I. VIETNAMESE STOCK MARKET WEEK 13-17/01/2025

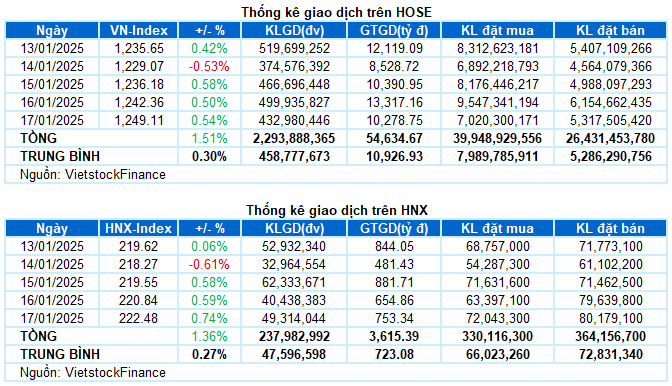

Trading: The main indices continued their positive recovery momentum on the last trading day of the week. By the end of the session on January 17, VN-Index gained 0.54% from the previous session, reaching 1,249.11 points; HNX-Index increased by 0.74% to 222.48 points. For the whole week, the VN-Index rose by a total of 18.63 points (+1.51%), while the HNX-Index climbed 2.99 points (+1.36%).

The Vietnamese stock market witnessed a decent recovery this week after a decline of more than 40 points in the previous two weeks. Following a dip to the 1,220-point level on the first trading day of the week, bottom-fishing forces re-entered the market, especially with the leading role played by large-cap stocks, which helped the VN-Index gain in four out of five sessions and close the week at 1,249.11 points. However, cash flow remained cautious as liquidity consistently stayed at low levels. Moreover, the strong net selling pressure from foreign investors posed a significant challenge, making the market outlook still full of unpredictable variables.

In terms of impact, TCB, FPT, and HDB were the most positive contributors to the market in the last session, adding over 2.5 points to the index. Meanwhile, the 10 stocks with the most negative influence were not enough to take away 1 point from the VN-Index, with VCB leading the decline with a loss of nearly 0.3 points.

The green color dominated across all industry groups. The telecommunications and industrial sectors recorded the most remarkable breakthroughs, rising by 3.21% and 2.72%, respectively. Apart from the purple glow of stocks like YEG, ELC, MFS, and SGP, many other codes also attracted large buying forces, such as VGI (+3.28%), FOX (+4.2%), TTN (+2.49%), ICT (+5.78%); ACV (+2.68%), HAH (+1.56%), CTD (+1.51%), GMD (+1.31%), SCS (+3.57%), and VTP (+1.69%).

The financial sector, with its leading capitalization position, made a significant contribution to the market’s upward momentum today. Many names posted notable increases, including HDB (+3.69%), TCB (+2.31%), NAB (+1.86%), CTG (+1.09%), BVH (+1.95%), and SHS (+2.52%).

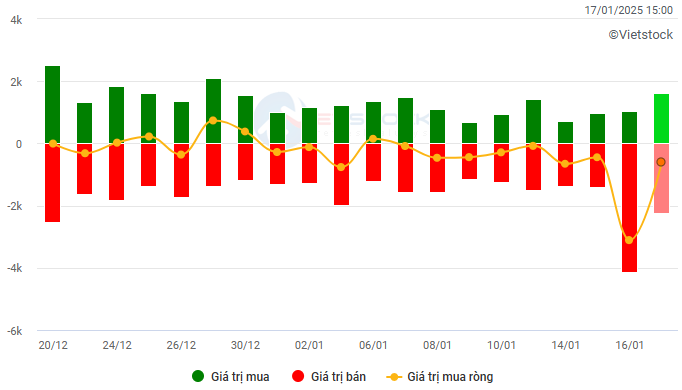

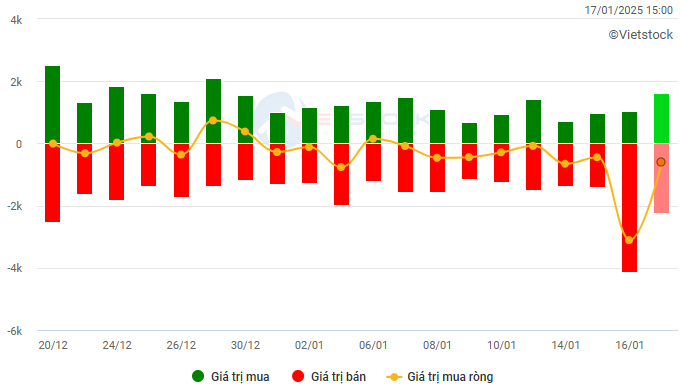

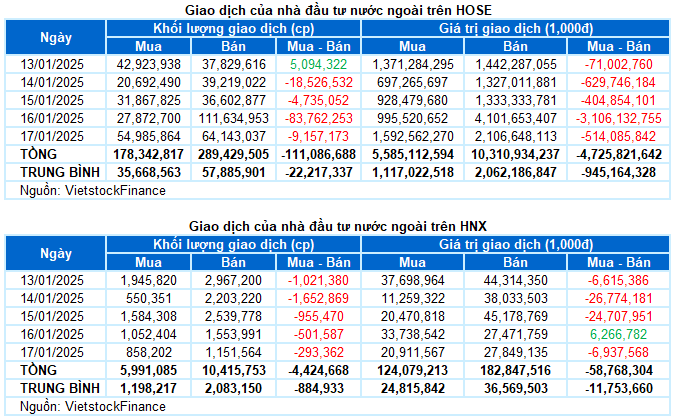

Foreign investors intensified net selling with a value of more than VND 4,784 billion on both exchanges during the past week. Specifically, they net sold nearly VND 4,726 billion on the HOSE and almost VND 59 billion on the HNX.

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: VND billion

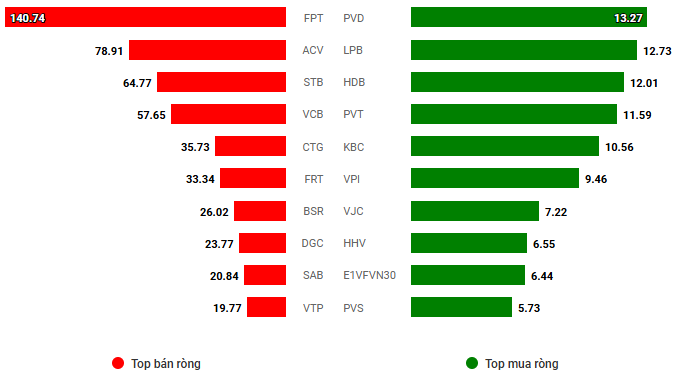

Net trading value by stock code. Unit: VND billion

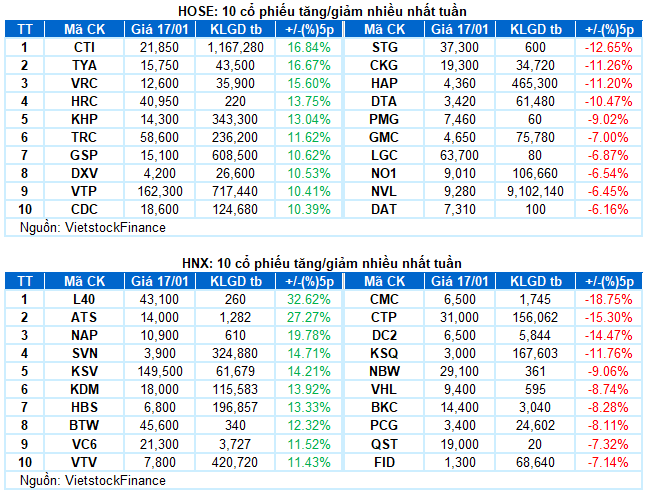

Stocks with the most significant increases this week: CTI

CTI rose by 16.84%: CTI experienced a brilliant trading week, surging by 16.84%. The stock has been witnessing strong upward momentum since breaking above the Middle line of the Bollinger Bands. Additionally, the trading volume staying above the 20-day average indicates the participation of strong buying forces.

At present, the Stochastic Oscillator and MACD indicators are trending upward after generating buy signals. If this condition persists in the coming period, the stock’s growth trajectory will likely be sustained.

Stocks with the most considerable decreases this week: CKG

CKG fell by 11.26%: CKG underwent a rather negative trading week, continuously dropping sharply with the emergence of Black Marubozu and Falling Window candlestick patterns. This reflects the strong selling pressure on this stock.

Currently, the Stochastic Oscillator and MACD indicators continue to decline after triggering sell signals. This suggests that the short-term downward risk remains.

II. STOCK MARKET STATISTICS FOR THE PAST WEEK

Economics and Market Strategy Division, Vietstock Consulting

– 16:49 17/01/2025

Market Beat: Optimism Returns, VN-Index Recovers Near 1,250-Point Mark

The market ended the session on a positive note, with the VN-Index climbing 0.54% to 1,249.11 and the HNX-Index gaining 0.74% to close at 222.48. The market breadth tilted in favor of the bulls, with 464 advancing stocks against 242 declining ones. The large-cap VN30 basket painted a similar picture, as 20 stocks added value, seven dragged, and three remained unchanged, ending the day in the green.

Stock Market Week of January 20-24, 2025: The Return of Optimism

The VN-Index witnessed a robust increase, staying above the 200-day SMA, with trading volume indicating a recovery. This reflects an improvement in investor sentiment, suggesting a shift towards optimism. However, continued foreign selling may dampen the index’s growth prospects in the near future.

The Stock Market Week of February 3-7, 2025: Foreigners Continue to Sell

The VN-Index sustained a positive upward trajectory with consecutive sessions in the green last week. Accompanying this rise was a trading volume that surpassed the 20-day average, indicating a resurgence in investor activity. However, the index faces a challenge as foreign investors have been net sellers for a prolonged period, with relatively large transaction values. Should this trend persist, it could significantly impact the index’s growth prospects in the near future.

Market Beat 22/01: Stuck in a Tug-of-War, VN-Index Hovers Around 1,245 Points

The market closed with the VN-Index down 3.56 points (-0.29%) to 1,242.53, while the HNX-Index fell 1.01 points (-0.46%) to 220.67. The market breadth tilted towards decliners with 422 losers and 286 gainers. Notably, the large-cap stocks in the VN30-Index witnessed a dominant red hue, recording 24 decliners, 3 advancers, and 3 stocks unchanged.

“Vietstock Weekly: A Cautious Short-Term Outlook”

The VN-Index rallied and recovered after a steep decline in previous weeks. The index also rose above the 200-week SMA. However, trading volume has remained below the 20-week average since November 2024, indicating a lack of positive momentum in market participation. At the moment, the MACD indicator is signaling a sell-off and has crossed below the zero threshold, suggesting that the short-term outlook remains bearish.