Financial costs continue to be a “stranglehold”

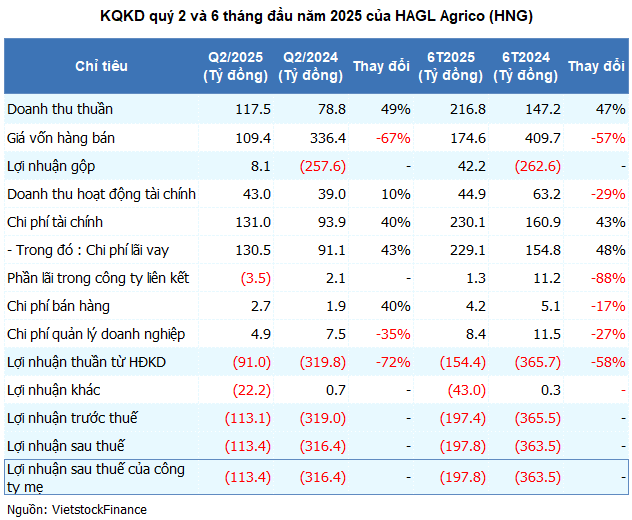

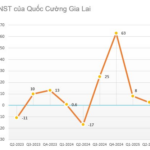

HAGL Agrico reported a net loss of over 113 billion VND in Q2 2025, marking the 17th consecutive quarter of losses for the company. Compared to the same period in 2024, the loss has significantly decreased from 316 billion VND. However, the prolonged loss-making situation persists.

| HNG’s consecutive loss streak from Q2 2021 to present |

HNG’s financial expenses increased by 40% to 131 billion VND, with interest expenses accounting for 99.6%. This was the main reason for the continued erosion of profits, despite the company recording gross profits after years of selling below cost.

This quarter’s revenue reached 117.5 billion VND, a 49% increase year-on-year, mainly due to a 67% reduction in cost of goods sold. As a result, gross profit improved slightly to over 8 billion VND compared to a loss of 258 billion VND in the same period last year. However, the gross profit margin for Q2 was only 6.9%, a significant decrease from 34.3% in Q1.

Financial revenue increased by 10% to 43 billion VND, but it was insufficient to offset financial expenses. In addition, HNG recorded a loss of nearly 3.5 billion VND from associated companies (compared to a profit of 2 billion VND in the same period last year) and other losses of over 22 billion VND (a slight profit in the same period last year). These losses further deepened the quarterly loss.

|

According to the explanation, the loss in Q2 was also due to the recognition of 47.2 billion VND in depreciation expenses for unharvested orchards and inefficient assets. At the same time, interest expenses increased due to large outstanding debts from past rubber and oil palm projects.

As of June 30, 2025, HNG’s total financial debt stood at 10,223 billion VND, a 3% increase from the beginning of the year. Of this, more than 9,300 billion VND was borrowed from Thaco Agri, the largest shareholder and financial sponsor of HAGL Agrico.

At the 2025 Annual General Meeting of Shareholders, Mr. Tran Ba Duong, Chairman of the Board of Directors of HNG, frankly acknowledged: “Previously, when Thaco came in, we saw that HAGL Agrico had debt and land, but in reality, there were many accumulated issues. HAGL Agrico was like a lifeless body, and we are trying to resolve all the issues in 2025 so that we can be more relaxed from 2026.”

Six-month accumulated loss of nearly 200 billion VND

In the first half of the year, HNG recorded a net loss of nearly 198 billion VND, an improvement from a loss of over 363.5 billion VND in the same period last year. Revenue increased by 47% to nearly 217 billion VND but only achieved about 20% of the yearly plan. In the revenue structure, fruit sales accounted for 71%, rubber 28%, and the rest were services and supplies.

As of the end of Q2, HNG’s accumulated loss reached nearly 9,582 billion VND, and equity stood at only 1,666 billion VND. With a full-year pre-tax loss target of 854 billion VND, the first-half loss is still within the “planned loss” set by the Board of Directors. Chairman Tran Ba Duong stated that most of the planned loss for 2025 is due to asset depreciation and orchard conversion, and depreciation does not accurately reflect the profitability of the assets.

HAGL Agrico expects to have about 3,000 hectares of banana plantations in production from 2026 onwards, which, if managed well, could significantly improve business performance.

In the stock market, HNG’s share price closed at 6,000 VND/share on August 1, 2025. Compared to a year ago, the market price has recovered by 53%, with liquidity maintained at a high level, averaging more than 4 million shares traded per session.

| HNG Share Price Movement since the beginning of 2025 |

– 15:22 01/08/2025

“Quang Anh Group Settles 2.882 Trillion VND Debt with a 100 Billion Payment”

With a remarkable turnaround, the company has reported a post-tax profit of over VND 10.7 billion for the first half of the year, compared to a loss of VND 16.6 billion in the same period last year.

VietinBank Capital Divests an Additional 10.1 Million VSC Shares, Hitting a New High After Touching Bottom

VietinBank Capital continues to offload over 10 million VSC shares in a record-breaking trading session, with the transaction value estimated at a staggering 232 billion VND. Despite experiencing a market-driven dip, VSC shares swiftly rebounded, surging to new heights with two consecutive ceiling-hitting sessions.