I. VIETNAMESE STOCK MARKET WEEK 03-07/02/2025

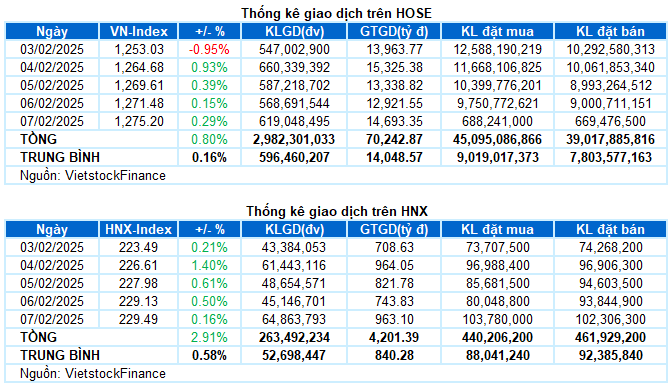

Trading: The main indices ended the first trading week of the new year in the green. At the close of the 07/02 session, VN-Index increased by 0.29% from the previous session, reaching 1,275.2 points; HNX-Index rose by 0.16% to 229.49 points. For the whole week, VN-Index gained a total of 10.15 points (+0.8%), while HNX-Index added 6.48 points (+2.91%).

The Vietnamese stock market had a quite impressive start to the year. Despite facing adjustment pressure in the first trading session of the week, buying pressure quickly returned, helping VN-Index to gain four consecutive sessions, advancing to the old peak of 1,275 points. In addition, market liquidity after the holiday also improved significantly, surpassing the 20-week average trading volume after a chain of 9 consecutive weeks below this threshold. However, the prolonged selling streak of foreign investors remains a concern in the context of global market turmoil.

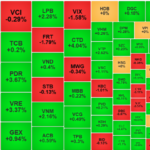

In terms of impact, CTG, BID, and TCB were the three main pillars contributing to the VN-Index’s green today, with nearly 4 points gained. Meanwhile, there were no notable names on the opposite side. A total of 10 stocks with the most negative impact took away just over 1 point from the index.

Most industry groups were mixed in the last trading session of the week. The green of the financial group, in particular, and the market, in general, was mainly maintained thanks to the “support” of a few large-cap stocks such as CTG (+3.29%), BID (+1.76%), TCB (+2.18%), and BVH (+1.76%). The rest of this group mostly fluctuated slightly around the reference mark.

Meanwhile, the telecommunications group had a challenging trading day, finishing at the bottom with a drop of more than 2%. The red spread was widespread, especially the strong selling pressure in the leading stocks such as CTR (-1.56%), VGI (-2.39%), YEG (-2.02%), VNZ (-1.38%), and MFS (-3.16%).

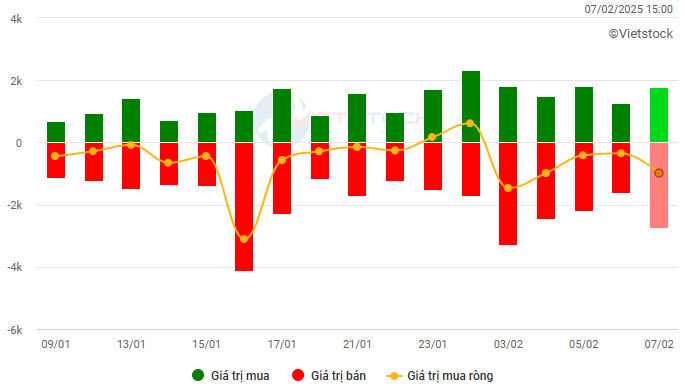

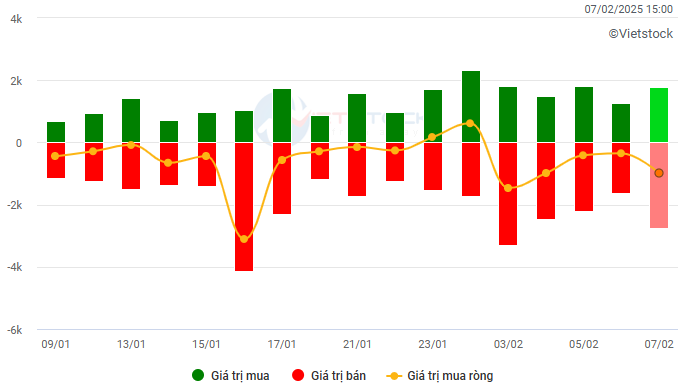

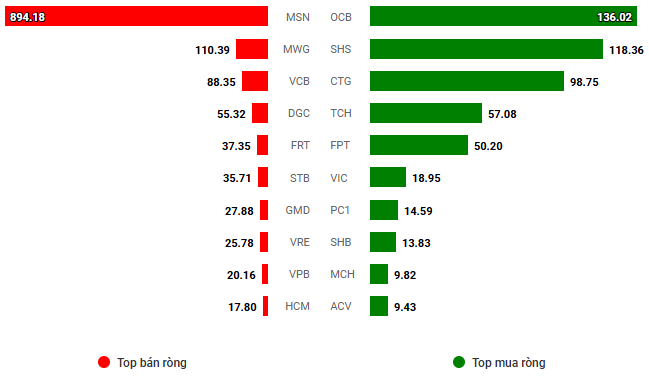

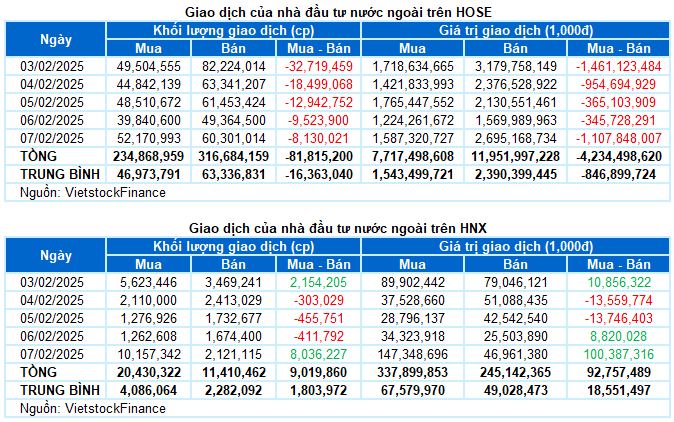

Foreign investors net sold nearly VND 4,142 billion on both exchanges last week. Of which, they net sold more than VND 4,234 billion on the HOSE and net bought nearly VND 93 billion on the HNX.

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: VND billion

Net trading value by stock code. Unit: VND billion

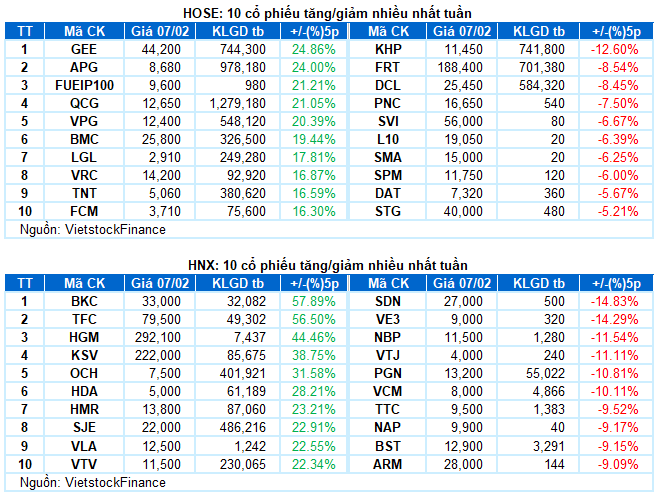

Stocks that increased significantly last week were GEE

GEE rose by 24.86%: GEE recorded a colorful trading week with a gain of 24.86%. The stock continuously surged strongly while closely following the Upper Band of the expanding Bollinger Bands, indicating a very optimistic situation. Trading volume remains above the 20-day average, reflecting very positive participation.

However, the stock slowed its upward momentum with a decrease in the last session of the past week, along with the appearance of an Inverted Hammer candlestick pattern. At the same time, the Stochastic Oscillator indicator has just given a sell signal in the overbought region. This suggests that the risk of correction will increase in the coming time if the indicator falls out of this region.

Stock with a sharp decline last week was KHP

KHP fell by 12.6%: KHP experienced a rather negative trading week, recording 4/5 decreasing sessions. This reflects the strong selling pressure on this stock.

Currently, the Stochastic Oscillator and MACD indicators continue to decline after giving sell signals. This suggests that the risk of short-term correction remains.

II. STOCK MARKET STATISTICS FOR LAST WEEK

Economic Analysis and Market Strategy Department, Vietstock Consulting

– 17:09 07/02/2025

Market Beat 22/01: Stuck in a Tug-of-War, VN-Index Hovers Around 1,245 Points

The market closed with the VN-Index down 3.56 points (-0.29%) to 1,242.53, while the HNX-Index fell 1.01 points (-0.46%) to 220.67. The market breadth tilted towards decliners with 422 losers and 286 gainers. Notably, the large-cap stocks in the VN30-Index witnessed a dominant red hue, recording 24 decliners, 3 advancers, and 3 stocks unchanged.

“Vietstock Weekly: A Cautious Short-Term Outlook”

The VN-Index rallied and recovered after a steep decline in previous weeks. The index also rose above the 200-week SMA. However, trading volume has remained below the 20-week average since November 2024, indicating a lack of positive momentum in market participation. At the moment, the MACD indicator is signaling a sell-off and has crossed below the zero threshold, suggesting that the short-term outlook remains bearish.

The Caution Quotient Rises

The VN-Index declined, slipping further below the Middle Bollinger Band. This downward movement, coupled with trading volumes remaining below the 20-day average, indicates a cautious sentiment among investors. However, the MACD indicator offers a glimmer of hope as it narrows its gap with the Signal Line, suggesting a potential buy signal in upcoming sessions. Should this materialize, it would alleviate concerns of an immediate short-term correction.

“Banking Stocks Rebound: Foreign Investors Still Dumping FPT and VNM”

Liquidity weakened this morning, but demand for high-priced stocks remained robust. The banking sector played a pivotal role in the VN-Index’s impressive recovery, surging past the 1260-point mark. Most of the blue-chips that experienced heavy selling yesterday staged a strong rebound, paving the way for a more vigorous rally in the mid and small-cap segments. Notably, foreign investors persisted in their net selling activities, focusing their attention on FPT and VNM.

The Cash Flows into Mid and Small-Cap Stocks

Although the VN-Index closed today with a modest gain of 0.39%, nearly a hundred stocks outperformed, rising over 1% against their reference prices. The large-cap VN30 basket contributed only 6 tickers to this group, with the remainder being mid and small-cap stocks. Notably, several of these high-performing stocks also featured among the market’s leaders in terms of liquidity.