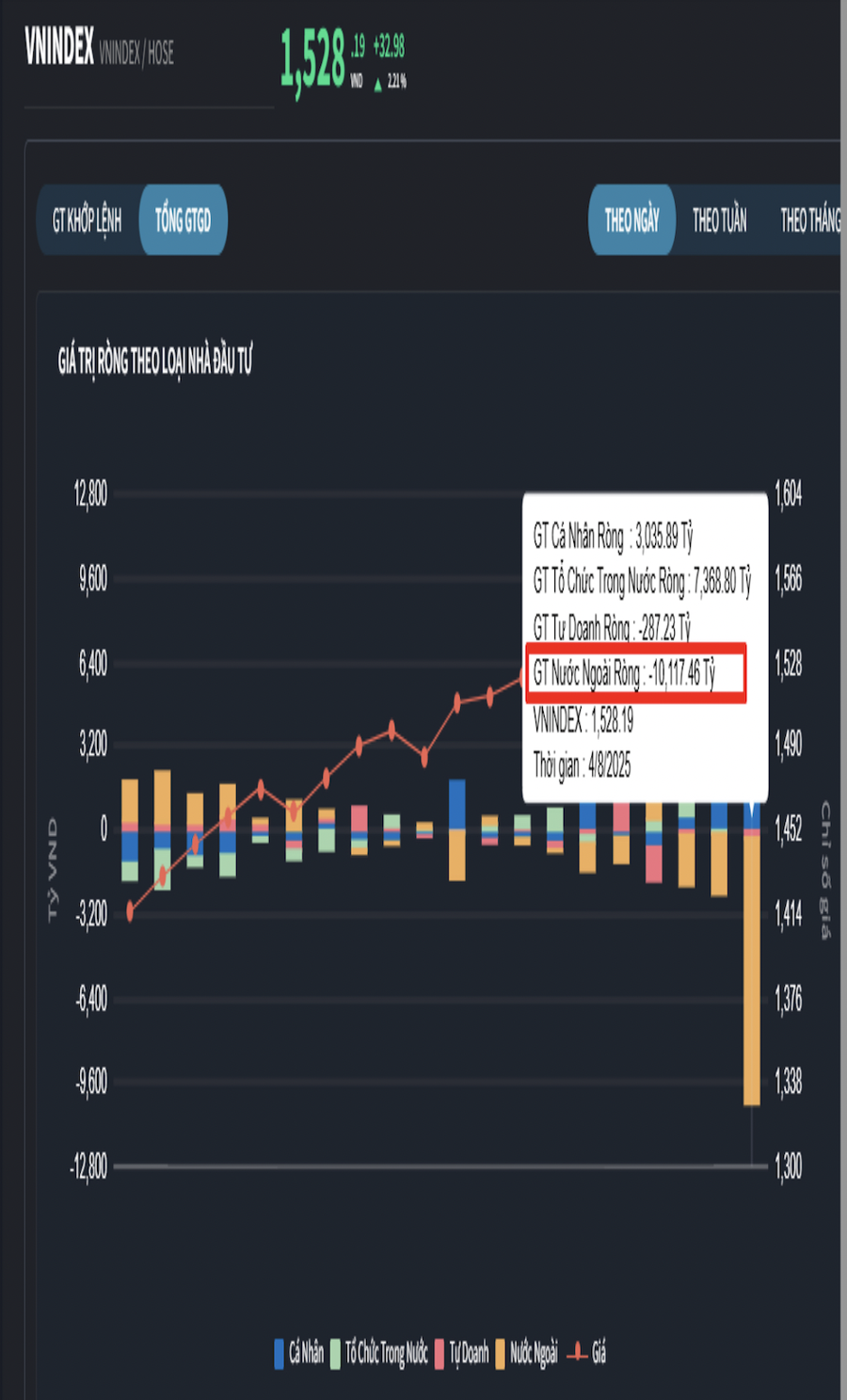

Foreign investors recorded net selling of VND10,100.7 billion, with net selling of VND271.7 billion in matched orders. Their net buying in matched orders was concentrated in the banking and industrial & consumer services sectors. The top stocks bought by foreign investors in matched orders were GEX, NVL, VIX, SHB, VPB, NLG, BCM, ANV, KBC, and VCB.

On the selling side, foreign investors offloaded stocks mainly in the financial services sector, with the top stocks sold in matched orders being SSI, VHM, FPT, HPG, VC1, HAH, CTG, VCG, and PLX.

Individual investors recorded net buying of VND3,035.9 billion, including net selling of VND524.7 billion in matched orders. In terms of matched orders, they net bought in 5 out of 18 sectors, mainly in the financial services sector. The top stocks bought by individual investors included SSI, TCB, FPT, HPG, BSR, VHM, VCI, HCM, VJC, and HDB.

On the selling side, they net sold in 13 out of 18 sectors, mainly in the industrial & consumer services and real estate sectors. The top stocks sold by individual investors included GEX, CII, VND, STB, VIX, MWG, DIG, VIC, and VSC.

Proprietary trading arms of securities firms recorded net selling of VND287.2 billion, with net buying of VND7.0 billion in matched orders. In terms of matched orders, they net bought in 6 out of 18 sectors, with real estate, food & beverage, and consumer goods sectors witnessing the strongest net buying. The top stocks bought by proprietary trading arms in matched orders were HPG, VHM, MSN, VNM, TCB, MWG, STB, VRE, LPB, and VJC. On the selling side, they offloaded stocks mainly in the oil & gas sector, with the top stocks sold being BSR, VPB, VGC, DCM, VHC, NT2, VIB, FPT, NVL, and VIX.

Domestic institutional investors recorded net buying of VND7,368.8 billion, with net buying of VND789.3 billion in matched orders. In terms of matched orders, they net sold in 3 out of 18 sectors, with the banking sector witnessing the largest net selling. The top stocks sold by domestic institutions included TCB, NVL, VJC, PC1, OCB, TPB, VPB, EIB, HDB, and HCM. On the buying side, they focused on the financial services sector, with the top stocks bought being CHI, SSI, GEX, VND, DCM, BSR, HHS, VCI, FPT, and STB.

Proprietary trading arms of securities firms recorded net selling of VND287.2 billion, with net buying of VND7.0 billion in matched orders. Focusing on matched orders, they net bought in 6 out of 18 sectors, primarily in the real estate, food & beverage, and consumer goods sectors. The top stocks bought by proprietary trading arms included HPG, VHM, MSN, VNM, TCB, MWG, STB, VRE, LPB, and VJC. Conversely, they net sold in the oil & gas sector, offloading stocks such as BSR, VPB, VGC, DCM, VHC, NT2, VIB, FPT, NVL, and VIX.

Domestic institutional investors recorded net buying of VND7,368.8 billion, with net buying of VND789.3 billion in matched orders. Analyzing matched orders, they net sold in 3 out of 18 sectors, predominantly in the banking sector. The top stocks sold by domestic institutions were TCB, NVL, VJC, PC1, OCB, TPB, VPB, EIB, HDB, and HCM. Conversely, they focused their net buying on the financial services sector, with the top stocks being CHI, SSI, GEX, VND, DCM, BSR, HHS, VCI, FPT, and STB.

Today’s negotiated trades amounted to VND11,815.6 billion, up 124.8% from the previous session and contributing 25.1% to the total trading value. Notably, VJC witnessed significant negotiated trades, with 90 million shares worth VND9,818.6 billion traded as a foreign institution offloaded its holdings to individual and domestic institutional investors.

In terms of sector allocation, money flows increased in real estate, banking, chemicals, agricultural & seafood products, electrical equipment, and aviation sectors, while decreasing in securities, construction, steel, software, warehousing, and courier services sectors.

Analyzing matched orders, money flows increased in the large-cap VN30 sector while decreasing in the mid-cap VNMID and small-cap VNSML sectors.

The Great Unloading: Corporate Leaders Race to Sell Shares, HIG Bids Farewell to the Stock Exchange

“In a recent development, four top executives at Petrosetco have signaled their intent to offload nearly 1 million PET shares between August 6 and September 4, through matching and negotiated transactions. This move comes as Hà Đức Hiếu, a member of the Board of Management at Dat Xanh Group, also registers to sell 6.355 million DXG shares to reduce his equity holdings.”

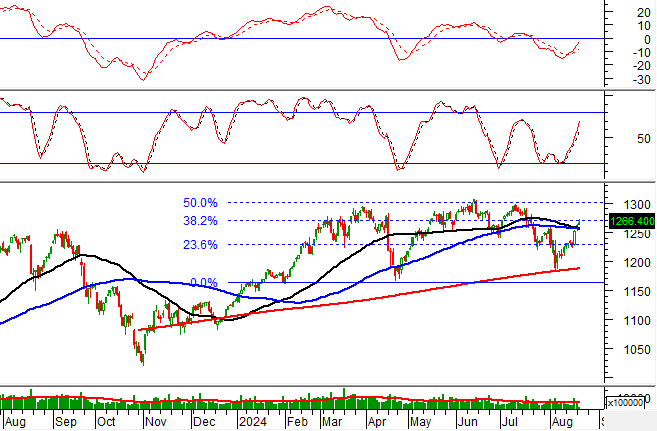

What to Do When the VN-Index Takes a Nosedive and Foreign Investors Start Selling?

The VN-Index has witnessed a consecutive two-day decline, with intense selling pressure from foreign investors – often deemed as ‘smart money’. Is this a telling sign for investors?

What to Expect After the Wild Stock Market Swings?

The stock market is experiencing a lull as the VN-Index once again falters at the 1,500-point mark. Profit-taking pressures are mounting, while supportive news is drying up. Analysts suggest that the market may be entering a phase of accumulation and differentiation, with investors reassessing prospects for the second half of the year.

“Technical Analysis for August 4th: Proceeding With Caution”

The VN-Index and HNX-Index both climbed, while trading volume dipped compared to yesterday’s morning session, indicating investors remain cautious.