Knight Frank Vietnam – a leading real estate consultancy firm

Knight Frank, a prominent real estate consultancy firm, highlights Vietnam’s remarkable potential in attracting foreign direct investment. This is driven by its strategic location, favorable demographics, and open policies. In 2024, the Vietnamese real estate market witnessed impressive performance in the office, built-ready warehouse, and apartment sectors, propelled by strong dynamics.

Specifically, in 2024, the office rental market in Vietnam flourished, absorbing over 160,000 square meters, the highest in the last five years. This growth was primarily fueled by the robust expansion of the information technology and banking sectors. The swift recovery underscored a “quality shift” trend, with newly constructed, green-certified offices in Ho Chi Minh City and Hanoi witnessing significant transactions.

Ho Chi Minh City welcomed over 118,000 square meters of office space for lease, predominantly in District 1, including notable locations like The Nexus, Riverfront Financial Centre, ThaiSquare The Merit, and e.town 6 in Tan Binh District. Meanwhile, Hanoi recorded nearly 87,000 square meters of new office space, attracting considerable interest during the pre-opening leasing phase due to superior construction quality and competitive leasing terms. Despite high average asking rents in both cities, landlords offered more flexible policies to tenants, including rent-free periods and fixed-term discounts.

Leo Nguyen, Senior Director of Tenant Strategy and Solutions at Knight Frank Vietnam, remarked that 2024 was a record-breaking year, witnessing the successful execution of significant contracts. In 2025, the leasing activity is anticipated to grow steadily in both Ho Chi Minh City and Hanoi. Building owners will proactively enhance their leasing strategies, focusing on competitive pricing, improved services, and attractive leasing terms to cater to tenant demands and ensure sustained occupancy.

Photo: Ha Vy

In the built-ready warehouse/factory sector, Vietnam has reached a mature stage, leading in industrial development and investment. Its advantageous location, coupled with competitive costs, has solidified Vietnam’s position as a prominent destination in the “China + 1” strategy, especially since the US-China trade war in 2018.

Knight Frank points out that over the past six years, the supply of built-ready warehouses/factories has doubled from 6.6 million square meters in 2018 to over 15.6 million square meters in 2024, largely due to the involvement of institutional investors such as BW, SLP, Frasers, Cainiao, and KCN Vietnam.

Bac Ninh and Hai Phong remain the primary industrial hubs in Northern Vietnam, with new supply originating from projects like BW Thuan Thanh 3B – Phase 1, Industrial Centre Yen Phong 2C – Phase 1, BW ESR Nam Dinh Vu, and SLP Park Bac Ninh. In the South, the provinces of Dong Nai and Long An continue to be the main industrial development areas, with projects such as KCN Ho Nai, KCN Phu An Thanh, BW Xuan A, and SLP Park Long Hau. Modern infrastructure and high technical standards contributed to higher average rental rates in 2024, significantly narrowing the rental rate gap between the South and the North.

The rise of e-commerce and its impact on the warehouse/factory market

Both regions maintained average occupancy rates above 80% in 2024, driven by the robust growth of e-commerce and the shift of manufacturing operations from small and medium-sized companies in China and Europe to Vietnam. Going forward, projects adhering to ESG standards and mixed-use developments are expected to thrive, while advantages in land availability, competitive rents, and infrastructure upgrades will facilitate the growth of secondary markets like Ha Nam, Bac Giang, Vinh Phuc, and Binh Phuoc.

“In 2025, the demand for built-ready warehouses and factories is anticipated to remain robust, fueled by the production shift from China and government support for manufacturing and trade to achieve the 8% GDP growth target,” emphasized Knight Frank Vietnam’s representative.

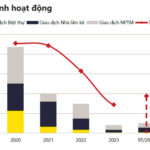

Turning to the apartment market, Hanoi witnessed a significant surge in 2024, with 27,268 new apartments, triple the number launched in 2023. Absorption rates soared to 98%, with over 30,700 new sales, triple the figure from 2023, marking the highest absorption in the past five years.

Ho Chi Minh City, after hitting a low in 2023, showed slight signs of recovery with an absorption rate of approximately 63%, equivalent to 6,234 apartments sold. Strong demand was observed in Thu Duc City (East Zone), with nearly 4,200 new sales, accounting for about 67% of the total sales in the city this year.

The New Homeowner Generation: Will ACB’s Bold Move to Lend to Young Buyers End Millennial Marriage and Birthrate Blues?

Deploying ACB Chairman Tran Huy Hung’s “First Home” loan package for young people will help alleviate the alarming “reluctance to marry and have children” trend currently prevailing in Vietnam.

The Vibrant Commercial Street of STC Long Thành – Thriving Next to Long Thành Airport

The Eastern region of Ho Chi Minh City is experiencing a significant wave of investment, attributed to its remarkable infrastructure development. STC Long Thanh, a prominent existing real estate, is just 2.5 km from the upcoming Long Thanh airport, offering a unique opportunity for investors. With its ready-to-possess pink book and strategic location, it is an ideal choice for those seeking to diversify their portfolios and capitalize on the anticipated infrastructure “boom” in the 2026-2027 phase.

The Congress Proposes a Resolution to Invest in an $8.3 Billion Railway Project

At an extraordinary session on February 13, the National Assembly discussed the proposal and assessment report on the investment policy for the Lao Cai – Hanoi – Hai Phong railway project, with a proposed investment mode of public investment. The preliminary total investment is estimated at VND 203,231 billion (approximately USD 8,369 million).