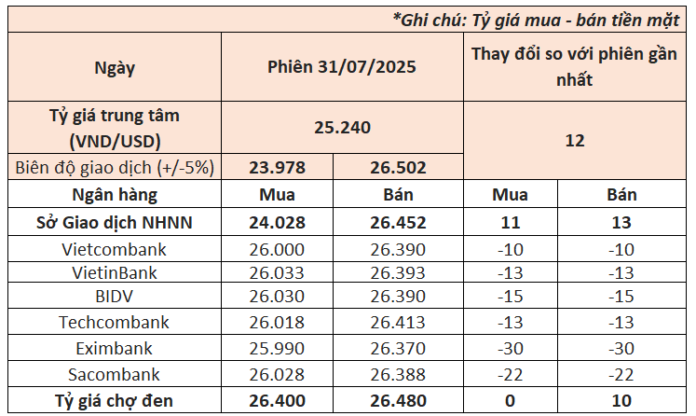

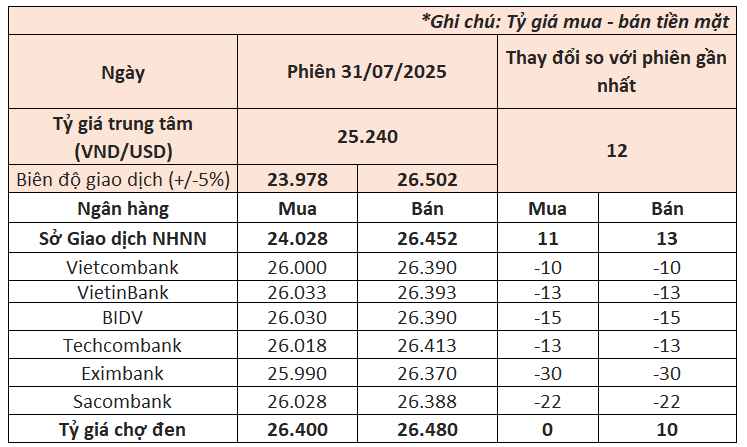

On July 31st, the State Bank of Vietnam (SBV) continued to increase the daily reference exchange rate by 12 VND to 25,240 VND/USD. Since the beginning of the week, the SBV has raised the reference rate by a total of 76 VND, reaching a new peak since the implementation of this mechanism in early 2016. This marks a 3.7% increase in the reference exchange rate since the start of the year.

With a permitted fluctuation of 5%, commercial banks can now trade dollars within the range of 23,978 – 26,502 VND/USD.

The buying and selling rates at the State Bank of Vietnam’s Trading Center were also increased to 24,028 – 26,452 VND/USD.

Contrary to the movement of the reference rate, the USD rates listed at commercial banks showed a downward trend this morning.

At 11 am, Vietcombank, the bank with the largest foreign currency transactions in the system, listed the USD rate at 26,000 – 26,390 VND/USD, a decrease of 10 VND in both buying and selling rates compared to yesterday’s morning session. Since the beginning of the year, the USD rate at Vietcombank has increased by approximately 3.3%.

VietinBank and BIDV decreased their rates by 13 and 15 VND, respectively, in both buying and selling, bringing the selling rate to 26,390 VND/USD.

In the group of private banks, the USD rates also decreased simultaneously. Techcombank, Sacombank, and Eximbank reduced their rates by 13 VND, 22 VND, and 30 VND, respectively, compared to yesterday’s morning session.

In the interbank market, the exchange rate closed at 26,200 VND/USD on July 30th, a decrease of 23 VND from the previous session.

In the black market, the USD rate showed a slight upward trend. At 11:00 am, the dollar was traded at 26,400 – 26,480 VND/USD, with the buying rate remaining unchanged and the selling rate increasing by 10 VND compared to yesterday.

Internationally, the US Dollar Index (DXY), which measures the strength of the US dollar against other major currencies, hovered around 99.7 points.

The US dollar strengthened against major currencies after the Federal Reserve (Fed) decided to keep interest rates unchanged, in line with market expectations, despite pressure from President Donald Trump.

In their statement after the meeting, the Fed acknowledged that economic growth in the first half of the year had slowed, although the labor market remained stable and unemployment rates stayed low. However, inflation remained above the Fed’s 2% target, despite cooling from the previous quarter.

The US dollar also found support from stronger-than-expected US economic growth data for the second quarter, which showed a 3% increase compared to the 2.4% estimate in a Reuters poll of economists.

The US dollar reached a one-month high against the euro after US President Donald Trump and European Commission President Ursula von der Leyen reached a trade deal framework on Sunday, setting a 15% import tariff on EU goods, half the rate Trump had previously threatened.

With the DXY having risen 2% from its low at the end of June, the USD/VND exchange rate is facing upward pressure. Previously, the USD/VND rate had increased by 3% in the first half of 2025, despite an 11% decline in the US dollar in the international market.

However, a positive sign is that the overnight VND-USD interest rate spread in the interbank market has returned to a positive state. This factor will somewhat support the VND in reducing depreciation pressure.

According to analysts, the SBV’s continuous increase in the reference exchange rate and the “floating” of the USD selling rate for intervention indicate that the regulator is accepting a stronger exchange rate fluctuation. In fact, as of July 31st, the reference exchange rate has been adjusted upward by 3.7% compared to the beginning of the year, while the official and black market rates have only increased by about 3.3%.

The Greenback Slides: A Sudden Shift in Fortune

“The U.S. dollar took a turn last week, experiencing a decline in the international market as the deadline for higher tariffs loomed. As the week of July 21-25, 2025, unfolded, the implications of President Donald Trump’s trade policies became increasingly apparent, with the dollar’s performance reflecting the market’s anticipation of these changes.”

Gold Prices Dip on Monday, but Short-Term Outlook Remains Positive

The outlook for gold prices is looking brighter, with the precious metal poised to reclaim the $3,400/oz mark. This is according to market analysts who foresee a short-term boost for the commodity.