Gold Price Surges Today, August 3rd

This weekend, on August 3rd, SJC gold bars were listed by companies at VND 121.5 million per tael for buyers and VND 123.5 million per tael for sellers, surging by VND 2.4 million per tael compared to the previous weekend.

Gold prices broke the two-week losing streak with a strong surge at the weekend. Gold bar prices are heading towards the historical peak of over VND 124 million, set back in April this year.

Similarly, the price of 99.99% gold rings and jewelry also increased by VND 2 million per tael compared to the previous weekend, reaching VND 116.5 million per tael for buyers and VND 117 million per tael for sellers.

Domestic gold prices surprised with a strong upward movement, following the jump in global prices.

In the international market, gold prices ended the trading week at $3,363 per ounce, up nearly $30 per ounce from the previous week. During the week, gold prices fluctuated continuously, with many sessions plunging to $3,267 per ounce before rebounding. It wasn’t until the last session of the week that the precious metal surged by $70 per ounce on international markets.

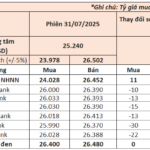

SJC gold bar prices surge compared to the previous week

The sharp turn in global gold prices has made experts optimistic about the trend for the coming week, according to Kitco’s survey. This week, 17 analysts on Wall Street participated in the poll, and an overwhelming 94% predicted higher gold prices, with none expecting a decline and only 6% forecasting sideways movement. This survey result is quite surprising in the current context.

According to experts, gold prices reversed sharply higher at the end of the week as the US dollar plunged. The US Dollar Index (DXY) in the international market unexpectedly fell from above the 100-point threshold to 98.6 points, losing 1.28% from the previous session.

Tariffs Impact on Gold Market Outlook

Some analysts remain optimistic about gold as it continues to serve as a safe-haven asset, especially with US President Donald Trump imposing higher import tariffs on the world. While trade agreements with Japan and Europe last week, which included a 15% increase in import tariffs, somewhat eased global trade tensions, countries like Canada, which have not yet finalized agreements, will face a 35% tariff increase this August.

Meanwhile, Indian imports face a 25% increase, and Taiwanese exports will be taxed at 20%…

“Tariffs mean countries will transact less in USD, and gold prices will continue to rise as the world seeks an alternative asset,” said Chris Vecchio, Head of Futures and Forex Strategy at Tastylive.com.

Currently, at Vietcombank’s exchange rate, world gold prices are at VND 107 million per tael, which is VND 16.5 million lower than SJC gold bar prices.

The Greenback Slides: A Sudden Shift in Fortune

“The U.S. dollar took a turn last week, experiencing a decline in the international market as the deadline for higher tariffs loomed. As the week of July 21-25, 2025, unfolded, the implications of President Donald Trump’s trade policies became increasingly apparent, with the dollar’s performance reflecting the market’s anticipation of these changes.”

Gold Prices Dip on Monday, but Short-Term Outlook Remains Positive

The outlook for gold prices is looking brighter, with the precious metal poised to reclaim the $3,400/oz mark. This is according to market analysts who foresee a short-term boost for the commodity.