Ho Chi Minh City Back on Track

According to Knight Frank, Hanoi welcomed the launch of 27,300 new apartments for sale in the past year, triple the number in 2023. Hanoi’s apartment demand surged, with 98% of the supply absorbed. In terms of prices, Hanoi’s apartment prices increased by 35% year-on-year, reaching an average of VND 72 million/sqm, the highest in the last decade.

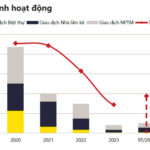

In Ho Chi Minh City, tight credit policies in the real estate sector and legal entanglements continued to dampen supply. The city saw only around 4,900 new apartments launched last year, with an absorption rate of about 63%.

Ho Chi Minh City recorded an apartment price of up to VND 91 million/sqm, 19% higher than Hanoi.

Similarly, One Housing reported that the average primary apartment price in Ho Chi Minh City was around VND 84 million/sqm in the past year, a 15% increase from 2023. The East (Thu Duc City) witnessed an 18.3% price hike, while the South (Binh Chanh and Nha Be) and the West (District 8, District 12, Go Vap, and Tan Phu), which are home to many mid-range and affordable projects, saw price increases of 5.6% and 8.2%, respectively.

Savills Vietnam’s 2024 real estate market overview report revealed that the average primary apartment price in Hanoi was VND 75 million/sqm in 2024. In contrast, Ho Chi Minh City recorded a record-high price of VND 91 million/sqm, 19% higher than Hanoi.

Historically, there was a significant gap between apartment prices in Hanoi and Ho Chi Minh City. However, since late 2023, the price race between these two metropolises has tightened. In Q3/2024, Hanoi’s apartment prices surpassed those in Ho Chi Minh City, but in Q4/2024, the latter bounced back due to the dominance of luxury and ultra-luxury projects.

Ho Chi Minh City’s Construction Department report also showed that the city had only over 30 commercial housing projects under development last year, offering 31,167 apartments, just one-third of the annual pre-pandemic project implementation number.

There were only four commercial housing projects eligible to mobilize capital and introduce products to the market, a 75% decrease in project numbers. These projects provided only 1,611 units, all of which were high-end apartments, with an average price of VND 9.39 billion/unit as registered with the Construction Department. Notably, all of these were high-end residences (a 90% decrease in the number of houses compared to the same period in 2023, with 19 commercial housing projects comprising 17,753 units introduced to the market).

Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association (HoREA), stated that this was the first time the high-end segment had dominated the city’s real estate market. Currently, there is a lack of mid-range and affordable housing in new commercial projects, leading to a distorted market structure that fails to meet the actual housing needs of the majority of middle and low-income earners. As a result, the market is developing in an unsustainable, unsafe, and unhealthy manner.

Capital Flows South

According to Batdongsan.com.vn, 66% of Hanoi residents surveyed expressed interest in southern real estate. Additionally, peripheral areas and satellite cities of Ho Chi Minh City, such as Binh Duong, Long An, Dong Nai, and Ba Ria – Vung Tau, are also attracting attention from Hanoi-based property seekers.

The most popular property types among Hanoi consumers considering a move south are apartments (chosen by 75% of respondents), followed by shophouses/townhouses (53%), land plots (53%), detached houses (39%), villas (29%), and resort properties (28%).

The southern real estate market is showing positive signs of demand.

Mr. Dinh Minh Tuan, Director of Business at PropertyGuru Vietnam, noted a clear differentiation in the Hanoi and Ho Chi Minh City markets over the last two years. Not only Hanoi residents but also investors from Ho Chi Minh City are actively seeking opportunities in the southern metropolis. “There is a noticeable shift of capital from Hanoi to Ho Chi Minh City in Q4/2024,” said Mr. Tuan.

Mr. Tuan further attributed this capital flow to the southern region’s attractive potential, favorable pricing, and the availability of high-quality new projects. In contrast, real estate prices in Hanoi and its surrounding areas have soared.

Mr. Vo Hong Thang, Deputy General Director of DKRA Group, observed positive signals in the southern real estate market’s demand. Many apartment, townhouse, and land projects launched in Ho Chi Minh City, Binh Duong, and Long An at the beginning of this year have recorded absorption rates of up to 80-90%, with a notable presence of northern investors. This indicates a recovery in southern real estate purchases.

“The early implementation of the Land Law, Housing Law, and Real Estate Business Law has helped resolve long-standing legal entanglements, and supply in Ho Chi Minh City and its neighboring provinces is expected to break through. The central and local governments are working together to expedite the removal of obstacles, instilling confidence in all participants for the coming period,” said Mr. Thang.

The Flatlining Condo Prices: Investors Anxious Over ‘Holding Duds’

After the Lunar New Year, apartment prices tend to stabilize, a trend that often sparks fears of losses among investors who bought at the peak.

“Vietnam to Emerge as One of the Top 3 Fastest-Growing Emerging Markets by 2025 in Industrial Development and Investment”

Knight Frank, a renowned real estate consultancy firm, has released its Regional Overview Report for 2025, and the outlook for Vietnam’s property market is exceptionally promising. The report highlights that the country’s real estate sector is maturing, showcasing impressive growth and leading the way in industrial development and investment opportunities.

The Luxury Slump: Million-Dollar Mansions in Ho Chi Minh City Face Price Cuts and Poor Sales

Compared to the same period last year, villa and townhouse prices in Ho Chi Minh City have dropped by 10%, now sitting at VND 330 million per square meter. This price decline is attributed to the high prices that have been a hindrance to transaction settlement for this property type.

The Capital’s Call: Uncovering Housing Society Scandal

The inspection process uncovered severe violations in the management and rental of the first floor of the Kim Chung Social Housing Area. The municipal inspection agency has referred the case to the investigative authority and recommended that the Hanoi People’s Committee review and discipline the involved officials.