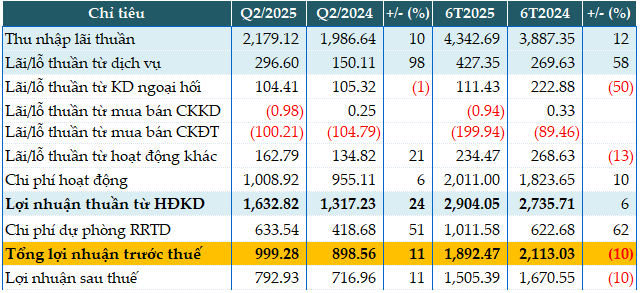

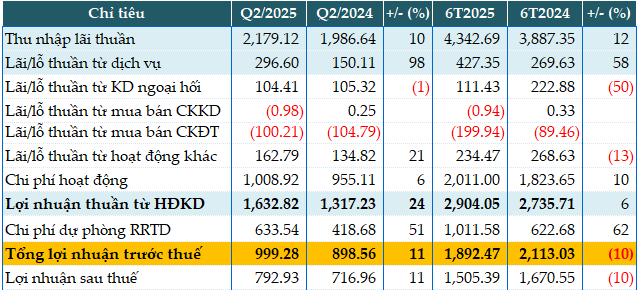

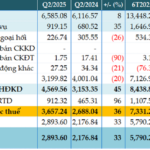

OCB’s net interest income for Q2 2025 increased by 10% year-on-year to over VND 2,179 billion, driven by growth in credit scale.

Non-interest income grew significantly by 62% year-on-year. Notably, service activities surged by 98%, generating nearly VND 297 billion in profit, attributed to the growth in consulting and other services.

After facing adverse impacts from market fluctuations, foreign currency trading profit rebounded in Q2 compared to the previous quarter, reaching VND 104 billion, recovering to the level of the same period last year.

Operating expenses rose by 6% to VND 1,008 billion. As a result, profit from business activities climbed by 24% to VND 1,632 billion.

During the quarter, OCB set aside VND 634 billion for credit risk provisions, a 51% increase. Consequently, pre-tax profit surpassed VND 999 billion, marking an 11% year-on-year growth.

For the first six months of the year, OCB’s pre-tax profit exceeded VND 1,892 billion, a 10% decrease compared to the same period last year. Against the full-year pre-tax profit target of VND 5,338 billion, OCB has accomplished 35% in the first half.

|

OCB’s Q2 and six-month business results for 2025 in VND billion

Source: VietstockFinance

|

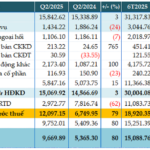

As of the end of Q2, the bank’s total assets expanded by 12% from the beginning of the year to VND 308,899 billion. Market 1 lending reached VND 190,789 billion, up by 8%. Customer lending amounted to VND 186,333 billion, a 9% increase. Green credit continued its upward trajectory, rising over 10% in the first half.

Market 1 deposits climbed by 8% year-to-date to VND 153,940 billion. In the individual customer segment, the ratio of transactions through digital channels reached a high level. The number of transactions on OCB OMNI digital banking increased by 97%; CASA rose by 28%, and online savings turnover grew by 30% compared to the same period in 2024.

For corporate customers, as of now, the number of transactions connected via Open API with OCB surged by 58% year-on-year; transaction value increased by 185%, and average CASA rose by 31.8%.

According to Mr. Pham Hong Hai, CEO of OCB: “Retail remains our core strategy, but we also focus on small and medium-sized enterprises (SMEs), especially the Startup group, as we believe this is a highly potential segment in the market. For Startup enterprises, the bank will have to offer very specific credit policies. The bank cannot stand outside the startup ecosystem. If startups are the new lifeblood of the economy, then banks must be the lifeblood that channels smart capital.”

Han Dong

– 17:05 30/07/2025

Vietcombank Reports 9% Rise in Q2 Pre-Tax Profit, Attributed to Reduced Provisions

The recently released consolidated financial statements for the second quarter of 2025 reveal impressive results for the Joint Stock Commercial Bank for Foreign Trade of Vietnam, commonly known as Vietcombank (HOSE: VCB). The bank reported a remarkable pre-tax profit of over VND 11,034 billion, reflecting a 9% increase compared to the same period last year. This outstanding performance is attributed to a significant reduction in risk provisions.

BIDV Posts 6% Pre-Tax Profit Increase in Q2, Total Assets Near VND 3 Quadrillion

The consolidated financial statements for the second quarter of 2025 reveal impressive results for the Joint Stock Commercial Bank for Investment and Development of Vietnam, better known as BIDV (HOSE: BID). The bank posted a remarkable pre-tax profit of nearly VND 8,625 billion, reflecting a 6% increase compared to the same period last year. As of the end of the second quarter, BIDV’s total assets stood at over VND 2.99 million billion.

“Sacombank’s Strategic Cost Management Pays Off: A 36% Jump in Pretax Profit for Q2”

The consolidated financial statements for the second quarter of 2025 revealed impressive results for the Saigon Thuong Tin Commercial Joint Stock Bank, more commonly known as Sacombank (HOSE: STB). The bank demonstrated its resilience and strong performance by recording a remarkable pre-tax profit of over VND 3,657 billion, reflecting a significant 36% increase compared to the same period last year, despite substantially bolstering its risk provisions.

“VietinBank’s Impressive Performance: A 80% Surge in Pre-Tax Profit for Q2”

“VietinBank’s recently released consolidated financial statements for Q2 2025 reveal impressive results. The bank, listed as CTG on the Ho Chi Minh Stock Exchange (HOSE), reported a remarkable 79% year-over-year increase in pre-tax profits, totaling over VND 12,097 billion. This outstanding performance is largely attributed to a significant reduction in risk provisions.”

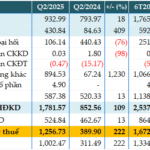

Profits Soar and Bad Debt Declines: ABBank’s Impressive First Half of the Year

The recently released Q2 2025 consolidated financial statements reveal that An Binh Joint Stock Commercial Bank (ABBank) posted a remarkable performance with a pre-tax profit of VND 1,257 billion, tripling its figure from the previous year. This outstanding result brings the bank’s half-year pre-tax profit to VND 1,672 billion, achieving 92% of its annual target.