Market liquidity increased compared to the previous trading session, with the VN-Index‘s matched trading volume reaching over 400 million shares, equivalent to a value of more than 9.3 trillion VND. The HNX-Index also saw a trading volume of over 39.2 million shares, with a value of more than 610 billion VND.

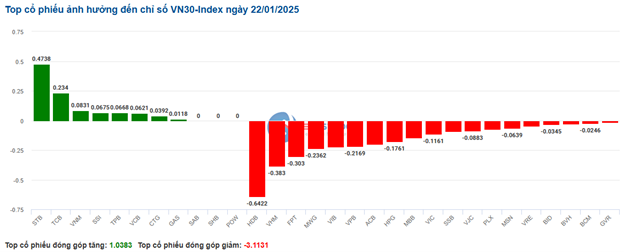

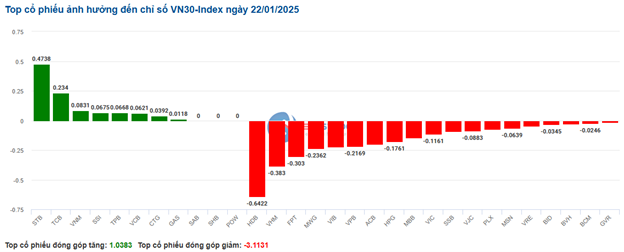

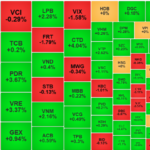

VN-Index continued its tug-of-war in the first half of the afternoon session but gradually lost ground as selling pressure increased, causing the index to plunge into the red. In terms of impact, HDB, BID, VHM, and GVR were the most negative stocks, taking away more than 1.8 points from the index. On the other hand, LPB, HVN, FRT, and BSR were the most positive stocks, contributing over 2 points to the overall index.

Similarly, the HNX-Index also had a rather pessimistic performance, with the index negatively impacted by stocks such as KSV (-5.04%), IDC (-1.1%), CDN (-4.97%), and NTP (-1.82%)…

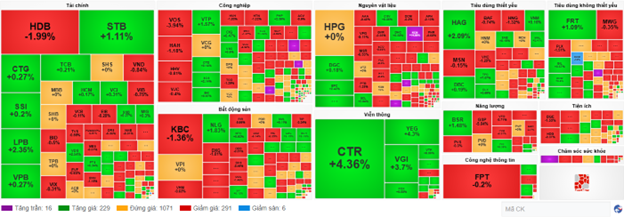

At the market close, the market declined by 0.2%. The materials sector led the decline with a drop of 1.05%, mainly due to losses in HPG (-0.57%), DCM (-1.94%), VGC (-0.82%), and HSG (-1.44%). This was followed by the real estate and industrial sectors, which fell by 0.76% and 0.72%, respectively. On the other hand, the telecommunications sector saw the strongest recovery in the market, surging by 3.18%. VGI (+3.48%), FOX (+2.44%), CTR (+4.21%), VNZ (+0.66%), and YEG (+6.95%) all closed in the green. The energy and healthcare sectors also saw recoveries, rising by 0.68% and 0.25%, respectively.

In terms of foreign trading, foreign investors continued to net sell on the HOSE exchange, focusing on stocks such as FPT (56.07 billion VND), GMD (47.86 billion VND), FRT (46.55 billion VND), and VPB (42.56 billion VND). On the HNX exchange, foreign investors net bought over 14 billion VND, mainly investing in PVS (15.51 billion VND), SHS (2.2 billion VND), IVS (850 million VND), and VTZ (650 million VND).

Morning Session: Tug-of-War Around the Reference Level

The market continued to fluctuate around the reference level on low liquidity. The main indices ended the morning session in negative territory, with the VN-Index closing at 1,244.75 points, down 0.11%, and the HNX-Index falling by 0.17% to 221.29 points. The market breadth inclined towards decliners, with 330 stocks falling and 230 stocks advancing.

LPB was the most notable stock in the morning session, surging by nearly 5% with strong buying pressure. This helped to “carry” the VN-Index and added more than 1 point to the index. On the other hand, VHM and BID were the top decliners, each taking away about 0.3 points from the index.

Most sectors were in a state of flux within a narrow range, with changes of less than 1%, except for the telecommunications sector, which shone with impressive trading in stocks like VGI (+3.59%), CTR (+5.3%), FOX (+5.08%), and YEG (+3.97%).

The recovery of BSR (+1.23%) helped the energy sector turn green, but most other stocks in the sector were drowned in red. Notable losers included PVD (-0.64%), PVS (-0.3%), PVB (-1.54%), AAH (-5.41%), and TMB (-2%)…

The industrial and real estate sectors temporarily recorded the most negative performance, with many stocks falling on notable trading volume. These included HAH (-1.57%), VOS (-3.64%), GSP (-5.4%), GMD (-1.29%); KBC (-2.04%), DXG (-1.01%), HDG (-1.29%), and VHM (-0.88%)…

Foreign investors continued their familiar net-selling trend, with a total net-selling value of over 172 billion VND on the three exchanges in the morning session. FRT and FPT saw the highest net-selling volume, with values of 33.79 billion VND and 31.66 billion VND, respectively. Conversely, LPB was the most net-bought stock by foreign investors in the morning session, with a value of over 47 billion VND.

10:40 am: Pre-Tet Profit-Taking Sentiment Persists

Selling pressure increased compared to the beginning of the session, pushing the main indices below the reference level. As of 10:30 am, the VN-Index fell by more than 1 point, trading around 1,245 points. The HNX-Index dropped by 0.26 points, trading around 221 points.

Most stocks in the VN30 basket faced strong selling pressure. Specifically, HDB, VHM, FPT, and MWG took away 0.64 points, 0.38 points, 0.3 points, and 0.23 points from the index, respectively. On the other hand, STB, TCB, VNM, and SSI remained in positive territory, but their gains were not significant.

Source: VietstockFinance

|

The industrial sector recorded a sharp decline in the market. Notably, VOS fell by 3.64%, HAH dropped by 1.18%, VJC slipped by 0.1%, and HHV declined by 0.81%…

Notably, GSP witnessed its third consecutive day of decline and formed a Three Black Candles pattern after the Stochastic Oscillator indicator showed a bearish divergence, indicating a rather pessimistic short-term outlook. Additionally, the stock’s price broke below the neckline (around 13,300-13,700) of the Double Top pattern as the MACD signaled a sell-off and approached the zero level. If the indicator cuts below this level, the downward adjustment risk will persist in the near term, and the potential price target will be 11,500-11,700 if the price breaks below the SMA 200-day moving average in the medium term.

Source: https://stockchart.vietstock.vn/

|

Following this, the real estate sector experienced a state of flux, with selling pressure dominating stocks like KBC, which fell by 1.36%, VHM down by 0.5%, DXG declining by 0.34%, and DIG dropping by 0.54%… Meanwhile, stocks such as NLG, PDR, NTC, and SIP managed to stay in positive territory, but their gains were not significant.

On the other hand, a cheerful green color returned to most stocks in the telecommunications sector, including CTR, which rose by 3.12%, YEG up by 4.64%, VGI advancing by 2.58%, and FOX climbing by 4.51%…

Compared to the beginning of the session, sellers gained the upper hand. There were 291 declining stocks (including 6 stocks hitting the floor price) and 229 advancing stocks (including 16 stocks hitting the ceiling price).

Source: VietstockFinance

|

Opening: Telecommunications Services Stocks Rise Early

At the start of the January 22 session, as of 9:30 am, the VN-Index gained over 2 points, reaching 1,248.38 points. The HNX-Index also saw a slight increase, maintaining its level at 221.84 points.

The green color temporarily prevailed in the VN30 basket, with 6 decliners, 16 advancers, and 8 stocks remaining unchanged. Among them, PLX, BVH, and HDB were the top losers, while POW, MSN, and STB were the biggest gainers.

The telecommunications services sector led the market with a gain of 2.99% in the early morning session. Notably, stocks like VGI rose by 2.24%, YEG surged by 5.3%, CTR climbed by 0.62%, and FOX jumped by 7.99%…

The non-essential consumer goods sector also recorded impressive growth, positively contributing to the overall market index. Notably, SAS hit the ceiling price with a gain of 14.93%, followed by stocks like FRT rising by 1.97%, PNJ up by 0.1%, TNG climbing by 0.86%, VGT advancing by 0.74%, and PET gaining 1.3%…

– 14:05, January 22, 2025

“Vietstock Weekly: A Cautious Short-Term Outlook”

The VN-Index rallied and recovered after a steep decline in previous weeks. The index also rose above the 200-week SMA. However, trading volume has remained below the 20-week average since November 2024, indicating a lack of positive momentum in market participation. At the moment, the MACD indicator is signaling a sell-off and has crossed below the zero threshold, suggesting that the short-term outlook remains bearish.

The Caution Quotient Rises

The VN-Index declined, slipping further below the Middle Bollinger Band. This downward movement, coupled with trading volumes remaining below the 20-day average, indicates a cautious sentiment among investors. However, the MACD indicator offers a glimmer of hope as it narrows its gap with the Signal Line, suggesting a potential buy signal in upcoming sessions. Should this materialize, it would alleviate concerns of an immediate short-term correction.

“Banking Stocks Rebound: Foreign Investors Still Dumping FPT and VNM”

Liquidity weakened this morning, but demand for high-priced stocks remained robust. The banking sector played a pivotal role in the VN-Index’s impressive recovery, surging past the 1260-point mark. Most of the blue-chips that experienced heavy selling yesterday staged a strong rebound, paving the way for a more vigorous rally in the mid and small-cap segments. Notably, foreign investors persisted in their net selling activities, focusing their attention on FPT and VNM.

The Stock Market Breakthrough: Scaling New Heights in 2025

The upgrade of the stock market from frontier to emerging status is a significant and correct government initiative, closely monitored and directed by the Prime Minister in the past term. The goal is to have the Vietnamese stock market upgraded to emerging status by 2025, as outlined in the approved Strategy for the Development of the Stock Market until 2030.

The Cash Flows into Mid and Small-Cap Stocks

Although the VN-Index closed today with a modest gain of 0.39%, nearly a hundred stocks outperformed, rising over 1% against their reference prices. The large-cap VN30 basket contributed only 6 tickers to this group, with the remainder being mid and small-cap stocks. Notably, several of these high-performing stocks also featured among the market’s leaders in terms of liquidity.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)