The Ministry of Finance has recently submitted a draft decree to the Government on tax administration for business activities on e-commerce and digital platforms by households and individuals.

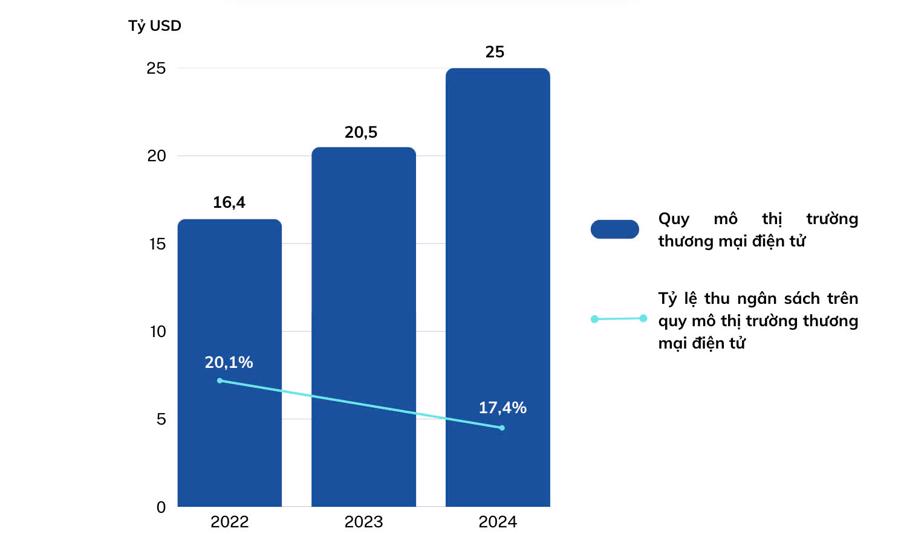

In the submission, the Ministry of Finance stated that Vietnam’s e-commerce market size has grown significantly in recent years: from 16.4 billion USD in 2022 to 20.5 billion USD in 2023 and is expected to reach approximately 25 billion USD in 2024.

However, the total revenue from e-commerce activities of domestic enterprises, households, and foreign providers without a permanent establishment in Vietnam only accounts for about 20% of the e-commerce market size. Notably, this proportion is declining from 20.1% in 2022 to 17.4% in 2024.

The Ministry of Finance affirmed that these figures indicate that many business entities have not declared and paid taxes as required by tax laws on revenue from e-commerce activities.

REVENUE FROM “KOL” IS SUBJECT TO TAX

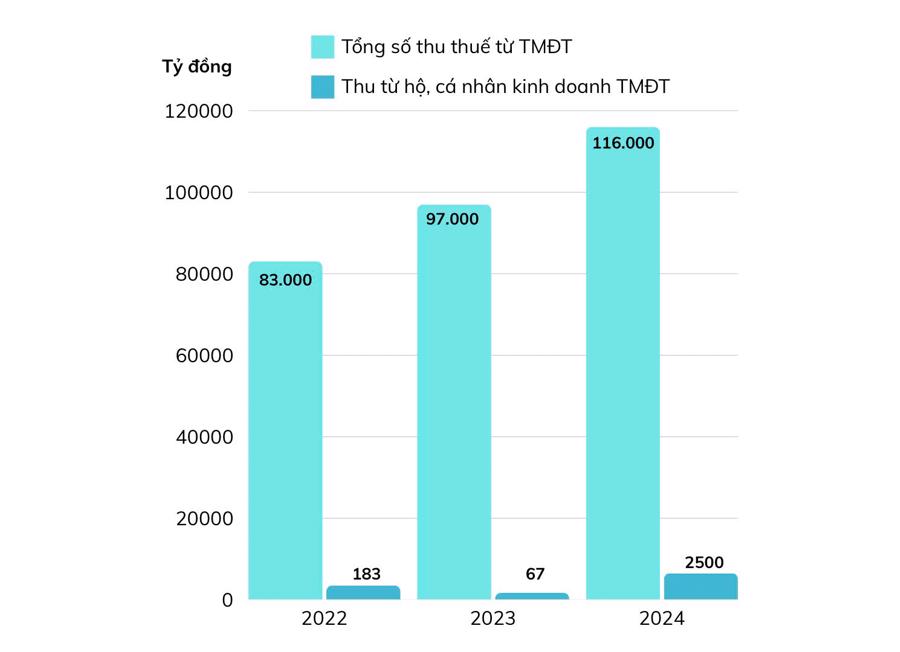

According to the Ministry of Finance, up to now, the General Department of Taxation has built and operated a database on domestic e-commerce activities with information on more than 500,000 organizations and individuals doing business on more than 400 e-commerce trading floors, with estimated tax revenue in 2024 reaching 116 trillion VND.

For cross-border e-commerce activities: Through tax administration from the electronic information portal, the General Department of Taxation has data on 120 foreign providers without a permanent establishment in Vietnam that generate income in Vietnam from e-commerce business activities, with state budget revenue from these entities up to now is 17.8 thousand billion VND.

Information about Vietnamese organizations and individuals who declare and pay taxes on behalf of foreign providers includes 31,000 organizations and individuals using advertising services and more than 4,200 organizations and individuals using e-commerce platform services such as TikTok shop. Information about foreign organizations and individuals generating income on Vietnamese e-commerce platforms (Shopee, Lazada) with a total of 183 million transactions and a transaction value of 16,641 billion VND.

According to data provided by the Ministry of Industry and Trade, in 2023, there were 929 websites and applications registered with the Ministry of Industry and Trade as prescribed in Decree 52/2013/ND-CP. However, according to the Ministry of Finance, through screening, many websites are only established to serve the sales of the unit itself that set up the website, and not yet a website providing e-commerce trading floor services.

In addition to business activities on large domestic e-commerce platforms, households and individuals also do business on foreign e-commerce service platforms such as: Booking, Agoda, Airbnb, Tripadvisor… (accommodation service platform); digital content platforms, social networks such as: Netflix, Spotify (subscription platform); Google, Youtube, Facebook, Tiktok (advertising platform, social network); Apple Store, CH Play (app store platform)…

Currently, there is a new business entity, which is individuals with a large influence (KOL-Key Opinion Leader) in society, conducting business on e-commerce platforms and digital platforms through livestreaming to advertise and sell goods and services.

According to information from state management agencies, KOLs are divided into 3 main groups: KOLs with credibility and influence in society, thereby creating influence on cyberspace (accounting for about 21.8%), KOLs without credibility in society but creating influence thanks to having a large number of followers on cyberspace (accounting for about 42%), and KOLs with indirect influence on cyberspace (accounting for about 36.2%). Information from the media shows that some KOLs livestreaming to advertise and sell products with revenue of tens of billions to hundreds of billions of VND.

The Ministry of Finance gave an example: Quyen Leo Daily with a total revenue of more than 75 billion VND in just 13 hours on the TikTok platform; even Quyen Leo Daily had a livestream session lasting 17 hours, with a “shocking” revenue of 100 billion VND; Pham Thoai has revenue of 1 livestream session of over 50 billion VND…

The Ministry of Finance said that currently, tax administration for households and individuals doing business on e-commerce and digital platforms is managed by the Tax Departments and Branches, so it is not really effective, and tax revenue from e-commerce business activities is very small compared to the scale and growth rate of e-commerce and digital platforms.

According to tax administration data in the period from 2022 to 2024, the total tax revenue of organizations and individuals with e-commerce business activities tends to increase (in 2022 it was 83 thousand billion VND, in 2023 it was 97 thousand billion VND, and in 2024 it is expected to reach 116 thousand billion VND), of which tax revenue from households and individuals is very low (in 2022 it was 183 billion VND, in 2023 it was 67 billion VND, and in 2024 it is expected to reach 2.5 thousand billion VND).

LOGISTICS COMPANIES MUST PROVIDE CUSTOMER INFORMATION TO THE TAX AUTHORITIES

The Ministry of Finance said that, according to current regulations in the Law on Tax Administration, agencies, organizations, and individuals related to taxpayers have the responsibility to provide information at the request of the tax authorities. Decree No. 91/2022/ND-CP amending and supplementing Decree No. 126/2020/ND-CP guiding the Law on Tax Administration in detail stipulates that e-commerce trading platforms must provide information of organizations and individuals doing business on the platform to the tax authorities on a quarterly basis electronically. However, the provision of information by e-commerce platforms does not fully meet the requirements for tax administration for cases of business on social networks or other e-commerce platforms.

All organizations and individuals doing business on e-commerce platforms and other digital platforms (including KOLs) will be subject to the Decree on tax administration for e-commerce business activities, which is expected to take effect from April 1, 2025.

The Ministry of Finance said that, with the e-commerce business model, most organizations and individuals selling goods must go through intermediary shipping units to deliver goods to buyers (including exports and imports through e-commerce), so logistics service providers will have information related to the sellers, which are organizations and individuals.

The Ministry of Finance informed that, in the past time, in implementing the provisions of Clause 1, Article 29 of the Law on Tax Administration on the responsibility of organizations and individuals in providing information related to the determination of tax obligations at the request of the tax authorities, some tax authorities have been implementing to request logistics service providers to provide information related to organizations and individuals using transportation services to serve the inspection of subjects generating taxable income, in order to propagate and guide tax declaration and payment in accordance with regulations.

“However, the request for information has not been implemented synchronously and uniformly nationwide, which has caused some disadvantages and difficulties for logistics service providers in terms of competitiveness among transportation units, pressure to provide information with large data for many tax authorities manually,” the Ministry of Finance emphasized.

For the above reasons, the Ministry of Finance affirmed that to improve the effectiveness of tax management for e-commerce activities (especially for business entities on digital platforms but not through e-commerce trading platforms with online ordering functions), it is necessary to supplement mechanisms to concretize the responsibility for providing information from logistics service providers.

The Ministry of Finance emphasized that the regulation on the responsibility of logistics companies to provide information about individuals and organizations using delivery services is legal, reasonable, and does not increase costs for enterprises.

The Ultimate Guide to Start-up Success: Surviving the First 3 Years Without a Salary, Living in a Warehouse

Douglas Tan, the charismatic and visionary entrepreneur, founded Magix after facing numerous setbacks in his pursuit of career re-entry. Despite possessing impressive credentials, expertise, and experience, his journey began with a series of unsuccessful attempts to reintegrate into the workforce.

The Year-End Super Sale: Shopee, TikTok Shop, and Lazada Cash in on the Action

Shopee Live and Shopee Video witnessed a remarkable surge in product sales on 12-12, with figures skyrocketing to nine times the average daily sales.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)