|

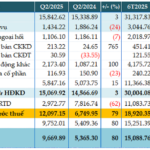

OIL’s Business Targets in Q2 2025

Source: VietstockFinance

|

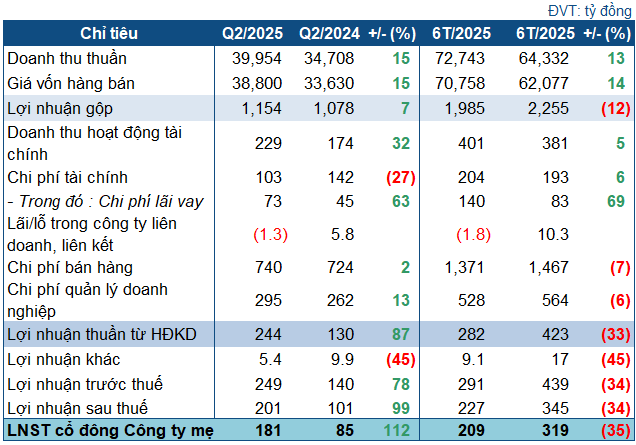

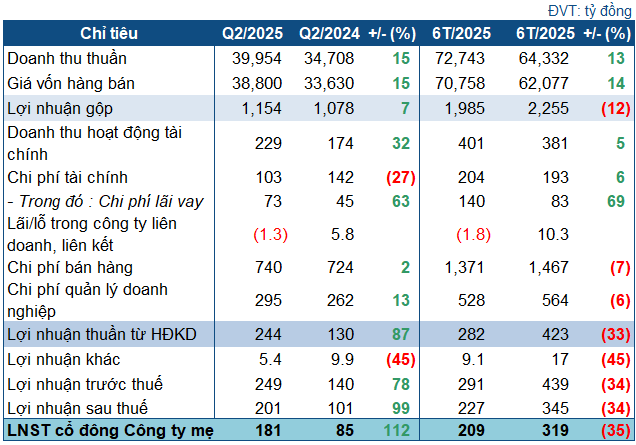

In the second quarter of 2025, OIL’s revenue reached nearly VND 40 trillion, up 15% year-on-year. However, due to a 15% increase in cost of goods sold, gross profit stood at over VND 1,150 billion, a 7% increase.

Financial income rose 32% to VND 229 billion, while financial expenses fell 27% to over VND 103 billion. Despite losses from associates and joint ventures of VND 1.3 billion (compared to a profit of VND 5.8 billion in the same period last year) and increases in selling and management expenses, OIL recorded an impressive net profit of VND 181 billion, more than double that of the previous year.

OIL attributed this performance to the fluctuating oil price environment. Brent DTD oil prices averaged USD 67.82 per barrel in Q2 2025, 20% lower than the previous year’s average of USD 84.97. Prices of oil products also declined by 17-20% during this period. Conversely, domestic base prices, set by authorities, exhibited an upward trend, contrasting the downward trend observed in the previous year.

Additionally, financial activities contributed significantly to the improved results, as foreign exchange losses decreased, outpacing the rise in interest expenses. These factors collectively led to OIL’s enhanced performance.

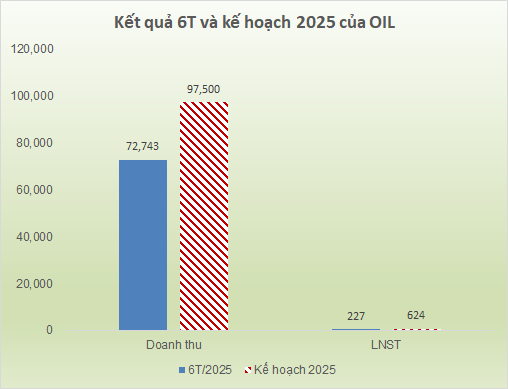

Given the significant loss in Q1, the half-year results were less remarkable. In the first six months of 2025, OIL achieved VND 72.7 trillion in net revenue, a 13% increase year-on-year, while net profit stood at VND 209 billion, a 35% decrease. Compared to the plan approved at the 2025 Annual General Meeting of Shareholders, the PVN member achieved nearly 75% of the revenue target and over 36% of the annual after-tax profit goal.

Source: VietstockFinance

|

As of the end of Q2, OIL’s total assets amounted to nearly VND 43.7 trillion, a 5% increase from the beginning of the year. Short-term assets slightly increased to over VND 37 trillion. Cash and cash equivalents reached nearly VND 15.3 trillion, a slight increase, while inventory surged by almost 50% to over VND 5.3 trillion.

On the capital side, the majority of liabilities were short-term, amounting to nearly VND 31.7 trillion, a nearly 6% increase. Short-term borrowings rose by 14% to over VND 8.4 trillion. The current and quick ratios both stood at approximately 1, indicating OIL’s strong financial health and ability to meet short-term obligations.

– 15:58 04/08/2025

“Saigonbank Reports a 22% Drop in Pre-Tax Profits: A Significant Rise in Provision Costs”

“Saigonbank’s latest quarterly report reveals a pre-tax profit of over VND 76 billion in Q2 of 2025, marking a 22% dip compared to the previous year’s figures. This decrease is attributed to a significant 79% surge in credit risk provisions, highlighting the bank’s cautious approach amidst economic uncertainties.”

“Sacombank’s Strategic Cost Management Pays Off: A 36% Jump in Pretax Profit for Q2”

The consolidated financial statements for the second quarter of 2025 revealed impressive results for the Saigon Thuong Tin Commercial Joint Stock Bank, more commonly known as Sacombank (HOSE: STB). The bank demonstrated its resilience and strong performance by recording a remarkable pre-tax profit of over VND 3,657 billion, reflecting a significant 36% increase compared to the same period last year, despite substantially bolstering its risk provisions.

“VietinBank’s Impressive Performance: A 80% Surge in Pre-Tax Profit for Q2”

“VietinBank’s recently released consolidated financial statements for Q2 2025 reveal impressive results. The bank, listed as CTG on the Ho Chi Minh Stock Exchange (HOSE), reported a remarkable 79% year-over-year increase in pre-tax profits, totaling over VND 12,097 billion. This outstanding performance is largely attributed to a significant reduction in risk provisions.”

Vingroup’s Unprecedented Wealth: Holding Over 82,000 Billion VND in Cold Hard Cash, Total Assets Nearing the 1,000 Trillion VND Milestone

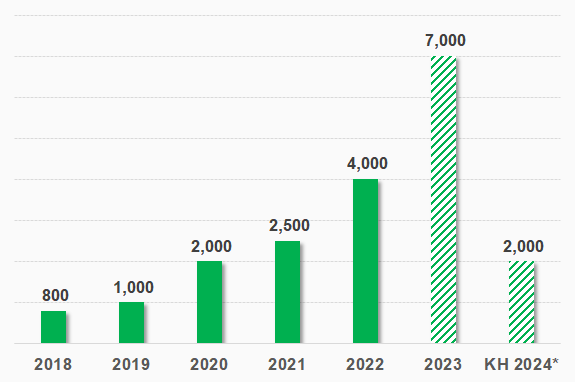

Vingroup’s total assets have consistently demonstrated resilience, maintaining an upward trajectory since its listing. With its impressive performance, the conglomerate helmed by billionaire Pham Nhat Vuong is poised to become Vietnam’s second non-financial enterprise to surpass the remarkable milestone of 1 million billion dong in assets, hot on the heels of Petrovietnam.