|

Source: VietstockFinance

|

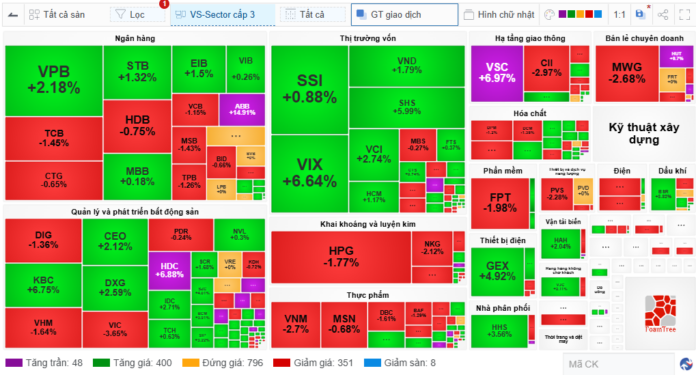

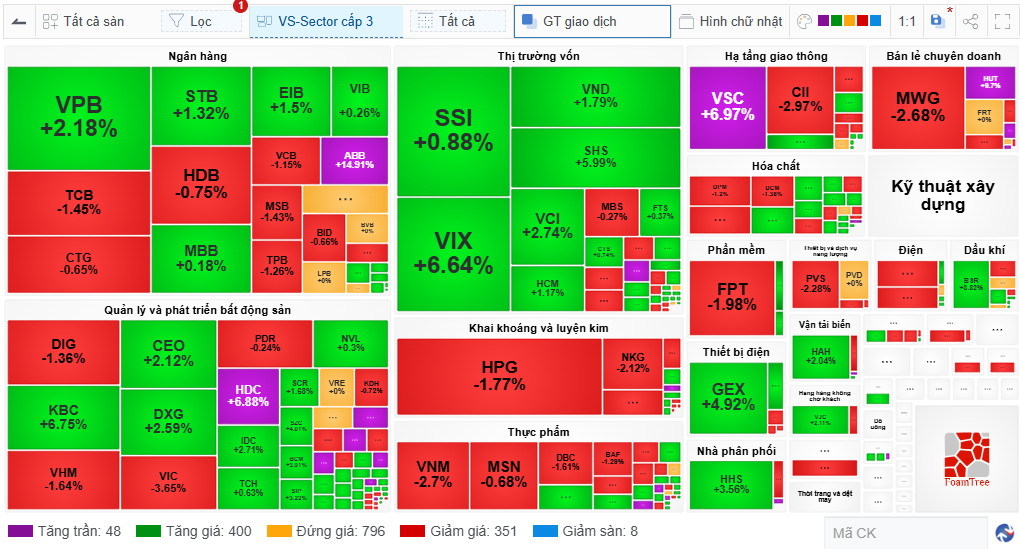

A glance at the market map reveals a true resurgence of green, with 400 codes, mainly large areas of green appearing in the securities, banking, and real estate groups.

In securities, a series of good risers are VIX up 6.64%, SHS up 5.99%, VCI up 2.74%, VND up 1.79%, HCM up 1.17%, and SSI up slightly by 0.88%.

Meanwhile, the banking and real estate sectors are more differentiated. In the banking group, while VPB increased by 2.18%, STB by 1.32%, MBB by 0.18%, EIB by 1.5%, and VIB by 0.26%… TCB fell by 1.45%, CTG by 0.65%, HDB by 0.75%, MSB by 1.43%, and TPB by 1.26%…

Similarly, in the real estate group, many codes increased, with KBC up 6.75%, CEO up 2.12%, DXG up 2.59%, and IDC up 2.71%… but there were also quite a few codes that retreated, notably the duo of VIC down 3.65% and VHM down 1.65%, along with DIG down 1.36% and PDR down 0.24%…

In addition, the market recorded up to 48 ceiling codes, notably ABB, HDC, VSC, PC1, and HUT. In this group, ABB has just announced consolidated Q2/2025 financial statements with pre-tax profit of nearly VND 1,257 billion, 3.2 times higher than the same period last year, bringing the 6-month pre-tax profit to VND 1,672 billion, equivalent to 92% of the full-year target; or the case of HDC also recorded net profit of nearly VND 58 billion, up 15% and the highest since Q1/2023 thanks to capital divestment at Dai Duong Vung Tau, offsetting the lowest gross profit margin since 2016.

On the contrary, PC1 still hit the ceiling despite Q2 profit reaching only over VND 138 billion, down 13%. Cumulatively, the company’s 6-month net profit reached nearly VND 194 billion, down 19% over the same period. The main reasons for the decrease in profit in the first half of 2025 were the reduction in electricity generation and mineral exploitation output.

Although there were 400 green codes and 48 purple ceiling codes, more than 351 red codes and 8 green floor codes, the VN-Index still lost more than 5 points, mainly due to pressure from many large-cap stocks in the real estate group, especially VinGroup; banking group; steel such as HPG down 1.77%, NKG down 2.12%…; food with VNM down 2.7%, MSN down 0.68%; retail like MWG down 2.68%; software with FPT down 1.98%…

This picture is more clearly shown when looking at the results by capitalization, with the Large Cap group down 0.4%, while Mid Cap up 0.79% and Small Cap up 1.15%, and Micro Cap down 1%.

Source: VietstockFinance

|

Clearly, after a strong uptrend, the market is experiencing many volatile sessions, and is even expected to occur more frequently in the future. However, the overall trend is still up.

In terms of liquidity, the market continued to record a vibrant trading session with nearly VND 49,000 billion in trading value, equivalent to more than 2 billion shares changing hands.

In the context of vibrant liquidity, foreign investors net sold more than VND 2,245 billion, as they actually net sold more than VND 5,520 billion, the highest in the last 11 sessions, while net buying narrowed to nearly VND 3,275 billion.

In today’s net selling list, CTG led with a value of nearly VND 378 billion, followed by 7 securities that were net sold in the hundreds of billions of VND, including VPB, FPT, HPG, KBC all above VND 200 billion, and VCB, MWG, IDC all above VND 100 billion.

On the buying side, VIC was the only stock that was net bought in the hundreds of billions of dong, specifically more than VND 140 billion.

| Foreigners increased net selling in the session of July 31 |

| Top stocks net bought/sold by foreign investors in the session of July 31 |

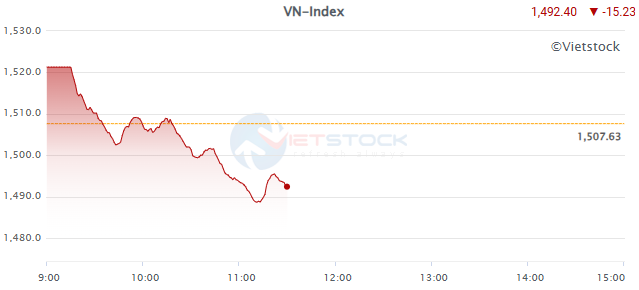

Morning session: Pressure increases, VN-Index “lunch break” down more than 15 points

The 1,500-point threshold was not maintained in the morning session today, as the VN-Index fell 15.23 points and temporarily “lunch break” at 1,492.4. Meanwhile, HNX-Index and UPCoM-Index ended the morning session in the green, up 0.05 points to 261.56 and up 0.48 points to 105.59, respectively.

Source: VietstockFinance

|

The whole market recorded 16 declining industries, out of a total of 23 industries according to VS-SECTOR, with the strongest being consumer services down 2.51% under pressure from VPL down 2.7%. Next was software and services down 1.66%, mainly due to FPT retreating 1.79%.

Groups with high capitalization also decreased and put great pressure on the general market, including real estate down 1.6%, banking down 0.68%, and securities down 0.91%…

On the rising side, hardware and equipment led with a gain of up to 7.41%, supported by DLG near the ceiling of nearly 7%, VEC up 11.61%, and POT up 8.72%. Next was entertainment and media up 5.19%, notably with VNZ up 8.83%, or YEG up 0.39%.

The trading value of the whole market reached VND 26,190 billion, with nearly 1.1 billion shares changing hands. Specifically, HOSE trading value reached nearly VND 23,274 billion, slightly higher than the average at the same time in the previous session.

In this context, foreign investors increased net selling by nearly VND 2,955 billion, while only net bought more than VND 1,576 billion, thereby net selling nearly VND 1,379 billion in the morning session. The stock that was net sold the most by foreign investors in the morning session was CTG with nearly VND 230 billion, followed by FPT with nearly VND 141 billion and HPG with nearly VND 128 billion.

Up to now, the Q2 business results season has gradually passed, especially after the market has risen strongly, making it difficult to find momentum to continue rising at this time. Many experts predict that the market will witness more volatile sessions in the short term ahead.

10:30 am: Increasing differentiation

The whole market recorded 329 green codes and 24 purple ceiling codes, while there were also up to 307 and 6 floor codes, and the remaining 938 codes stood still. Differentiation is present in many industries.

The notable positive performing industry was industrial real estate, with SZC up 3.73%, BCM up 2.32%, IDC up 2.71%…, and even KBC hitting the ceiling of nearly 7%.

In the banking group, while SHB rose 5.28%, VPB 2.57%, STB 1.32% or VIB 0.78%, and even ABB hit the ceiling of nearly 15%, a series of other codes fell into the red, such as TCB, EIB, MSB, TPB…

The securities group also had a similar performance, with SSI up 0.15%, VIX up 3.91%, SHS up 3.23%… while VND fell 0.22%, VCI 0.72%, FTS 1.36%, and MBS 1.92%…

Many industries showed a somewhat negative picture with red dominating. First of all, there was civil real estate, when a series of big names VIC, DIG, CEO, DXG, VHM, PDR, TCH, NVL, HDC recorded quite strong declines.

The steel group recorded large caps in the industry such as HPG down 1.57%, NKG down 2.12%, and HSG down 0.63%; the food group with VNM down 2.54%, MSN down 1.78%; software with FPT down 1.51%; retail with MWG down 1.34%.

It can be seen that many large-cap stocks are performing negatively, which is clearly reflected in the fact that the Large Cap group decreased by 0.42%, while Mid Cap increased by 0.17% and Small Cap by 0.67%. Meanwhile, the Micro Cap group decreased the most in the market, contracting by 0.63%.

Opening: Exciting at the beginning of the session but quickly reversed

Vietnam’s stock market opened the morning session with green, this performance was somewhat contrary to the Asian markets, however, the market quickly reversed to red.

In the increasing group, notably a series of bank stocks recorded good increases such as SHB, VPB, ABB, HDB, CTG… or securities such as SHS, VIX… However, the financial group still had mixed performances, with quite a few codes slightly in the red, such as TCB, MSB, EIB, MBS, VFS, VCI…

The contrast was more evident when looking at the real estate, industrial, service, and essential consumer goods groups. In which, big names such as VIC, VHM, VNM, and HPG are putting pressure on the market.

The red of the Vietnamese stock market is somewhat similar to the current picture of Asian markets, when many attractive indexes mostly decreased, including Hang Seng, Shanghai Composite… going against the trend is Nikkei 225.

In the US market last night, the S&P 500 index erased early gains and closed in the red on Wednesday (July 30) after Fed Chairman Jerome Powell signaled that the central bank was not ready to cut interest rates, as the Fed assessed the impact of President Donald Trump’s tariff hike on the inflation picture.

At the close of the session on July 30, the S&P 500 fell 0.12% to 6,362.90 points, while Dow Jones lost 171.71 points to 44,461.28 points, and Nasdaq Composite rose 0.15% to 21,129.67 points.

Stock Market Insights: Has the Tide Turned?

The VN-Index retreated, forming a Bearish Engulfing candlestick pattern as it encountered resistance at the psychological level of 1,500 points. This retreat indicates significant profit-taking pressure. Additionally, the Stochastic Oscillator has provided a sell signal within the overbought territory. Investors should exercise caution in the near term as a fall below this level could trigger increased short-term corrective pressure.

Market Beat: VN-Index Soars Over 26 Points, Setting a New Record High

The trading session concluded with significant gains, as the VN-Index surged by 26.29 points (+1.72%), closing at 1,557.42. Simultaneously, the HNX-Index displayed robust performance, climbing 9.23 points (+3.63%) to finish at 263.79. The market breadth was overwhelmingly positive, with 537 advancing stocks versus 247 declining ones. This bullish sentiment was echoed in the VN30 basket, where 26 constituents rose, 3 fell, and 1 remained unchanged, painting a predominantly green picture for the day’s trading activities.

Market Pulse for July 21: Foreign Investors Turn Net Buyers, VN-Index Hovers Near 1,500 Points

The market closed with the VN-Index down 12.23 points (-0.82%), settling at 1,485.05. The HNX-Index also witnessed a decline of 1.98 points (-0.8%), ending the day at 245.79. The market breadth inclined towards the bears with 435 declining stocks against 331 advancing stocks. Within the VN30 basket, 17 stocks lost ground, 12 advanced, and 1 remained unchanged, reflecting a similar bearish sentiment.

Vietstock Daily: Embracing Challenges, August 1st, 2025

The VN-Index retreated after a volatile session, relinquishing early gains. Despite this pullback, the index remains above the middle Bollinger Band, a critical support level to sustain its upward trajectory. Meanwhile, the Stochastic Oscillator has begun to descend from overbought territory, indicating that the short-term outlook may encounter challenges ahead.

Market Beat: VN-Index Makes a Dramatic U-Turn, Soaring Nearly 9 Points at the Close

The market opened the afternoon session on a shaky note, with the index dropping more than 9 points at one point and flirting with the 1,500-point threshold. However, the latter half of the afternoon painted a different picture, as the index staged a steady recovery, erasing the losses from earlier in the day.