Market liquidity increased compared to the previous trading session, with the matched trading volume of the VN-Index reaching over 549 million shares, equivalent to a value of more than 12.5 trillion dong; HNX-Index reached nearly 56.5 million shares, equivalent to a value of more than 844 billion dong.

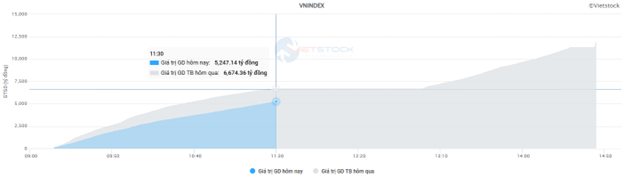

| Top 10 stocks with the strongest impact on the VN-Index on February 7, 2025 |

VN-Index performed quite well in the first half of the afternoon session, with buyers continuing to appear, helping the index maintain its positive momentum. However, towards the end of the session, buying momentum weakened slightly, causing the index to retreat and close in the green. In terms of impact, CTG, BID, TCB, and MBB were the most positive influences on the VN-Index, contributing over four points to the increase. On the other hand, HPG, BCM, VPB, and GAS were still under selling pressure, but their impact was not significant.

HNX-Index followed a similar trajectory, positively influenced by stocks such as KSV (+2.3%), HGM (+9.98%), HUT (+1.26%), and DTK (+1.54%), among others.

|

Source: VietstockFinance

|

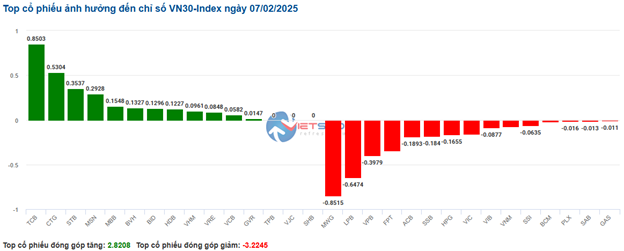

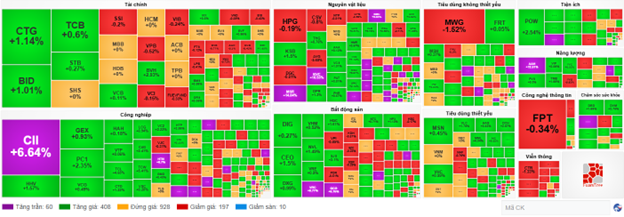

The healthcare sector was the group with the strongest growth, up 0.73%, mainly driven by stocks such as IMP (+0.53%), DHT (+0.68%), DBD (+0.68%), and DVN (+7.39%). This was followed by the financial and materials sectors, with increases of 0.71% and 0.52%, respectively. On the other hand, the energy sector experienced the largest decline in the market, falling by -2.02%, mainly due to VGI (-2.39%), FOX (-0.61%), CTR (-1.56%), and VNZ (-1.38%).

In terms of foreign trading, they continued to sell a net amount of more than 1,100 billion dong on the HOSE exchange, focusing on stocks such as MSN (894.18 billion), MWG (110.39 billion), VCB (88.35 billion), and DGC (55.32 billion). On the HNX exchange, foreign investors bought a net amount of over 100 billion dong, mainly investing in SHS (118.36 billion), DHT (9.06 billion), HUT (970 million), and TVC (920 million).

| Foreign Trading Buy-Sell Dynamics |

Morning Session: Cautious Trading Around the 1,275-Point Level

Cautious sentiment slowed down the market significantly, resulting in a narrow range-bound movement with a slight advantage for buyers. At the end of the morning session, the VN-Index gained 0.23% to reach 1,274.38 points, while the HNX-Index increased by 0.37% to 229.98 points. The market breadth was positive, with 415 advancing stocks and 240 declining stocks.

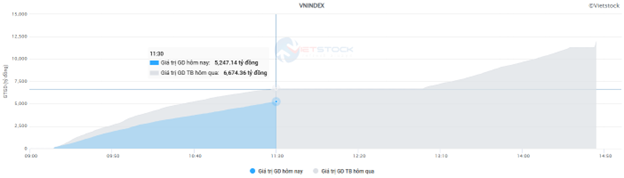

The matched trading volume of the VN-Index in the morning session reached over 232 million units, equivalent to a value of more than 5.2 trillion dong, a 21% decrease compared to the previous day. Meanwhile, the HNX-Index recorded a trading value similar to the previous session, at over 424 billion dong.

Source: VietstockFinance

|

CTG, BID, and GVR were the main contributors to the VN-Index’s positive performance, adding nearly 2.5 points to the index. On the other hand, selling pressure was not strong enough to significantly impact the market, as the top 10 negative stocks only took away 1.5 points from the index.

The market’s mixed performance led to minor fluctuations in most industry groups. However, the materials sector stood out with a vibrant purple hue, thanks to a series of stocks such as KSV, MSR, BMC, HGM, MTA, and more, resulting in a 1.36% increase for the group. The utilities group also witnessed impressive gains, including POW (+2.97%), REE (+1.82%), DDG (+6.9%), VSH (+1.2%), and DNW (+2.45%), among others.

On the contrary, the telecommunications group underwent a significant correction, with large-cap stocks dipping into the red, notably CTR (-1.33%), VGI (-1.41%), MFS (-2.66%), YEG (-0.34%), and VNZ (-0.55%).

Foreign investors maintained their net selling position in the morning session, with a net sell value of over 341 billion dong across all three exchanges. The stocks experiencing the highest net sell-off were MWG (72.15 billion), DGC (42.41 billion), and VCB (38.71 billion). However, foreign investors halted their net selling streak in FPT and turned to net buying, with a net buy value of nearly 32 billion dong in the morning session.

10:30 am: Rangebound Trading Around the Reference Level

The market witnessed strong divergence, with the major indices fluctuating around the reference level. As of 10:30 am, the VN-Index gained 2.3 points, trading around 1,273 points, while the HNX-Index increased by 0.77 points, trading around 229 points.

Stocks within the VN30 basket displayed a balanced mix of green and red ticks. Specifically, on the buying side, TCB, CTG, STB, and MSN contributed 0.85 points, 0.53 points, 0.35 points, and 0.29 points to the index, respectively. Conversely, MWG, LPB, VPB, and FPT faced selling pressure, resulting in a loss of more than 1.8 points from the VN30-Index.

Source: VietstockFinance

|

The materials sector took the lead in the recovery, with a 1.29% increase. Notably, mid- and small-cap stocks in this sector unexpectedly surged to the ceiling price from the start of the session and maintained their positive momentum, including MSR, BMC, MTA, and KVC. Regarding KSV, this stock had a streak of three consecutive ceiling-price increases before today, reflecting the prevailing optimistic sentiment among investors. Moreover, after breaking out of its accumulation range from August to December 2024, KSV’s mid-term uptrend has been well maintained, with the MACD indicator continuing to form higher highs and higher lows, generating a buy signal. However, trading volume in recent sessions has remained below the 20-day average. If this factor improves in the future, the uptrend will become more sustainable.

Source: https://stockchart.vietstock.vn/

|

Following the healthcare sector, although still somewhat mixed, also recorded a decent increase. Specifically, IMP rose by 0.85%, DHT by 2.05%, DBD by 1.19%, DVN by 5.22%, and TRA by 0.79%… Meanwhile, stocks like DHG (-0.19%), TNH (-0.25%), DAN (-13.6%), and DCL (-3.85%) remained in the red.

Additionally, the industrial sector, despite some divergence, leaned towards the buying side, facilitating a solid recovery with a 0.38% increase. Within this sector, notable gainers included CII (+6.27%), HHV (+1.57%), PC1 (+2.56%), and VCG (+0.49%)… Conversely, a few stocks like ACV (-1.36%), SCS (-0.37%), and MST (-1.41%) dipped into the red.

On the flip side, the telecommunications sector faced intense selling pressure, weighing on the overall market. Specifically, YEG fell by 1.01%, CTR by 1.33%, VGI by 1.19%, FOX by 0.5%… Only a small portion of stocks managed to stay in the green, including ABC (+2.26%), SGT (+1.2%), and VNB (+1.75%), but their impact was not significant.

Compared to the opening, buyers and sellers engaged in a fierce tug-of-war, with over 900 stocks trading flat and buyers slightly gaining the upper hand. There were 408 rising stocks (including 60 ceiling-price stocks) and 197 declining stocks (including 10 floor-price stocks).

Source: VietstockFinance

|

Opening: Cautious Start to the Session

At the start of the February 7 session, as of 9:30 am, the VN-Index hovered around the reference level, reaching 1,272.22 points. The HNX-Index edged slightly higher, trading around 229.75 points.

The S&P 500 index advanced for the third consecutive session on Thursday (February 6) as investors assessed the latest round of corporate earnings reports. Specifically, at the close of the trading session on February 6, the S&P 500 rose by 0.36% to 6,083.57 points, while the Nasdaq Composite gained 0.51% to reach 19,791.99 points. In contrast, the Dow Jones lost 125.65 points (equivalent to 0.28%) to settle at 44,747.63 points.

The red tick temporarily prevailed in the VN30 basket, with 21 declining stocks, 6 advancing stocks, and 4 stocks trading flat. Among them, MWG, LPB, and SSB were the most negative performers. Conversely, BVH, BID, and GVR were the top gainers.

The telecommunications services sector was the most negative influence on the market in the morning session, with most stocks in this group dipping into the red from the start of the session, including CTR (-1.02%), VGI (-1.74%), MFS (-1.83%), ELC (-0.34%), YEG (-0.34%), TTN (-0.43%), and more…

On the other hand, the materials sector extended its growth momentum, led by familiar names from recent sessions, such as KSB (+1.5%), VLB (+5.28%), DRI (+3.02%), DPM (+0.14%), GVR (+0.17%), and HSG (+0.28%), among others.

Stock Market Update for Jan 13-17, 2025: A Murky Road to Recovery

The VN-Index posted gains in 4 out of 5 trading sessions last week, indicating a strong recovery. However, trading volume remained below the 20-day average, reflecting a persistent cautious sentiment among investors. Moreover, net foreign selling in recent times has also been a less-than-favorable factor for the index.

Market Beat: Optimism Returns, VN-Index Recovers Near 1,250-Point Mark

The market ended the session on a positive note, with the VN-Index climbing 0.54% to 1,249.11 and the HNX-Index gaining 0.74% to close at 222.48. The market breadth tilted in favor of the bulls, with 464 advancing stocks against 242 declining ones. The large-cap VN30 basket painted a similar picture, as 20 stocks added value, seven dragged, and three remained unchanged, ending the day in the green.

Stock Market Week of January 20-24, 2025: The Return of Optimism

The VN-Index witnessed a robust increase, staying above the 200-day SMA, with trading volume indicating a recovery. This reflects an improvement in investor sentiment, suggesting a shift towards optimism. However, continued foreign selling may dampen the index’s growth prospects in the near future.

The Stock Market Week of February 3-7, 2025: Foreigners Continue to Sell

The VN-Index sustained a positive upward trajectory with consecutive sessions in the green last week. Accompanying this rise was a trading volume that surpassed the 20-day average, indicating a resurgence in investor activity. However, the index faces a challenge as foreign investors have been net sellers for a prolonged period, with relatively large transaction values. Should this trend persist, it could significantly impact the index’s growth prospects in the near future.

Market Beat 22/01: Stuck in a Tug-of-War, VN-Index Hovers Around 1,245 Points

The market closed with the VN-Index down 3.56 points (-0.29%) to 1,242.53, while the HNX-Index fell 1.01 points (-0.46%) to 220.67. The market breadth tilted towards decliners with 422 losers and 286 gainers. Notably, the large-cap stocks in the VN30-Index witnessed a dominant red hue, recording 24 decliners, 3 advancers, and 3 stocks unchanged.