“Despite the persistently low-interest-rate environment, idle cash flow from individuals and economic organizations continues to pour into the banking system.”

Source: SBV

|

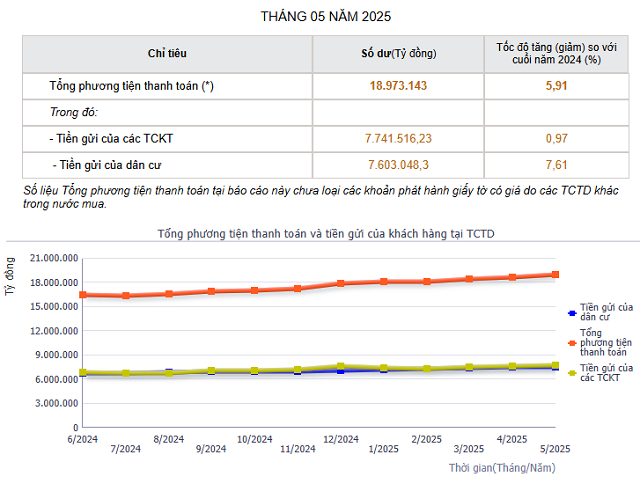

“According to data from the State Bank of Vietnam (SBV), as of May 2025, the total means of payment reached VND 189.7 million billion, up 5.91% compared to the end of 2024.”

“Total deposits of residents in credit institutions reached VND 76 million billion, up 7.61% from the previous year. In May alone, individuals deposited more than VND 65,400 billion into the banking system.”

“Deposits from economic organizations also recorded growth, with a balance of over VND 7.7 million billion at the end of May, up 0.97% from the previous year. Compared to the end of April, deposits from this group increased by more than VND 116,000 billion.”

“In total, the inflow of money from these two groups of individuals and organizations into the banking system amounted to more than VND 181,400 billion in May, bringing the total deposits in banks to over VND 153.4 million billion at the end of May.”

“Notably, the upward trend in deposits continued even as deposit interest rates remained on a downward trajectory or saw only slight increases at a few banks.”

– 09:41 30/07/2025

The Rising Interest Rates on Deposits: A Year-End Phenomenon

In early December, commercial banks continued to raise deposit interest rates to meet the surge in capital demand during the year-end period.

The Central Bank’s New Directive to Commercial Banks: Stabilize Deposit Rates, Lower Lending Rates

The State Bank (SBV) has requested that credit institutions maintain a stable and reasonable deposit interest rate, one that aligns with their capital balancing capabilities, healthy credit expansion, and risk management competencies. This move aims to contribute to the stability of the monetary market and interest rate environment.