| Indices Close in the Green Across the Board |

|

Source: VietstockFinance

|

In terms of gains, materials stocks led the market with a 2.21% increase, supported by a series of mining stocks that continued their upward momentum in the past period. Notable gainers include KSV, MSR, HGM, and BKC, which all hit the ceiling price; rubber stocks with GVR up 2.43%, PHR up 2.52%, and DPR up 5.47%; fertilizer stocks with DCM up 3.86%, DPM up 4.74%, and RTB up 6.11%; chemicals with CSV up 5.87% and DGC up 0.09%; and steel with HPG up 0.19% and TVN up 2.41%.

The market also recorded three sectors with gains of over 1%, namely consumer and decorative goods (up 1.86%), specialized services and trading (up 1.34%), and automotive and components (up 1.09%).

Although they did not appear in the list of sectors with the strongest gains, banking, securities, and real estate had a certain influence on the recovery of the indices during the session. In the top 10 stocks that contributed the most points to the VN-Index, VHM led with nearly 0.75 points, followed by several bank stocks such as CTG with nearly 0.5 points, TCB with over 0.4 points, MBB with nearly 0.3 points, and LPB with over 0.2 points.

On the other hand, telecommunications and software were the worst-performing sectors in the market, falling 1.68% and 1.26%, respectively. In telecommunications, notable decliners included VGI down 1.97%, FOX down 0.83%, and CTR down 1.14%. As for software, the decline of industry giant FPT by 1.31% was the main factor.

Another group that attracted much attention today was durable goods distribution and retail, impacted by retail stocks such as ICT (MWG down 2.84%, FRT down 0.94%, and DGW down 0.13%), as well as automotive stocks like CTF down 3.94% and HAX down 2.39%.

Considering the VN-Index, FPT and MWG were the two stocks that took away the most points, with nearly 0.66 points and over 0.5 points, respectively.

The market’s total trading volume exceeded 619 million shares, equivalent to a trading value of over 13,376 billion VND, slightly higher than the previous session but still relatively low compared to the recent period.

The scale of foreign trading also reflected the market’s liquidity dynamics. At the close of the February 13 session, foreign investors bought nearly 1,049 billion VND and sold nearly 1,361 billion VND, resulting in a net sell-off of nearly 312 billion VND, continuing the trend since the Tet holiday.

The stocks that were net sold the most today were VNM (nearly 64 billion VND), VPB (over 58 billion VND), MWG (over 51 billion VND), and NLG (over 40 billion VND). On the buying side, DPM stood out with over 43 billion VND.

Overall, the continuation of net selling was not a surprising outcome for investors, as many experts had predicted that foreign investors were not expected to return to net buying in the first quarter and might even extend into the second quarter.

| Foreign Investors Continuously Net Sell After Tet Holiday |

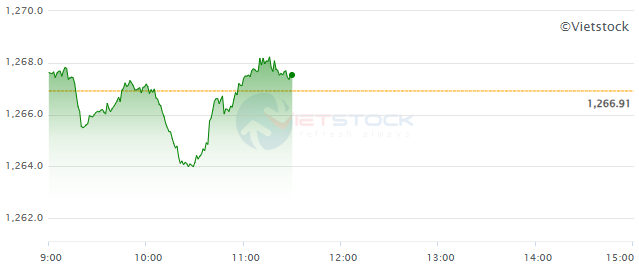

Morning Session: Blue-chip Stocks Reverse Course, VN-Index Returns to Green

Unlike the dominant red in the first half of the morning session, many large-cap stocks in sectors such as banking and securities rebounded in the latter half, joining the early gainers like metals and mining, electrical equipment, and electricity, thereby helping push the VN-Index back into positive territory.

|

VN-Index Strives to Regain Green

Source: VietstockFinance

|

At the end of the morning session, all three main indices posted gains, with the VN-Index up 0.63 points to 1,267.54, the HNX-Index up 0.04 points to 229.36, and the UPCoM-Index up 0.56 points to 97.36.

The VN-Index returned to positive territory after a challenging start. This positive turn was largely due to the reversal of large-cap stocks, particularly in the banking and securities sectors.

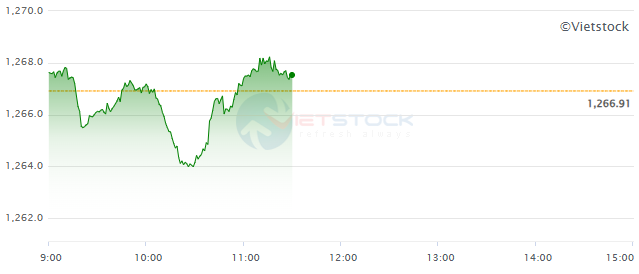

In the banking sector, CTG stood out with a 1.11% increase, while other gainers included TCB (up 0.19%), SHB (up 0.47%), MBB (up 0.22%), BID (up 0.25%), and LPB (up 0.54%). Notably, CTG was also the stock that contributed the most points to the VN-Index, at nearly 0.6 points.

|

CTG Leads in Point Contribution to VN-Index

Source: VietstockFinance

|

The securities sector also witnessed several stocks posting gains and contributing to the industry’s and market’s performance, including VIX (up 0.7%), BSI (up 0.2%), VCI (up 0.43%), and HCM (up 0.34%).

Additionally, sectors such as metals and mining, construction, ports, electricity, and electrical equipment also recorded positive performance, offsetting the pressure from food stocks like VNM and MSN, retail stocks like MWG and FRT, and real estate stocks like NLG, KDH, NVL, and DXG…

The market’s trading volume in the morning session was just over 6,073 billion VND, lower than the recent average. In this context, foreign investors also traded relatively modestly, with net buying of over 339 billion VND and gross selling of nearly 676 billion VND, resulting in a net sell-off of over 336 billion VND.

10:40 am: Under Pressure from Large-cap Stocks, VN-Index Retreats to 1,264

VN-Index made efforts to return to positive territory but quickly faced dominant selling pressure, pushing the index back to the 1,264-point level. As of 10:30 am, the VN-Index was down 2.76 points to 1,264.15, while the HNX-Index and UPCoM managed to stay in positive territory. The market’s trading volume was quite low, at just over 3,700 billion VND.

Source: VietstockFinance

|

The main pressure came from the increasing number of large-cap stocks in the red, including banks like TCB (down 0.39%), TPB (down 0.3%), STB (down 0.26%), VIB (down 0.73%), ACB (down 0.39%), and MBB (down 0.22%); residential real estate stocks like VPI (down 0.17%), NLG (down 1.52%), and DXG (down 0.69%); retail stocks like MWG (down 2.94%) and FRT (down 1.04%); software stocks like FPT (down 1.03%); and food stocks like VNM (down 0.66%) and MSN (down 0.72%).

On the other hand, the chemicals sector shone with green spreading across many stocks, notably DPM (up 2.87%), DCM (up 1.86%), CSV (up 1.84%), BFC (up 2.1%), and TRC (up 2.74%) …; as well as groups that quickly accelerated from the start of the morning session, such as construction, metals and mining, and electrical equipment.

Foreign investors were net sellers of over 190 billion VND, focusing on VNM and MWG, with values of over 27 billion VND each, and STB with over 20 billion VND. It appears that foreign investors have not shown any clear signs of ending their net selling streak, which has persisted since the first trading session of the Year of the Snake.

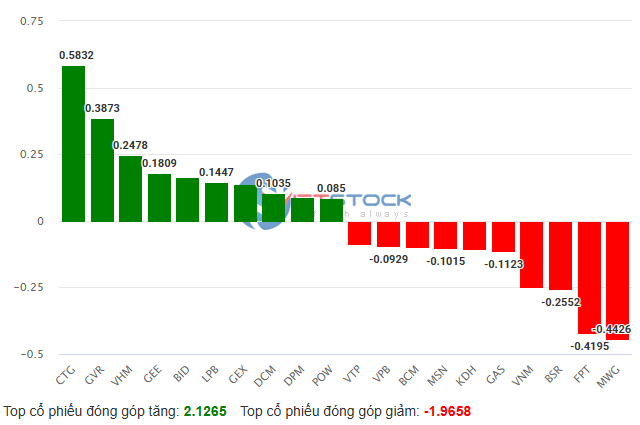

Opening: Fluctuations at the Start of the Morning Session

As of 9:30 am, the VN-Index was down slightly by 0.9 points (down 0.07%) to 1,266.01, fluctuating in the first few minutes before correcting below the reference level. In contrast, the HNX-Index rose slightly by 0.42 points (up 0.18%) to 229.73, and the UPCoM-Index gained 0.32 points (up 0.33%) to 97.12. The market’s trading volume was over 39 million shares, equivalent to a trading value of over 790 billion VND.

|

Market Map as of 9:30 am, February 13, 2025

Source: VietstockFinance

|

The electrical equipment sector performed well, with GEX up 2.55% and GEE even hitting the ceiling price of 7%. Green also appeared in many construction stocks, with CTD up 1.06%, BOT up 9.26%, PC1 up 1.27%, and HBC up 3.03%. Metals and mining stocks like HPG (up 0.58%), BMC (up 1.57%), MSR (up 3.21%), HGM (up 4.76%), and BKC (up 10%) also posted gains.

On the other hand, the market faced some pressure from declining retail stocks, notably MWG (down 2.13%) and FRT (down 1.46%); software stocks, with FPT down 0.41%; and mixed performance in the banking and securities sectors.

However, green prevailed in many major Asian indices, including Hang Seng (up 1.27%), Nikkei 225 (up 1.29%), All Ordinaries (up 0.19%), and Shanghai Composite (up 0.15%).

The situation was opposite on Wall Street last night, where the S&P 500 index fell 0.27% to 6,051.97 points, and the Dow Jones index lost 225.09 points (equivalent to 0.5%) to 44,368.56 points. Meanwhile, the Nasdaq Composite index edged up 0.03% to 19,649.95 points.

The S&P 500 index continued its decline, and interest rates surged after the CPI rose more than expected in January

Market Mayhem: Navigating the Storm

The VN-Index’s ascent narrowed amid sustained above-average trading volumes. This indicates persistent selling pressure as the index retests the old peak from December 2024 (around 1,270-1,285 points). Unless this dynamic changes in upcoming sessions, breaking out of this range seems unlikely. Notably, the Stochastic Oscillator is venturing deeper into overbought territory. Should a sell signal emerge and push the index out of this region, the risk of a downward correction heightens.

The Vietstock Daily: A Glimmer of Hope for the Short-Term Outlook

The VN-Index rebounded after a previous sharp decline, with trading volume remaining above the 20-day average. This indicates that investors are still actively trading. However, selling pressure at the old peak in December 2024 (corresponding to the 1,270-1,280-point range) remains strong. To sustain the upward momentum, the index needs to surpass this range. Currently, the MACD indicator is still showing a buy signal and is above the zero threshold. If this condition persists in the coming period, risks will be mitigated.

The Cautious Mindset Returns

The VN-Index retreated with below-average trading volume, indicating investor caution as the index nears its December 2024 peak (1,270-1,280 points). Additionally, the Stochastic Oscillator has signaled a sell-off in overbought territory, suggesting heightened short-term adjustment risks if the indicator falls from these levels.

The Power of Persuasive Writing: Crafting a Compelling Headline

“Vietstock Weekly: Upholding the Uptrend”

The VN-Index continued its upward trajectory, marking three consecutive weeks of gains since crossing above the 200-week SMA. Accompanying this rise is a surge in trading volume, which has exceeded the 20-week average since mid-November 2024. This indicates a positive shift in market participation. At present, the MACD indicator has just triggered a buy signal, crossing above the signal line. Should this momentum be sustained, the short-term outlook remains optimistic.